The financial services industry stands at the edge of the largest wealth transfer in history. Over the coming decades, an estimated $124 trillion will shift from Baby Boomers to their heirs, primarily Gen X, Millennials, and eventually Gen Z.

This generational shift brings both complexity and opportunity.

Firms that take time to understand the evolving expectations of younger investors will be better equipped to maintain trust and relevance, while those that don’t may struggle to retain long-standing client relationships.

The Generational Shift is Underway

The Baby Boomer generation has been the backbone of wealth management for decades, but today their children and grandchildren are stepping into decision-making roles. Gen Xers are already managing significant assets, while Millennials, now the largest generation in the workforce, are quickly building wealth through careers, entrepreneurship, and inheritance. Gen Z, digital natives just beginning their financial journeys, are poised to become influential clients over the next decade.

Each of these groups brings distinct preferences to the table. They value transparency, personalized engagement, and digital fluency. Many expect financial guidance to align with their broader life goals, from home ownership and entrepreneurship to sustainability and social responsibility.

Meeting these expectations requires a shift in how financial institutions engage, communicate, and deliver value.

Current Trends: From Reports to Real Life

Reports from Cerulli Associates and Merrill highlight how intergenerational wealth transfer is reshaping financial planning. One of the most significant findings is the rise of “giving while living”, a trend where families choose to distribute wealth earlier to support education, home purchases, or charitable causes, rather than waiting until inheritance.

This shift introduces new complexities for advisors. Financial strategies now need to account for multi-generational planning, tax implications, and the interpersonal dynamics that come with transferring wealth.

Increasingly, clients are looking for guidance that goes beyond managing assets, they want support in making financial decisions that reflect their family values and long-term goals.

The FSC Advantage

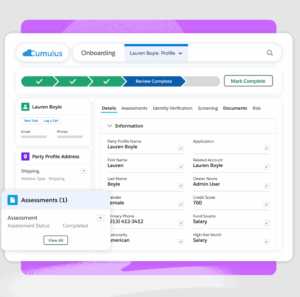

Navigating these changes requires more than traditional wealth management. FSC’s (Financial Services Cloud) household-centric model offers a powerful advantage. By viewing the client relationship through the lens of the entire household, rather than focusing on individual accounts, FSC helps firms build deeper, multi-generational connections.

This approach enables financial institutions to:

This approach enables financial institutions to:

• Personalize engagement tools to meet the expectations of Gen X, Millennials, and Gen Z.

• Align with next-gen values, such as digital-first service, sustainability, and inclusive financial planning.

• Bridge communication gaps between generations, ensuring that advisors remain trusted partners throughout the wealth transfer process.

Equally important, FSC empowers firms with the technology and insights needed to adapt in real time. By combining data-driven decision-making with a client-first philosophy, institutions can remain relevant and competitive in a fast-changing market.

Your Call to Action: Preparing Today for Tomorrow’s Investor

The great wealth transfer is not a distant event; it is happening now. Firms that hesitate risk losing clients as assets move to the next generation. The good news is that institutions that act today can position themselves as indispensable partners in this transition.

Financial leaders must ask:

• Are our engagement models built to resonate with Gen X, Millennials, and Gen Z?

• Do we have the tools to connect meaningfully across households, not just individual investors?

• Are we prepared to meet the expectations of digitally fluent, value-driven clients?

Now is the time to modernize client engagement strategies and build resilience for the decades ahead. To explore actionable steps and learn how FSC can support your firm in capturing the next generation of investors, download our latest guide.

And stay tuned for the final post in our “Chaos to Clarity” series, where we’ll explore how FSC helps financial institutions overcome some of the industry’s biggest challenges from data silos to AI adoption.

Source: Read MoreÂ