Ever found yourself spending hours on a single bank statement, wondering if all those numbers add up?Â

Whether you’re a loan officer reviewing an application or a business owner ensuring your clients’ payments are in order, bank statement verification is integral to ensuring financial accuracy and fraud prevention.

With an automated bank statement verification process, you can save hours of manual checking, avoid costly mistakes, and boost your confidence in your financial records.

Let’s discuss bank statement verification and find answers to some of your biggest challenges. Ready to crunch those numbers without the headache?Â

What is bank statement verification?Â

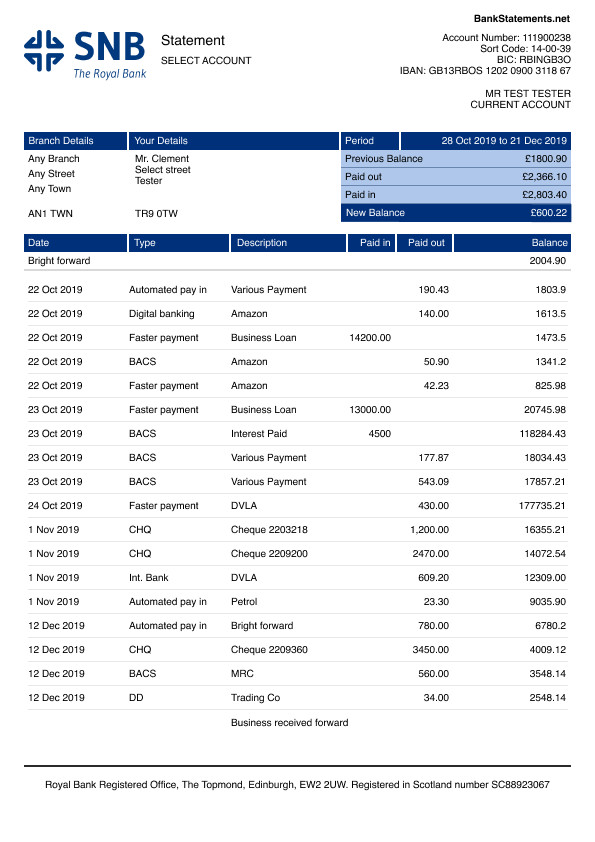

For example, how do lenders verify bank statements? The applicant submits their bank statements as proof of income, but how can the lender be sure they haven’t been altered?Â

Verification ensures the data matches the bank’s records, preventing fraud and giving you confidence in the applicant’s financial standing. Many organizations now rely on automated tools to speed up this process, ensuring faster approvals and fewer human errors.Â

Read more: How to use AI in bank statement processing

How does the bank statement verification process work?

The bank statement verification process involves several key steps to ensure the accuracy of the financial data provided. Here’s a breakdown of how it works:

Document submission: The applicant or customer submits their bank statement, either in digital or physical form.Initial review: Basic checks and analysis of statements ensure the document is complete, legible, and covers the necessary period.Data matching: Key details—such as balances, transactions, and account holder information—are compared with internal records or third-party databases.Fraud detection: The statement is analyzed for any signs of tampering, such as inconsistent fonts, altered numbers, or formatting issues.Verification tools: Automated tools can cross-verify transactions directly with the bank, streamlining the process.Final approval: Once everything checks out, the bank statement is verified, and the process is completed.

Technologies in bank statement verificationÂ

The bank statement verification process has evolved significantly with the help of advanced technologies, making it faster, more accurate, and more secure. Here are some key technologies now commonly used in the process:

Optical Character Recognition (OCR): OCR technology extracts text from scanned or image-based bank statements, converting unstructured data into a readable, structured format. This eliminates the need for manual data entry, drastically reducing errors and speeding up the process.Artificial Intelligence (AI) and Machine Learning (ML): AI-powered tools can detect patterns, spot discrepancies, and flag suspicious transactions that might indicate tampering. Machine learning algorithms improve over time, making the verification process smarter and more reliable.APIs (Application Programming Interfaces): APIs allow integration between verification platforms and financial institutions, enabling real-time access to bank data. This ensures that transaction details are cross-verified directly with the bank’s system, reducing fraud risk.Blockchain technology: Some verification systems adopt blockchain for secure, tamper-proof record-keeping. Blockchain ensures that once a bank statement is verified, it cannot be altered without leaving a trace, providing an additional layer of trust.Data encryption and security protocols: Strong encryption methods secure sensitive financial data during the verification process, ensuring that customer information remains protected from unauthorized access.

Read more: Best LLM APIs for document extraction

Challenges in the bank statement verification process

Bank statement verification often involves a range of complex challenges, especially when dealing with varying formats, technology limitations, and regulatory requirements.

Let’s explore common issues and how they can be addressed effectively.

Inconsistent data formats from multiple banks

Some use commas for decimals; others have different date formats, like DD/MM/YYYY in a UK bank statement or MM/DD/YYYY from a US bank. It’s time-consuming to sort through all this and manually verify everything accurately.

Solutions:

AI-driven bank statement extraction tools can automate the reading and processing of data from statements in various formats, recognizing currencies, date formats, and number representations.Â

For example, trained on thousands of global bank statements, Nanonets AI bank statement extractor can handle scanned PDFs, handwritten text, and digital documents, ensuring fast, accurate verification. By automating the recognition of cross-border variations, AI ensures faster, more precise verification without manual intervention.Â

Automating such data extraction tasks with rule-based workflows can save loan officers up to 40% of the time typically spent on manual verification.

Detecting fake or altered bank statements

Fraudsters use advanced tools to alter PDFs, changing transaction amounts, dates, and security features like watermarks. They also use AI-powered templates to generate entirely new statements nearly indistinguishable from genuine ones.

With hundreds of applications to process, catching these crafted fakes through manual checks is virtually impossible, posing significant financial and reputational risks to our institution.

Solutions:

AI-powered fraud detection: AI tools scan bank statements for subtle inconsistencies in fonts, layouts, and transaction patterns, identifying tampered documents more accurately than manual checks.Metadata analysis: Verifying the document’s metadata—such as creation date, modification history, and software used—can help flag altered or fraudulent bank statements.Real-time cross-verification: Implement APIs to enable instant verification of bank statements with different sources — the issuing bank, all your databases, and internal software to ensure that the submitted document matches official records.Third-party integration: Connect to government databases and services like Plaid and Yodlee (US and Europe) to confirm reported incomes.Credit bureau cross-checking: Use services like Experian or Equifax (in India) to validate financial data against official records.AI-driven pattern recognition: Integrate tools like DataRobot or SAS to quickly identify errors or unusual patterns.

Through comprehensive solutions, organizations can enhance their verification processes and better serve their clients by addressing the legitimacy of records and the need for quicker approvals.    Â

Inaccurate manual data entry

Despite their best efforts, my team faces a 10-20% error rate, with frequent issues with transaction amounts, dates, and account numbers. These mistakes compromise our verification accuracy and cause many delays in loan decisions. We have to double-check our work all the time.

The cost of correcting these errors escalates dramatically through our process – from $1 at entry to $10 during validation and up to $100 during final analysis. This has seriously impacted our team’s morale and led to a dip in profitability and customer satisfaction.

Solution:

Automating the data extraction and data entry process with AI-driven tools can avoid such costly mistakes by rectifying errors in time. These tools accurately extract key fields—such as transaction dates, amounts, and descriptions from bank statements.Â

Human oversight in AI tools is crucial. Instead of spending time on data entry, the loan officer could have let AI tools pull the data and verify it later.

Once verified, the accurate data can be easily exported into Excel, Google Sheets, a database, or any accounting software for post-processing. This streamlined workflow minimizes the risk of errors, enhances productivity, and ensures consistency throughout the verification process.

Limited scalability

Last month, we experienced a 300% surge, from 100 to 400 applications daily. Our outdated, template-based OCR system crawled to a near halt, creating a backlog of over 200 applications. Processing times skyrocketed, and accuracy plummeted.

The fallout was immediate – missed business opportunities, frustrated clients, and a flood of complaints about delayed loan approvals. This scalability crisis threatens our reputation and ability to capitalize on market growth.

Solution:Â

Implementing an advanced AI-driven tool like Nanonets can dramatically improve loan application processing capabilities.

Unlike traditional template-based OCR systems, these modern solutions are designed to handle sudden spikes in volume without compromising speed or accuracy. With the ability to process 1,000 applications per hour and extract key fields with 98% accuracy, Nanonets can easily manage the surge in your daily applications.

This automation eliminates backlogs and significantly reduces processing times by improving accuracy and directly addressing client frustrations and complaints about delays.

The 30% to 40% you can achieve through automation can be reinvested in growth initiatives to improve your company’s market position further.

Issues in reconciliation

My team wasted days manually tracking these transactions. With our high volume of transactions, currency exchanges, and timing differences, these reconciliation issues are becoming a recurring nightmare with many errors.

Solution:Â

Implementing automated bank statement reconciliation tools can streamline your process by integrating with popular accounting software, such as Quickbooks and Xero.

Whatever internal tools you have, they all need to have a seamless data flow and be in perfect sync so that you can catch such errors in time.

The system instantly flags discrepancies such as the $2,000 error you encountered, allowing your team to address issues promptly without manual intervention. By automating this process, you can typically reduce reconciliation time by up to 50% and achieve 95% accuracy in transaction matching.

This not only prevents delays in financial closing but also frees your team from the recurring nightmare of manual reconciliation, allowing them to focus on more strategic financial tasks.

How to automate bank statement verification tasks with AI

Let’s explore how an AI-powered bank statement document extraction can automate crucial processes in verification, making the process faster and more reliable.

I am taking Nanonets as an example here. Powered by generative AI, Nanonets offers a pre-trained bank statement extractor and a zero-training extractor that can simplify your verification process.

Extracting key fields from bank statements

With the pre-built bank statement extractor, you can easily extract 12+ key fields from bank statements, such as account numbers, addresses, bank names, transaction dates, transaction types, and balances and set up even more by customizing the AI model.

The platform recognizes various formats and layouts, ensuring consistent data extraction from diverse statement types.Â

Capturing data from cross-border bank statements

With Nanonets AI, you can capture data from bank statements in 40+ languages by training the AI model to handle documents in multiple languages.

The system uses advanced language models (LLMs) to interpret and extract information accurately, making it ideal for companies with international clients or diverse markets.Â

It can also standardize bank statements with different currencies to simplify processing.

Standardizing date formats in bank statements

For instance, when processing documents from various banks, you might encounter different formats for dates, such as “12 May,” “05•12•2022,” or “2022-05-12.”

You can standardize these entries using the Convert to Date Format action on your date fields in bank statements.Â

This process ensures that all the date entries are standardized automatically when you receive bank statements from any country or bank, facilitating more accessible data analysis and reporting.Â

Flag duplicate bank statements

You can set up different validation rules to ensure no duplicate files.

By flagging files with low confidence like statements with missing fields for mandatory review, you can prevent many issues.

Look up data from internal records

You can enrich your bank statements by pulling data from different third-party sources, spreadsheets, GL accounts, data base, accounting and ERP software, and more.

Scan QR codes or bar codes on the bank statements

You can enrich bank extract by incorporating additional information or standardizing formats.

Real-time verification and decision-making

You can set up real-time verification approval by defining different criteria.

For example, you can set up automatic mandatory approval for loan applications with bank balances under $50,000 while flagging those above the threshold for manager review.Â

This ensures that high-value or potentially risky applications receive appropriate scrutiny while routine cases are processed efficiently.Â

Reconciling bank statements

With Nanonets, you can automate the reconciliation process by establishing predefined validation rules. Here are some effective strategies for setting up rules:

Transaction categorization: Classify transactions into income, expenses, refunds to simplify matching and error identification.Threshold limits: Define monetary thresholds to focus on significant discrepancies, allowing for more efficient reviews.Date matching: Match transactions within a specific date range to minimize errors caused by timing differences.Reference number checks: Implement rules to verify unique identifiers associated with transactions.Automated Matching Algorithms: Utilize software that automatically matches transactions based on predefined criteria, reducing manual checks.Reconciliation frequency: Based on transaction volume, establish how often reconciliations should occur—weekly, monthly, or quarterly.Exception reporting: Create rules for generating reports on unmatched transactions, allowing you to focus on specific issues.Â

You can quickly compare transactions between bank statements and accounting records using advanced algorithms based on NLP techniques and fuzzy matching. This significantly reduces the time required for manual reconciliation from hours to minutes.Â

Conclusion

So, the next time you find yourself squinting at a bank statement, remember: you’re not just staring at random figures but engaging in a high-stakes game of “Spot the Fraud.â€

And with a little automation magic, you can trade in that tedious manual checking for a swift, streamlined approach that will leave you with more time to celebrate your financial victories—like treating yourself to a nice dinner instead of crunching numbers all night! Happy verifying!

Frequently Asked Questions (FAQs)

How do lenders verify bank statements?

Lenders verify bank statements by using automated systems that extract key financial details from the documents. These systems check for the information’s consistency, authenticity, and accuracy.

Automated AI-powered data extraction solutions, like Nanonets, can streamline this process by handling unstructured data from multiple banks, allowing lenders to review documents in loan applications quickly.

Is it safe to share bank statements for verification?

While sharing bank statements carries some risks, you can ensure safety by following key practices:

Use secure, encrypted platforms for data transmissionShare only necessary information and redact sensitive detailsVerify the recipient’s compliance with data protection regulations like GDPR and PCI DSSUnderstand the recipient’s data handling and retention policiesMonitor your accounts for any suspicious activity after sharing.

Remember, reputable verification processes prioritize your data security, but always exercise caution when sharing financial information.

What is real-time verification of bank statements, and why is it important?

Real-time verification allows lenders or financial institutions to instantly verify the accuracy and authenticity of bank statements without delays.

This is necessary for fast decision-making, especially in high-volume industries like loan processing. AI-based tools can set up workflows to automatically verify statements and trigger approvals as needed.

Source: Read MoreÂ