Traditional (manual) underwriting processes often struggle to keep pace with the growing complexity of modern risk assessment, data collection, and policy management.

Scaling traditional underwriting operations becomes increasingly challenging as underwriters spend a significant amount of time gathering and verifying data from multiple sources.

These include customer applications, financial records, medical reports, and external risk assessments such as geographic or weather-related data. These diverse data sets require careful aggregation and verification, making the process slow and error-prone.

Underwriting automation can help alleviate these issues to a great extent. It leverages AI and machine learning to quickly and accurately collect, assess, and process underwriting data. This not only accelerates decision-making but also ensures more accurate and consistent risk assessments. This also results in streamlined workflows, faster decisions, and significant cost reductions—by as much as 50% in operational expenses, according to some industry reports!

This article focuses on what specific aspects of the underwriting process can be automated, the technologies driving this change, and why this shift is so crucial for modern insurance companies.

Key underwriting processes that can be automated

Automating key steps in the insurance underwriting process allows insurers to streamline operations, improve accuracy, and reduce the time spent on manual tasks. Automation can transform how underwriters work, enabling faster and more consistent decision-making while minimizing human error.

Here are specific underwriting processes that can benefit from automation:

1. Data collection and aggregation

Underwriters manually gather and input data from various sources (e.g. customer applications, financial records, and risk assessments).

This process is not only time-consuming but prone to human error. Moreover, many documents arrive in different formats, such as scanned PDFs, emails, or handwritten forms, making it difficult to process them quickly and accurately.

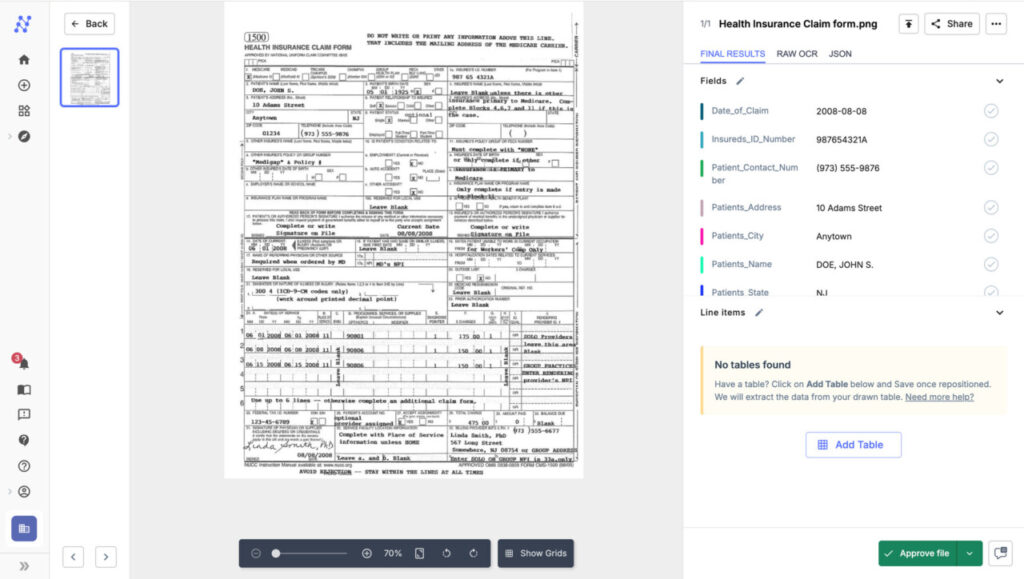

Automation using AI-based OCR or intelligent document processing (IDP) changes this entirely. OCR technology can digitize data from a variety of documents—whether they are in image, PDF, or text formats, while AI-driven extraction systems pull out relevant details contextually, without relying on pre-set templates. This not only reduces manual data entry errors but also accelerates the decision-making process.Â

100% data extraction accuracy from any custom document in seconds using Nanonets’ Zero-training extractor

Insurers using IDP software have reported up to a 90% reduction in processing time, allowing underwriters to focus more on analyzing risk instead of administrative tasks.

2. Task management and workflow automation

Underwriting involves managing multiple tasks such as evaluating applications, collecting additional documents, conducting compliance checks, and updating policy terms. Without automation, underwriters must manually prioritize and manage their workload, often resulting in bottlenecks.

Automation can help streamline task assignments and workflows by using AI to triage tasks and assign them based on priority, complexity, and workload distribution. For instance:

AI can route simpler applications, such as straightforward auto insurance renewals or low-risk home insurance policies, to junior underwriters or have them straight through processed by the system itself. More complex cases, like life insurance for individuals with pre-existing conditions or high-value properties in flood-prone areas, are routed to senior underwriters. Automated systems can also send reminders for pending tasks or compliance reviews.

By automating task triaging, insurers reduce turnaround times and improve task accuracy. This frees up underwriters to focus on high-value decisions such as evaluating non-standard risks or customizing policy terms for unique client needs.

3. Risk assessment and pricing

Risk assessment has traditionally relied on historical data, such as past claims, demographic trends, and economic indicators, to evaluate the likelihood of future claims. This data is analyzed by underwriters to set appropriate premiums.

However, this manual process is subjective, inconsistent, and slow, often leading to suboptimal pricing decisions.

AI and machine learning models allow for more precise risk assessment by analyzing vast datasets, identifying patterns, and predicting potential risks more accurately. These systems can automatically adjust premiums based on dynamic risk factors, such as geographical location, weather patterns, or an individual’s health profile.Â

For instance, AI-supported risk pricing models can instantly adjust a homeowner’s insurance premiums if they move from a low-risk to a high-risk flood zone without waiting for manual review.

This leads to better risk selection and reduced loss ratios. In fact, insurers that use AI for risk assessment report a 10-15% increase in revenue due to improved risk profiling.

4. Compliance

Underwriting also involves adhering to regulatory requirements, which can vary based on the type of insurance and the region. Ensuring compliance with standards such as AML/KYC, GDPR, or OFAC is critical!

AI solutions, like IDP or RPA software, can automate compliance checks by cross-referencing application data with relevant regulations. For example, an RPA bot can automatically check a client’s KYC details against global sanction lists (OFAC) before policy approval. Similarly, AI systems can monitor ongoing compliance by flagging any discrepancies between policy terms and updated regulatory requirements.

This automated approach ensures that every policy meets the necessary legal standards without manual intervention, reducing the risk of non-compliance and the associated fines.

Core technologies driving underwriting automation

As the insurance industry shifts toward automation, several key technologies play a pivotal role in transforming the underwriting process. These technologies not only streamline workflows but also enhance the accuracy and speed of decision-making, allowing insurers to manage more policies with fewer resources.

1. AI, Machine Learning (ML), and Intelligent Document Processing (IDP)

Artificial intelligence (AI) and machine learning (ML) are the backbone of underwriting automation. When combined with Intelligent Document Processing (IDP), they provide an end-to-end solution for automating document-intensive workflows, such as those found in underwriting.

In underwriting, AI and ML are used to:

Predict risks: AI models can assess factors like a client’s credit score, geographic risk (e.g., flood zones), or lifestyle patterns (e.g., smoking or high-risk occupations) to determine the likelihood of a claim.Automate risk scoring: AI-driven systems can automatically assign risk scores based on predefined criteria, removing the need for manual evaluation. Improve risk pricing: ML algorithms continuously learn from new data, improving their ability to recommend competitive premiums. This allows insurers to adjust pricing dynamically based on real-time factors, such as market trends or changes in customer risk profiles.Extract data from complex unstructured documents: IDP powered by AI and ML can extract structured data from complex documents such as claims forms, policy applications, medical records, and financial statements.For example, Nanonets’ IDP system can extract relevant fields like policyholder details, claim amounts, or accident descriptions, reducing manual data entry by up to 90% and handling document processing at speeds far greater than human operators.

The combination of AI-based OCR and ML helps insurers achieve a significant reduction in document handling costs while ensuring data accuracy and consistency.

2. Robotic Process Automation (RPA)

Robotic Process Automation (RPA) is another key technology that automates repetitive, rule-based tasks in underwriting, such as data entry, validation, and policy issuance. RPA is especially useful for automating the submission intake process, where insurance companies often receive large volumes of submissions that need to be triaged and reviewed.

RPA systems can:

Automate data transfers: RPA bots can seamlessly transfer data between systems, such as from legacy systems like AS/400 or IBM iSeries to modern cloud-based underwriting platforms, ensuring all necessary information is readily available for underwriters. This is especially valuable when integrating with older systems not optimized for modern workflows.Flag inconsistencies: RPA bots can automatically flag applications with missing or inconsistent information, routing them for manual review, while straightforward cases are processed without human intervention.Handle compliance checks: RPA systems can automate compliance checks, ensuring that policies adhere to local regulatory standards like Solvency II in Europe or the NAIC Model Act in the U.S

Benefits of automating insurance underwriting

Automation delivers tangible benefits to insurers, ranging from operational efficiencies to improved customer satisfaction. Let’s explore these benefits with real-world data and specific examples:

1. Efficiency gains

Automation allows insurers to process applications faster. For example, insurers who implement AI-driven underwriting have reported processing times reduced by as much as 70%, with some policies being issued in minutes rather than days.

According to a report by McKinsey, AI-driven underwriting can reduce the processing time of complex applications from days to less than 24 hours.

2. Improved accuracy

Automation ensures consistent, near error-free data processing, reducing mistakes by up to 75% in areas like data entry and risk calculations.Â

By using predefined rules and AI models, insurers can evaluate every application consistently, reducing the likelihood of biased or inconsistent decisions.

3. Cost savings

With automated underwriting, insurers can significantly reduce their reliance on manual labor and physical infrastructure for data processing, leading to lower operational expenses.

Companies that implement AI and RPA in underwriting processes report operational cost savings of 30-50%, especially in high-volume periods where scaling manual operations would otherwise require additional staff.

4. Enhanced customer experience

With automation, customers benefit from faster processing times, more accurate quotes, and a more personalized experience.

AI systems can tailor premiums based on individual risk profiles, ensuring that customers get the best possible coverage at competitive rates.

Automated underwriting systems can reduce the time to issue a policy by up to 60%.AI models can assess each customer’s unique risk factors to provide personalized quotes, making customers feel that their needs are being met more precisely.

Source: Read MoreÂ

![Why developers needn’t fear CSS – with the King of CSS himself Kevin Powell [Podcast #154]](https://devstacktips.com/wp-content/uploads/2024/12/15498ad9-15f9-4dc3-98cc-8d7f07cec348-fXprvk-450x253.png)