You’re sitting at your desk, sipping coffee that went cold half an hour ago, eyes flicking over a candlestick chart. Red. Green. Red. A notification buzzes — Nvidia’s up 3.2%. Too late. You missed it… again.

Now imagine an AI assistant that thinks like Warren Buffett and acts with the foresight of Michael Burry — not perfectly, not magically, but close enough to make you pause and say: “Whoa. That was smart.”

Yeah, that’s what we’re talking about.

Let’s get real for a second: The stock market isn’t just numbers.

It’s stories. Emotions. Crowd psychology wrapped in spreadsheets. And the greats? They don’t just crunch numbers — they interpret sentiment, context, chaos. They spot patterns in fog. They see fear before it’s priced in.

So, how do we train an AI to think that way?

Not by shoving it full of technical indicators and hoping it “gets it.” No. We teach it to learn like a human but process like a machine.

Let me explain.

Step One: Teach the AI to See the Market Like a Human

First, skip the old-school mindset of linear regressions and simple moving averages. Those are fine for textbook traders. But legends? They read between the lines.

Train your AI with:

- News sentiment analysis using NLP (Natural Language Processing)

- Twitter/X trends (think Elon tweets causing market chaos)

- Reddit threads that birth meme stocks overnight

- Earnings call transcripts (Buffett listens to tone, not just numbers)

This is where tools like OpenAI, Hugging Face, or FinBERT come in handy. You’re not just feeding it numbers — you’re feeding it context. The kind of messy, beautiful chaos that defines real-world investing.

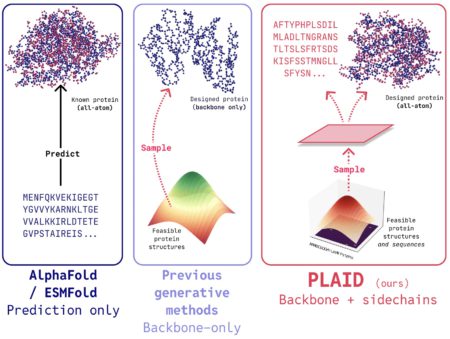

Step Two: Make It Think Like a Legend, Not Just Calculate Like a Robot

Want to bake a Buffett mindset into your model? You’ll need more than data. You’ll need philosophy.

Here’s a twist: Create custom embeddings of famous investor letters (think Buffett’s annual Berkshire letters or Howard Marks’ memos). Feed it the writings of Ray Dalio, Peter Lynch, even George Soros. Let it soak in their worldview.

You know what? Toss in some behavioral finance too. That’s where it starts to notice:

- Herd behavior during FOMO rallies

- Overreaction to quarterly losses

- Recurring fear cycles in financial downturns

And no, you don’t need a supercomputer. A solid GPT-based agent trained through vector databases like Chroma DB or Pinecone, paired with RAG (Retrieval Augmented Generation), can pull off more than you think.

Step Three: Let It Predict… But With Guardrails

This part’s tricky. No AI — not even the smartest LLM on Wall Street — can predict the market with 100% accuracy. But what it can do is identify probability curves based on past behavior, mood, and momentum.

Use tools like:

- Prophet by Meta (for time-series forecasting)

- XGBoost or LightGBM (for signal refinement)

- LangChain or Haystack (to tie insights with reasoning chains)

Set parameters. Add human review. Build dashboards with risk indicators. The goal here isn’t to replace your thinking. It’s to sharpen it.

Honestly? It’s like having a co-pilot who reads a thousand charts while you sip that lukewarm coffee.

But Wait, What About Real-Time Action?

Right. Prediction without execution is like a GPS with no steering wheel.

You can connect your AI agent with trading platforms using APIs (like Alpaca, Interactive Brokers, or even Robinhood). Set up guardrails to only alert, not auto-trade. Let it learn your risk appetite.

Soon, you’ll get alerts that sound less like “Stock X is rising” and more like:

“Based on recent Reddit sentiment, downward pressure from Fed commentary, and historical Q1 performance dips, consider reducing exposure to Tech ETF X.”

Tell me that doesn’t sound eerily human.

Don’t Forget the Intangibles: Curiosity, Patience, and Humility

Yeah, weird to mention emotions in an AI blog, but here we are.

The legends? They waited. They read. They adjusted. Burry didn’t short the housing market in a day. Buffett didn’t build an empire on quarterly earnings.

Build that spirit into your AI. Give it cooling periods. Train it to “pause” when uncertainty is high. Let it journal — yes, have your model generate internal logs explaining why it made a recommendation. That’s how you grow too.

A Small Digression: Why Most AI Trading Bots Fail?

Let’s be blunt. Most AI bots suck because they treat the market like a math problem. Like it’s something to be solved.

But the market isn’t math. It’s mood. It’s people. It’s fear wrapped in ambition wrapped in quarterly reports.

Teach your AI to reflect that, and suddenly it starts behaving… oddly wise.

So, Can You Really Train an AI Agent to Think Like a Stock Market Legend?

Short answer: Not perfectly.

Long answer? You can get damn close.

With the right blend of market data, human psychology, contextual awareness, and well-tuned models, you can build an AI that sounds like Lynch, pauses like Buffett, and analyzes like Burry. And maybe that’s enough.

Maybe you don’t need perfect. Maybe you just need consistent, calm, smart-enough advice in a chaotic world.

And hey, if it means you don’t miss Nvidia next time? Worth it.

Mini Article: Practical Steps to Train Smarter AI Agents Using Relevance AI

When it comes to turning raw data into real-world stock insight, tools like Relevance AI bring serious heat to your workflow. While most AI models drown in noise, Relevance AI helps you slice through the mess—organizing unstructured data, surfacing patterns, and even enabling low-code AI workflows.

Let’s break this down with practical moves you can make today:

1. Organize Your Data Like a Pro

Feed Relevance AI your Reddit threads, earnings calls, and even Twitter buzz. The platform lets you vectorize all that unstructured chatter using pre-trained models. Why does that matter? Because legends don’t trade headlines—they trade what’s behind the headlines.

2. Label Smarter, Not Harder

Use Relevance’s smart clustering to group similar financial sentiment, stock hype cycles, or recurring themes in investor forums. Whether it’s EV stocks gaining traction or tech undergoing corrections, the AI helps you see the trend before it’s trending.

3. Build Your Own Investor Copilot

Create custom dashboards that categorize sentiment shifts, track emerging tickers, and suggest strategy shifts. You can even integrate your own models or plug Relevance into your existing GPT-based stack to create a hybrid assistant that analyzes and explains.

4. Explainability Matters

Relevance AI supports explainability layers. That means your AI won’t just say “sell”—it’ll say “sell because retail investor sentiment dropped 40% after the Q1 call.” That’s insight you can act on.

So if you’re serious about building an agent that doesn’t just scrape financial data but thinks like a legend – Relevance AI might be your secret weapon.

FAQs (Naturally, You’re Wondering…)

Q: Can AI actually beat the market consistently?

A: Not really. But it can reduce human bias, speed up insights, and improve decision-making. That alone is powerful.

Q: What tools do I need to build something like this?

A: You’ll want access to LLMs (like GPT-4), vector databases (like Pinecone or ChromaDB), sentiment analyzers (FinBERT), and data pipelines (APIs from Yahoo Finance, Twitter, Reddit).

Q: Is this safe for beginner traders?

A: Only if you treat it as a co-pilot, not a self-driving car. Beginners should always review insights before acting.

Q: Will this replace human investors?

A: Nope. But it will make the good ones better.

Q: Can I integrate this with my own trading strategy?

A: Absolutely. Think of it as a flexible engine you can tune to your personal style.

Think like a legend. Code like a machine. Invest like it’s 2030.

Source: Read MoreÂ