Risk management in capital markets is becoming increasingly complex for investment portfolio managers. The need to process vast amounts of data—from real-time market to unstructured social media data—demands a level of flexibility and scalability that traditional systems struggle to keep up with.

AI agents—a type of artificial intelligence that can operate autonomously and take actions based on goals and real-world interactions—are set to transform how investment portfolios are managed. According to Gartner, 33% of enterprise software applications will include agentic AI by 2028, up from less than 1% in 2024. At least 15% of day-to-day work decisions are being made autonomously through AI agents.1 MongoDB empowers AI agents to effectively transform the landscape of investment portfolio management. By leveraging the combination of large language models (LLMs), retrieval-augmented generation (RAG), and MongoDB Atlas Vector Search, AI agents are enabled to analyze vast financial datasets, detect patterns, and adapt in real time to changing conditions dynamically. This advanced intelligence elevates decision-making and empowers portfolio managers to enhance portfolio performance, manage market risks more effectively, and perform precise asset impact analysis.

Intelligent investment portfolio management

Investment portfolio management is the process of selecting, balancing, and monitoring a mix of financial assets—such as stocks, bonds, commodities, and derivatives—to achieve a higher return on investment (ROI) while managing risk effectively and proactively. It involves thoughtful asset allocation, diversification to mitigate market volatility, continuous monitoring of market conditions, and the performance of underlying assets to stay aligned with investment objectives.

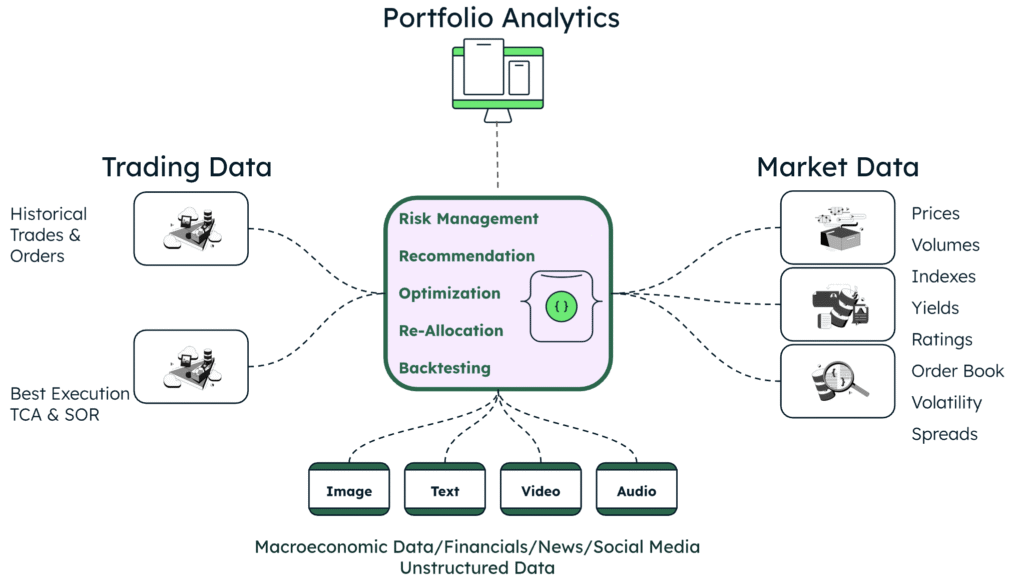

To stay relevant today, investment portfolio management requires the integration of diverse unstructured alternative data like financial news, social media sentiment, and macroeconomic indicators, alongside structured market data such as price movements, trading volumes, index, spreads, and historical execution records. This complex data integration presents a new level of sophistication in portfolio analytics, as outlined in Figure 1. It requires a flexible, scalable, unified data platform that can efficiently store, retrieve, and manage such diverse datasets, and pave the way for building next-gen portfolio management solutions.

Incorporating MongoDB’s flexible schema accelerates data ingestion across various data sources—such as real-time market feeds, historical performance records, and risk metrics. New portfolio management solutions enabled with alternative data supports more intelligent decision-making and proactive market risk mitigation. This paradigm shift realizes deeper insights, enhances alpha generation, and refines asset reallocation with greater precision, underscoring the critical role of data in intelligent portfolio management.

How MongoDB unlocks AI-powered portfolio management

AI-powered portfolio asset allocation has become a desirable characteristic of modern investment strategies. By leveraging AI-based portfolio analysis, portfolio managers gain access to advanced tools that provide insights tailored to specific financial objectives and risk tolerances. This approach optimizes portfolio construction by recommending an alternate mix of assets—ranging from equities and bonds to ETFs and emerging opportunities—while continuously assessing the evolving market conditions.

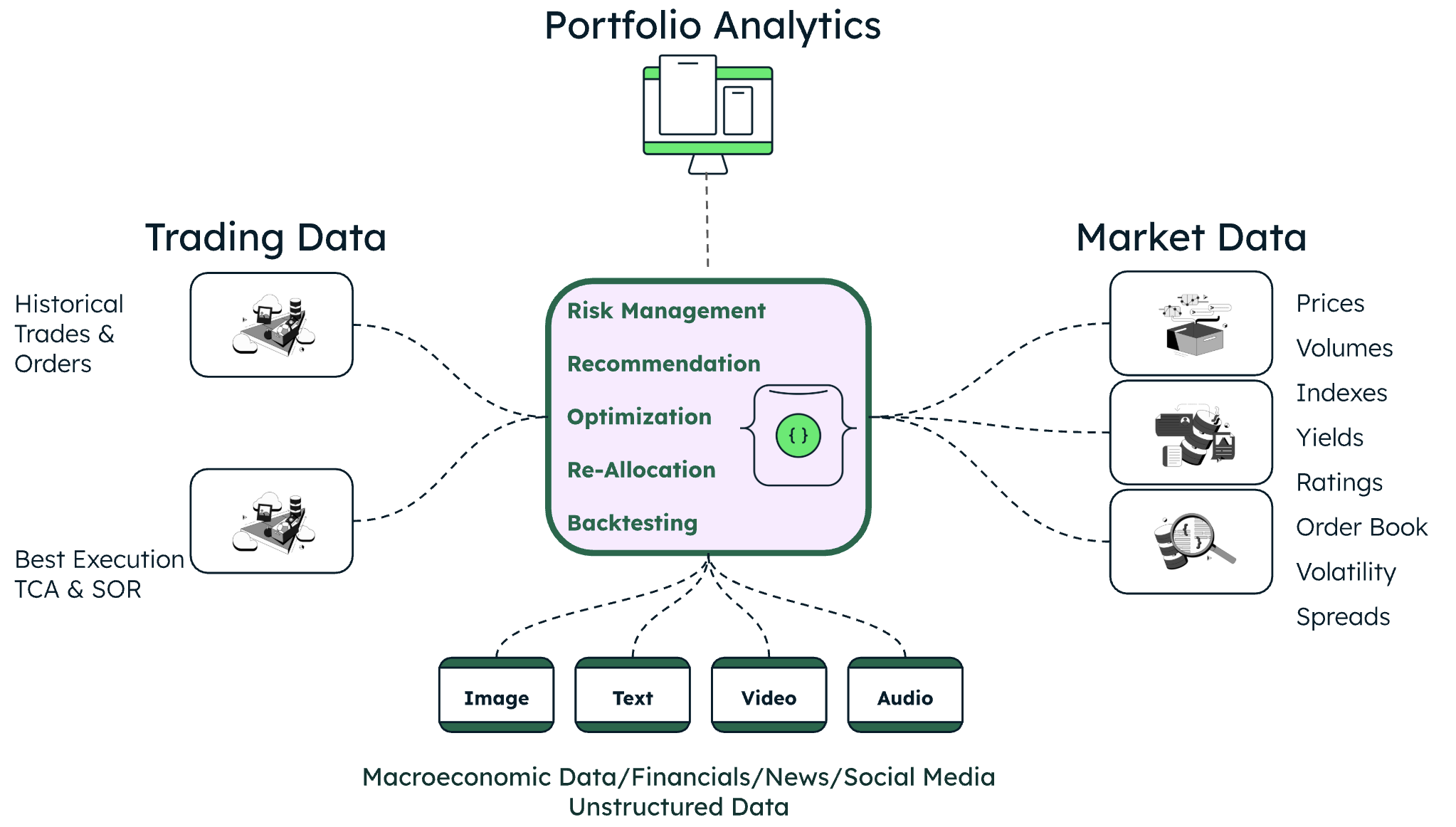

Figure 2 illustrates a proposed workflow for AI-powered investment portfolio management that brings diverse market data, including stock price, volatility index (VIX), and macroeconomic indicators such as GDP, interest rate, and unemployment rate, into an AI analysis layer to generate actionable and more intelligent insights.

MongoDB’s versatile document model unlocks a more intuitive way for the storage and retrieval of structured, semi-structured, and unstructured data. This is aligned with the way developers structure the objects inside the applications.

In capital markets, time series are often used to store time-based trading data and market data. MongoDB time series collections are optimal for analyzing data over time, they are designed to efficiently ingest large volumes of market data with high performance and dynamic scalability. Discovering insights and patterns from MongoDB time series collections is easier and more efficient due to faster underlying ingestion and retrieval mechanisms.

Taking advantage of MongoDB Atlas Charts’ business intelligence dashboard and evaluating advanced AI-generated investment insights, portfolio managers gain access to sophisticated capabilities that integrate high-dimensional insights derived from diverse datasets, revealing new patterns that can lead to enhanced decision-making for alpha generation and higher portfolio performance.

MongoDB Atlas Vector Search plays a critical role inthe analysis of market news sentiment by enabling context-aware retrieval of related news articles. Traditional keyword-based searches often fail to capture semantic relationships between news stories, while vector search, powered by embeddings, allows for a more contextual understanding of how different articles relate to a stock sentiment.

-

Storing news as vectors: When stock-related news are ingested, each news article is vectorized as a high-dimensional numerical representation using an embedding model. These embeddings encapsulate the meaning and context of the text, rather than just individual words. The raw news articles are embedded and stored in MongoDB as vectors.

-

Finding related news: Vector search is used to find news articles based on similarity algorithms, even if they don’t contain the exact same stock information. This helps in identifying patterns and trends across multiple news articles based on contextual similarity.

-

Enhancing sentiment calculation: Instead of relying on a single news sentiment, a final sentiment score is aggregated from multiple related news sources with similar and relevant content. This prevents one individual outlier news from influencing the result and provides a more holistic view of market news sentiment.

Agentic AI foundation

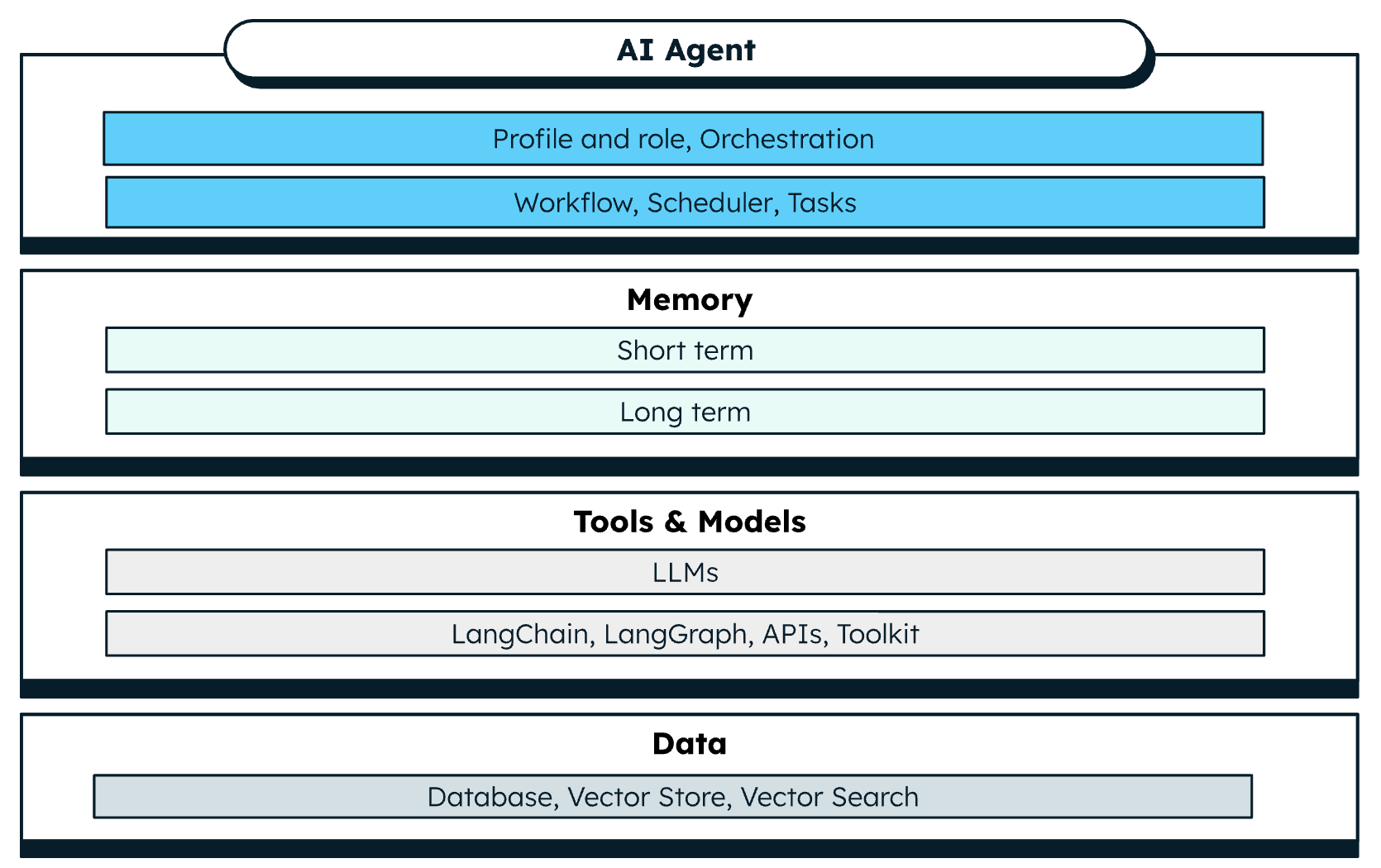

Agentic AI incorporates an orchestrator layer that manages task execution in workflows. AI Agents can operate either fully autonomous or semi-autonomous with a human-in-the-loop (HITL). AI agents are equipped with advanced tools, models, memory, and data storage. Memory leverages both long and short-term contextual data for informed decision-making and continuity of the interactions. Tools and models enable the AI agents to decompose tasks into steps and execute them cohesively. The data storage and retrieval are pivotal to AI agent effectiveness and can be advanced by embedding and vector search capabilities.

AI agents’ key characteristics:

-

Autonomy: The ability to make decisions based on the situation dynamically and to execute tasks with minimal human intervention.

-

Chain of thoughts: The ability to perform step-by-step reasoning and breaking complex problems into logical smaller steps for better judgement and decision-making.

-

Context aware: AI agents continuously adapt their actions based on the environment changing conditions.

-

Learning: AI agents improve their performance over time by adapting and enhancing.

Intelligent investment portfolio management with AI agents

AI agents are positioned to revolutionize portfolio management by shifting from rule-based to adaptive, context aware, and AI-powered decision-making. AI-enabled portfolio management applications continuously learn, adapt, and optimize investment strategies more proactively and effectively. The future isn’t about AI replacing portfolio managers, but rather humans and AI working together to create more intelligent, adaptive, and risk-aware portfolios. Portfolio managers who leverage AI, gain a competitive edge and deeper insights to significantly enhance portfolio performance.

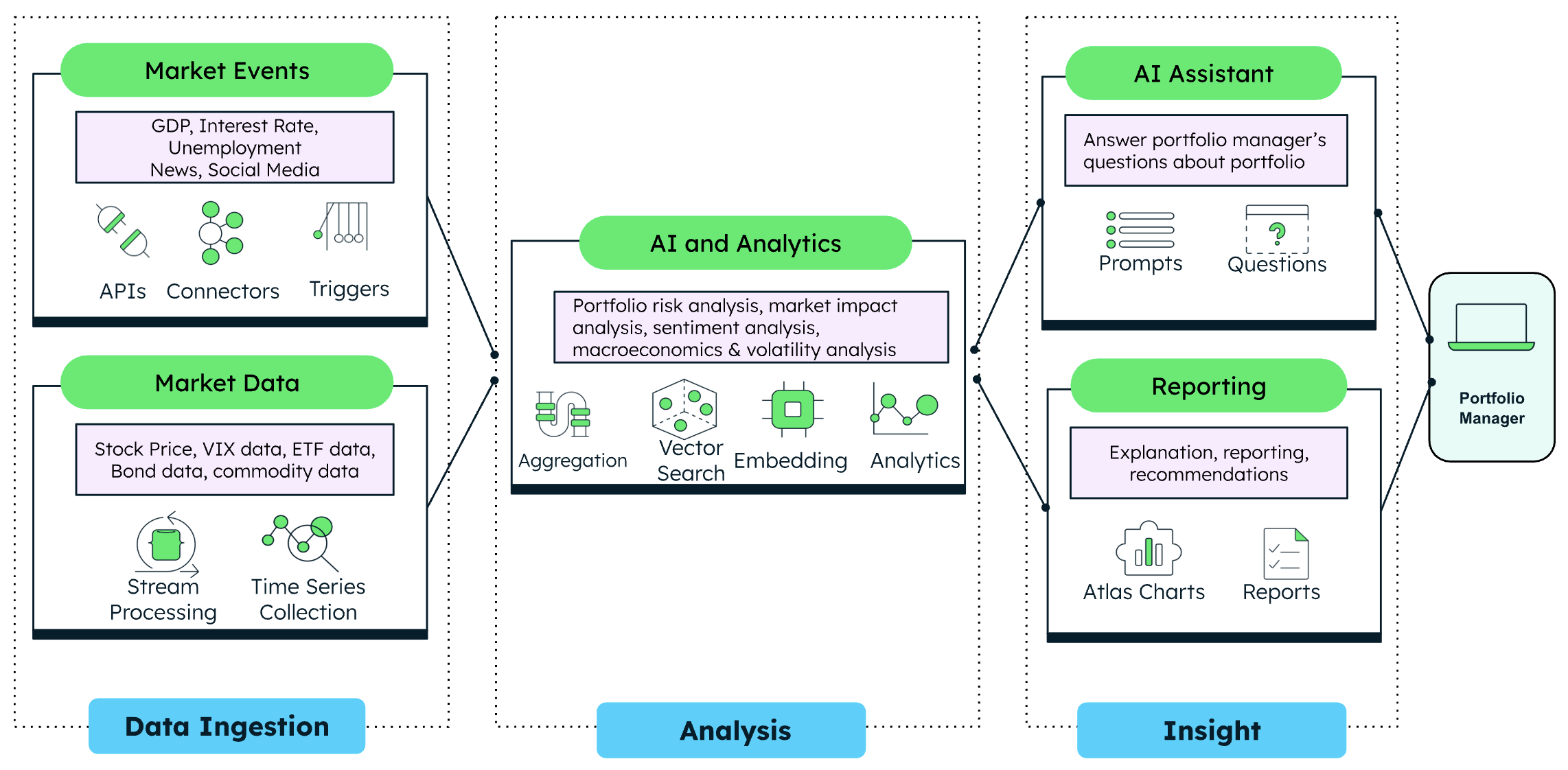

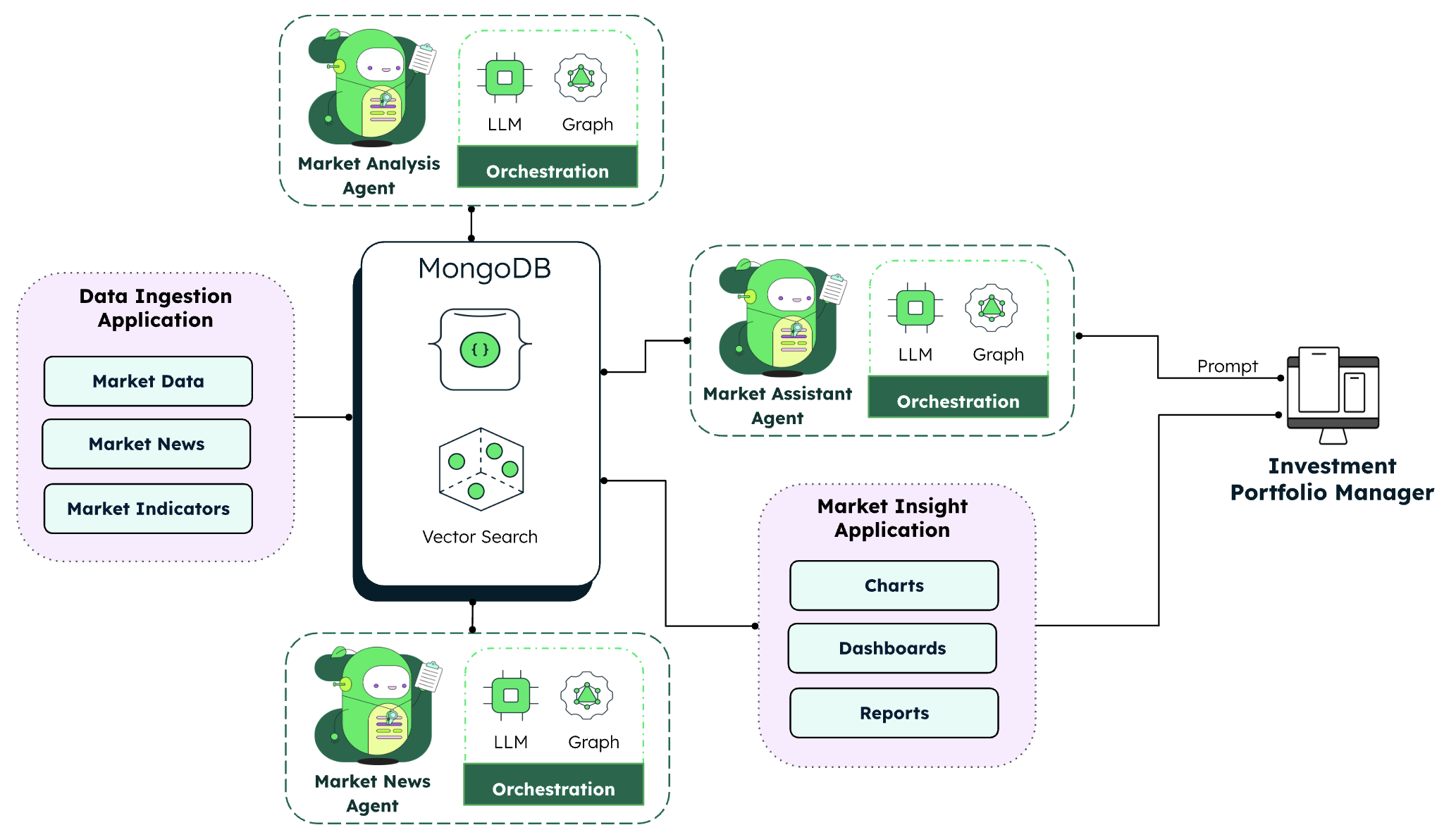

The solution, illustrated in Figure 4 below, includes a data ingestion application, three AI Agents, and a market insight application that work in harmony to create a more intelligent, insights-driven approach to portfolio management.

Data ingestion application

The data ingestion application runs continuously, captures various market data, and stores it in time series or as standard collections in MongoDB.

-

Market data: Collects and processes real-time market data, including prices, volumes, trade activity, and volatility index.

-

Market news: Captures and extracts market and stock-related news. News data is vectorized and stored in MongoDB.

-

Market indicators: Retrieves key macroeconomic and financial indicators, such as GDP, interest rate, and unemployment rate.

AI agents

In this solution, there are 3 AI agents. Market analysis agent and market news agent have AI analytical workflows. They run based on a daily schedule in a fully automated fashion, producing the expected output and storing it in MongoDB.

Market assistant agent has a more dynamic workflow and is designed to play the role of an assistant to a portfolio manager. It works based on prompt engineering and agentic decision making. Market assistant agent is capable of responding to questions about asset reallocation and market risks based on current market conditions and bringing the new AI-powered insights to the portfolio managers.

-

Market analysis agent: Analyzes market trends, volatility, and patterns to generate insights related to the risk of portfolio assets.

-

Market news agent: Assesses the news sentiment for each of assets by analyzing news that directly and indirectly can impact the portfolio performance. This agent is empowered by MongoDB vector search.

-

Market assistant agent: On demand and through a prompt, answers portfolio manager’s questions about market trends, risk exposure, and portfolio allocation by using data sources and insights that other agents create.

Market insight application

The market insight application is a visualization layer that provides charts, dashboards, and reports for portfolio managers, a series of actionable investment insights from the outputs created by AI agents. This information is generated based on a predetermined daily schedule automatically and presented to portfolio managers.

AI agents enable portfolio managers to have an intelligent and risk-based approach by analyzing the impact of market conditions on the portfolio and its investment goals. The AI Agents capitalize on MongoDB’s powerful capabilities, including the aggregation framework and vector search, combined with embedding and generative AI models to perform intelligent analysis and deliver insightful portfolio recommendations.

Next steps

According to Deloitte, by 2027, AI-driven investment tools will become the primary source of advice for retail investors, with AI-powered investment management solutions projected to grow to around 80% by 2028.2

By leveraging AI agents and MongoDB, financial institutions can unlock the full potential of AI-driven portfolio management to obtain advanced insights that allow them to stay ahead of market shifts, optimize investment strategies, and manage risk with greater confidence. MongoDB lays a strong foundation for Agentic AI journey and the implementation of next-gen investment portfolio management solutions.

To learn more about how MongoDB can power AI innovation, check out these additional resources:

1 Sun, D., “Capitalize on the AI Agent Opportunity”, Gartner, February 27, 2025.

2 AI, wealth management and trust: Could machines replace human advisors?, World Economic Forum, Mar 17, 2025.

Source: Read More