In existence since just July of 2019, the Pan African Payment and Settlement System (PAPSS) has in many ways surpassed the payment and settlement process of the western banking world. PAPSS enables the efficient flow of money securely across African borders to minimize risk and thereby contributing to financial integration of the African continent. PAPSS core service is provided by the PAPSS Instant Payment system (“PIP”). PIP offers:

- real time/near real time and irrevocable credits to customer accounts

- 24/7/365 immediate confirmation to both originator and the beneficiary

- ISO 20022 global message standard enabling interoperability

- Cyber security and payment fraud prevention powered by Artificial Intelligence.

PAPSS fits into the payment strategies of several Perficient clients who either currently are making or receiving payments to/from Africa or are exploring ways to execute and settle financial transactions in Africa. This blog also speaks to Perficient’s clients who are focused on modernizing the payment experience.

How It Works

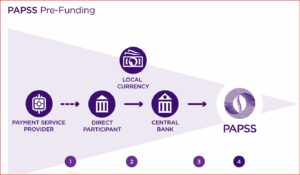

A. Pre-funding by participating banks

- Direct Participants issue credit instructions to settlement account at Central Bank.

- Central Bank credits pre-funded account of Direct Participant and notifies PAPSS.

- PAPSS credits Direct Participant’s clearing account.

- Indirect Participants leverage Sponsorship Agreements to issue funding instructions via Direct Participants.

diagram from the PAPSS corporate website

B. Instant Payment

- The originator issues a payment instruction in their local currency to its bank or payment service provider.

- The payment instruction is sent to PAPSS.

- PAPSS carries out all validation checks on the payment instruction.

- The payment instruction is forwarded to the beneficiary’s bank or payment service provider.

- The beneficiary’s bank clears the payment in their local currency.

diagram from the PAPSS corporate website

End of Day

- PAPSS determines multilateral net position in local currency for participating Central banks for their agreed settlement currencies.

- PAPSS issues aggregated net settlement instructions to the African Export-Import Bank (“Afreximbank”) to debit/credit the respective bank accounts.

Advantages of PAPSS for banks and other financial intermediaries

- PAPSS enables cross-border payments in local currencies without the need for transactions to pass through USD denominated correspondent banks. Traditional cross-currency clearing involves converting funds to US dollars or other foreign currencies.

- a simplified process that reduces the costs and complexities of foreign exchange for cross-border transactions between African markets

- are provided an instant and secure cross-border payment capability to their customers across Africa

- now have a platform that enables innovation in cross-border trade and access to new African markets

Corporates, SMEs and individuals can benefit from:

- instant/near instant payments of cross-border transactions without the hassle of currency conversion

- improved working capital through payment certainty and faster transactions

- access to various payment facilitating options through a growing network of financial intermediaries

The logo of PAPSS, which was on the homepage of this blog, comes from the cowrie shell, which is one of the oldest known currencies. The shell takes center stage, surrounded by radial lines that signify the connectivity of the technology of the PAPSS digital platform and the key partnerships that enable the payment system.

Ready to explore your firm’s payments strategy?

Our financial services experts continuously monitor the regulatory landscape and deliver pragmatic, scalable solutions that meet the mandate and more. Reach out to Perficient’s Financial Services Managing Director David Weisel to discover why we’ve been trusted by 18 of the top 20 banks, 16 of the 20 largest wealth and asset management firms, and are regularly recognized by leading analyst firms.

Source: Read MoreÂ