In the dynamic world of software development, the roles of Quality Assurance (QA) and Quality Engineering (QE) have become increasingly significant. Although often used interchangeably, QA and QE represent two distinct philosophies and approaches to ensuring software quality. Understanding the difference between QA vs QE isn’t just a matter of semantics; it’s a strategic necessity

The post QA vs QE: Understanding the Evolving Roles appeared first on Codoid.

Software Engineering

If your QA team is stuck fixing broken scripts every sprint, you are burning time and money. This blog breaks down how AI-driven performance testing changes that situation. Learn how self-healing tests adapt to app changes, reduce failures, and shrink maintenance by half. See how you can keep pace with rapid releases, trust your automation results, and spend less on rework; all while letting your engineers focus on real performance improvements instead of endless patch jobs.

The post The art of cutting Test Maintenance in Half Welcome AI-Driven Performance Testing first appeared on TestingXperts.

Looking for the best smartphones under ₹30,000 in India? Whether you’re a gamer, a photography enthusiast, or someone who just wants a powerful phone with great battery and display, we’ve handpicked the top 8 phones available on Amazon that offer premium features at mid-range prices. Ranked based on customer reviews, features, and overall value, these phones deliver flagship-like performance without breaking the bank. Scroll down for the full list with images, prices, Amazon affiliate links, and a comparison chart to help you pick the perfect one!

1. Nothing Phone (3a Pro)

Affiliate link: https://amzn.to/46yaDTA

Price: ₹30,337 (approx)

Summary:

Launched March 2025 with Snapdragon 7s Gen 3, a 6.77″ LTPO AMOLED display, triple-camera (50 MP OIS + 50 MP telephoto + 8 MP ultrawide), 5,000 mAh battery with 50 W fast charge, and NothingOS with 3 years of Android + 6 years of security updates.

Highlights:

Unique transparent design + Glyph interface

Periscope zoom on Pro model

Smooth 120 Hz high-bright LTPO screen

2. Infinix GT 30 Pro

Affiliate link: https://amzn.to/3IgnP5yPrice: ₹24,999

Summary:

A gamer’s delight with Dimensity 8350 Ultimate, 144 Hz AMOLED display, RGB lighting, shoulder triggers, 5,500 mAh battery, 45 W charging, and a 108 MP main camera.

Highlights:

Excellent for gaming at 120 fps

Bright display with ultrafast refresh rate

Strong everyday performance

3. OnePlus Nord 4

Affiliate link: https://amzn.to/4eI6bUr

Price: ₹26,688 (after discounts)

Summary:

Now under ₹27 k with deals; but still solid with Snapdragon 7+ Gen 3, 6.74″ 120 Hz AMOLED, 5,500 mAh battery with 100 W fast charge, dual-camera (50 MP+8 MP), and OxygenOS experience.

Highlights:

Clean design with Snapdragon power

Ultra-fast wired charging

Premier display brightness

4. Realme GT 6

Affiliate link: https://amzn.to/3Gf5Dc1Price: ₹27,999

Summary:

Equipped with Snapdragon 8s Gen 3, 6.78″ AMOLED, 120 Hz, dual 50 MP + 50 MP rear cams, 5,500 mAh battery. Excellent display and camera stabilization

Highlights:

Powerful chipset under ₹30k

Bright, high-refresh display

Strong camera and fast charging

5. iQOO Neo 10R

Affiliate link: https://amzn.to/45UsRhSPrice: ₹26,999

Summary:

Launched March 2025 with Snapdragon 8s Gen 3, 6.78″ 144 Hz AMOLED, 6,400 mAh battery; 50 MP + 8 MP + 32 MP selfie cam. High performance and smooth visuals.

Highlights:

Ultra‑high 144 Hz refresh

Snapdragon flagship-like feel

Large battery and speedy performance

6. Realme 14 Pro + 5G

Affiliate link: https://amzn.to/4lhgst1

Price: ₹26,480

Summary:

Features Snapdragon 7s Gen 3, 6.83″ AMOLED 120 Hz, 50 MP Sony IMX896 OIS, 6,000 mAh battery. Flagship feel with premium camera and display.

Highlights:

Excellent imaging & stabilization

Stunning bright display

Clean software UI

7. Motorola Edge 60 Pro (Fusion?)

Affiliate link: https://amzn.to/40Ayj60Price: ₹27,999

Summary:

Featuring Dimensity 8350 Extreme, 6.7″ curved pOLED 120 Hz, clean Android 15 experience, reliable camera and battery life.

Highlights:

Curved OLED aesthetics

Smooth near-stock Android

Dependable camera and longevity

8. Oppo Reno 11 Pro 5G

Affiliate link: https://amzn.to/4kt1crV

Price: ₹29,999

Summary:

MediaTek Dimensity 8200, 6.74″ AMOLED, 50 MP + 32 MP + 8 MP cam, 32 MP selfie, 4,600 mAh battery.

Highlights:

Sleek lightweight design

Good for photography users

Premium feel in sub‑30k segment

📊 Final Rankings by Reviews & Value:

Nothing Phone (3a Pro) – Standout design, periscope zoom, top-tier support

Infinix GT 30 Pro – Gamer’s delight with 144 Hz + RGB + strong battery

OnePlus Nord 4 – Clean OxygenOS, blazing 100 W charge

Realme GT 6 – Flagship-like experience under ₹30k

iQOO Neo 10R – 144 Hz display, Snapdragon 8s performance

Realme 14 Pro + – Great camera & display, solid mid‑range

Motorola Edge 60 Pro – Curved OLED & near-stock UI

Oppo Reno 11 Pro 5G – Design-first with solid optics

🛍️ Tips Before You Buy

Gamer? Choose Infinix GT 30 Pro or iQOO Neo 10R.

Camera priorities? Realme 14 Pro+, Nothing 3a Pro, or Oppo Reno 11 Pro deliver.

Smooth, clean software? Go with OnePlus, Motorola, or Nothing.

Fastest charging? Nord 4 leads with 100 W; others offer 45–50 W.

Conclusion

All eight are excellent under ₹30 k. If style & long-term support matter most, go for Nothing Phone (3a Pro). If you play games heavily, the Infinix GT 30 Pro is tailor-made. For a balanced blend of performance and clean software, Nord 4, Realme, iQOO, or Moto Edge are/well‑rounded picks.

In the fast-paced world of software development, teams are expected to deliver high-quality products quickly, often under shifting requirements. Enter Test Driven Development in Agile, a software testing strategy that flips traditional coding on its head by writing tests before the actual code. This preemptive approach ensures that every new feature is verified from the

The post Test Driven Development in Agile Framework appeared first on Codoid.

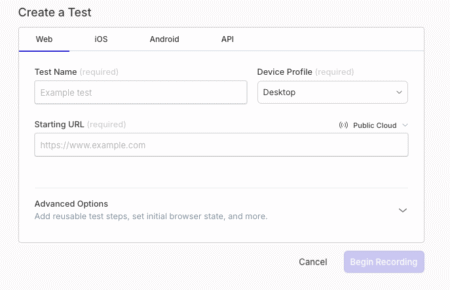

Automation testing has revolutionized software quality assurance by streamlining repetitive tasks and accelerating development cycles. However, manually creating test scripts remains a tedious, error-prone, and time-consuming process. This is where Playwright Codegen comes in a built-in feature of Microsoft’s powerful Playwright automation testing framework that simplifies test creation by automatically generating scripts based on your

The post Playwright Codegen: Record Tests in Seconds appeared first on Codoid.

This blog explores how NLP-powered virtual assistants transform insurance customer support and improve underwriting. It explains core technologies like machine learning, speech recognition, and context awareness, driving these assistants. The blog also highlights crucial security and compliance guardrails needed for ethical deployment.

The post Why NLP Virtual Assistants Are No Longer Optional for Insurers first appeared on TestingXperts.

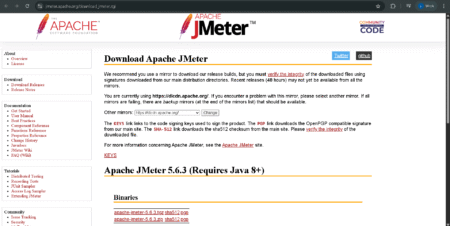

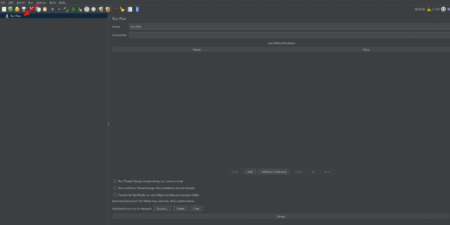

Delivering high-performance applications is not just a competitive advantage it’s a necessity. Whether you’re launching a web app, scaling an API, or ensuring microservices perform under load, performance testing is critical to delivering reliable user experiences and maintaining operational stability. To meet these demands, teams rely on powerful performance testing tools to simulate traffic, identify

The post JMeter vs Gatling vs k6: Comparing Top Performance Testing Tools appeared first on Codoid.

Selenium does not recognize webelements of Tableau. Is there any tool which is successful for UI automation of Tableau ?

Automated UI testing has long been a critical part of software development, helping ensure reliability and consistency across web applications. However, traditional automation tools like Selenium, Playwright, and Cypress often require extensive scripting knowledge, complex framework setups, and time-consuming maintenance. Enter Operator GPT, an intelligent AI agent that radically simplifies UI testing by allowing testers

The post Operator GPT: Simplifying Automated UI Testing with AI appeared first on Codoid.

Extended Reality (XR) transforms mobile app experiences through spatial interactions, real-time data, and immersive design. This blog explores key XR components, UX principles, testing strategies, and use cases across healthcare, retail, and gaming industries. It also addresses security, privacy, and ethical challenges unique to XR environments.

The post Your Customers See More Than Reality: Is Your Mobile Strategy Keeping Up? first appeared on TestingXperts.

The blog discusses how Enterprise Hyperautomation combines AI, RPA, and low-code platforms to automate complex processes, improve data accuracy, and accelerate digital transformation. By integrating these technologies, organizations streamline workflows, reduce manual effort, enhance compliance, and deliver agile, scalable solutions.

The post Why the Future Belongs to Enterprises That Build Intelligent Hyperautomation first appeared on TestingXperts.

Introduction to Cross-Browser TestingCross-browser testing is the process of verifying that web applications function consistently across different browser-OS combinations, devices, and screen sizes. With over 25,000 possible browser/device combinations in use today, comprehensive testing is essential for delivering quality user experiences.Why Cross-Browser Testing MattersBrowser Fragmentation: Chrome (65%), Safari (18%), Edge (6%), Firefox (4%) market share (2024 stats)Rendering Differences: Each browser uses different engines (Blink, WebKit, Gecko)Device Diversity: Mobile (58%) vs Desktop (42%) traffic splitBusiness Impact: 88% of users won’t return after a bad experienceCore Cross-Browser Testing Strategies1. Browser/Device Prioritization MatrixPriorityCriteriaExample TargetsTier 180%+ user coverage + business criticalChrome (Win/macOS), Safari (iOS), EdgeTier 215-80% coverage + key featuresFirefox, Samsung InternetTier 3Edge cases + progressive enhancementLegacy IE, Opera MiniPro Tip: Use Google Analytics to identify your actual user browser distribution.2. Responsive Testing MethodologyKey Breakpoints to Test:1920px (Large desktop)1366px (Most common laptop)1024px (Small laptop/tablet landscape)768px (Tablet portrait)375px (Mobile)3. Automation Framework Architecturejava// Sample TestNG XML for parallel cross-browser execution

<suite name=”CrossBrowserSuite” parallel=”tests” thread-count=”3″>

<test name=”ChromeTest”>

<parameter name=”browser” value=”chrome”/>

<classes>

<class name=”com.tests.LoginTest”/>

</classes>

</test>

<test name=”FirefoxTest”>

<parameter name=”browser” value=”firefox”/>

<classes>

<class name=”com.tests.LoginTest”/>

</classes>

</test>

</suite>Implementation Approaches1. Cloud-Based Testing SolutionsTool Comparison:ToolParallel TestsReal DevicesPricingBrowserStack50+Yes$29+/monthSauce Labs30+Yes$39+/monthLambdaTest25+Yes$15+/monthSelenium GridUnlimitedNoFreeExample Code (BrowserStack):javaDesiredCapabilities caps = new DesiredCapabilities();

caps.setCapability(“browser”, “Chrome”);

caps.setCapability(“browser_version”, “latest”);

caps.setCapability(“os”, “Windows”);

caps.setCapability(“os_version”, “10”);

WebDriver driver = new RemoteWebDriver(

new URL(“https://USERNAME:ACCESSKEY@hub-cloud.browserstack.com/wd/hub”), caps);2. Visual Regression TestingVisual regression testing is a quality assurance method that compares visual representations of web pages or application screens to detect unintended visual changes. Unlike functional testing, which verifies behaviors, visual testing focuses on:Layout integrityColor accuracyFont renderingElement positioningResponsive behaviorHow Visual Regression Testing Works?Recommended Tools:Applitools (AI-powered)Percy (Git integration)Selenium + OpenCV (Custom solution)Critical Checks:Font renderingBox model complianceCSS animation consistencyMedia query effectiveness3. Progressive Enhancement StrategyhtmlCopyDownloadRun<!– Feature detection example –>

<script>

if(‘geolocation’ in navigator) {

// Modern browser feature

} else {

// Fallback for legacy browsers

}

</script>Best Practices for Effective Testing1. Test Case Design PrinciplesCore Functionality FirstLogin flowsCheckout processesForm submissionsBrowser-Specific QuirkscssCopyDownload/* Firefox-specific fix */

@-moz-document url-prefix() {

.element { margin: 2px; }

}Performance BenchmarkingPage load timesFirst Contentful Paint (FCP)Time to Interactive (TTI)2. Debugging TechniquesCommon Issues & Solutions:ProblemDebugging MethodCSS inconsistenciesBrowser DevTools > Computed StylesJavaScript errorsSource Maps + Console logsLayout shiftsChrome Lighthouse > DiagnosticsPerformance gapsWebPageTest.org comparisonsConclusion and Next StepsImplementation Checklist:Audit current browser usage statisticsEstablish a testing priority matrixConfigure the automation frameworkSet up CI/CD integrationImplement visual regressionSchedule regular compatibility scansBonus ResourcesPerform Visual Testing using SeleniumBuild a Custom Visual Testing Tool

MetaTrader 5 (MT5) is an advanced trading platform supporting a multitude of different assets like Forex, cryptos, commodities, and so…

IntroductionIn today’s digital-first economy, e-commerce websites must deliver flawless user experiences to remain competitive. With complex functionalities spanning product catalogs, shopping carts, payment processing, and user accounts, rigorous testing is essential. This guide provides a complete framework of test cases to ensure your e-commerce platform performs optimally across all critical user journeys.Why E-Commerce Testing MattersE-commerce platforms face unique challenges:High transaction volumes requiring 24/7 reliabilityComplex user flows across devices and geographiesSecurity vulnerabilities handling sensitive payment dataPerformance demands during peak traffic periodsComprehensive testing helps prevent:Shopping cart abandonment due to functional defectsRevenue loss from checkout failuresBrand damage from security breachesNegative reviews from poor user experiencesCore Test Categories1. Registration & Login Test CasesPositive Scenarios✅ Guest Checkout: Verify unregistered users can purchase products.✅ User Registration: Validate seamless account creation.✅ Successful Login: Confirm registered users can log in.✅ Session Management: Check if user sessions persist for the intended duration.Negative Scenarios❌ Invalid Email Format: Ensure error appears for malformed emails.❌ Mandatory Field Validation: Prevent submission if required fields are empty.❌ Post-Logout Access: Verify users cannot access accounts after logging out.2. Search Feature Test CasesFunctionality Tests🔍 Filter Validation:Price rangeCategory/Brand filtersSort options (Price: Low → High)🔍 Search Accuracy:Relevant results for single/multiple filters.”No results” message for invalid queries.🔍 Pagination:Verify fixed product count per page (e.g., 10/products per page).3. Product Details Page Test Cases📌 Content Validation:Product title, description, images.Stock availability (e.g., “In Stock” vs. “Out of Stock”).📌 Interaction Tests:Select variants (size/color).Adjust quantity (min/max limits).Apply promotional offers (if available).📌 Cart Integration:Confirm “Add to Cart” updates the cart icon.4. Shopping Cart Test Cases🛒 Price & Calculations:Correct subtotal/tax/shipping calculations.Dynamic updates on quantity changes.🛒 Coupon & Discounts:Apply valid/invalid coupon codes.Verify discount reflects in the total.🛒 Cart Management:Remove items.Empty cart state handling.5. Checkout & Order Confirmation Test Cases💳 Checkout Flow:Guest vs. Registered user paths.Auto-fill saved addresses (if enabled).💳 Payment Methods:Test all options (Credit Card, PayPal, etc.).Validate error handling for failed transactions.💳 Post-Order Verification:Order confirmation email/SMS.Order tracking link functionality.Advanced Test Scenarios1. Performance TestingPerformance testing evaluates how your e-commerce system behaves under various load conditions to ensure optimal speed, stability, and scalability.Key Focus Areas:Page Load Times Under Peak TrafficMeasures homepage, PLP (Product Listing Pages), and PDP (Product Detail Pages) loading during simulated high traffic (e.g., Black Friday)Tools: Lighthouse, WebPageTest, GTmetrixDatabase Query OptimizationAnalyzes SQL query efficiency for product searches, cart operations, and checkout processesIdentifies slow-running queries needing indexing or refactoringTools: MySQL EXPLAIN, New Relic, DatadogCDN EffectivenessValidates content delivery network caching for static assets (images, CSS, JS)Tests geographical distribution performanceTools: Cloudflare Analytics, Akamai mPulseCache ValidationVerifies proper caching headers and TTL (Time-To-Live) settingsEnsures dynamic content (pricing, inventory) bypasses cache when neededTools: Browser DevTools, Cache-Control headers2. Security TestingSecurity testing protects sensitive customer data and ensures compliance with industry standards.Critical Components:PCI-DSS ComplianceValidates adherence to Payment Card Industry Data Security StandardsChecks encryption of card data in transit and at restTools: ASV scans, Qualys PCISQL Injection PreventionAttempts malicious SQL queries through form inputs and URLsVerifies parameterized queries and ORM protectionTools: OWASP ZAP, SQLMapXSS Vulnerability ChecksTests for Cross-Site Scripting vulnerabilities in:Product reviewsSearch fieldsUser profile inputsTools: Burp Suite, AcunetixBrute Force ProtectionVerifies account lockout mechanisms after failed login attemptsTests CAPTCHA effectiveness during suspicious activityTools: Kali Linux tools, custom scripts3. Localization TestingLocalization testing ensures the platform adapts correctly to different regions and cultures.Essential Verifications:Currency Conversion AccuracyTests real-time exchange rate calculationsVerifies rounding rules and currency formatting (€1.234,56 vs $1,234.56)Tools: Fixer.io API, custom validatorsTax Jurisdiction RulesValidates automated tax calculations for:VAT (EU)GST (Canada/Australia)Sales tax (US)Tools: Avalara, TaxJar test environmentsLanguage TranslationsChecks UI translations for accuracy and contextVerifies RTL (Right-to-Left) language support (Arabic, Hebrew)Tools: Smartling, LokaliseRegional Payment MethodsTests local payment options:iDEAL (Netherlands)Boleto (Brazil)Alipay (China)Verifies country-specific checkout flows4. Accessibility TestingAccessibility testing ensures compliance with disability access standards and inclusive design.WCAG 2.1 Priority Checks:Screen Reader CompatibilityVerifies proper ARIA labels and landmarksTests logical reading orderTools: NVDA, VoiceOver, JAWSKeyboard NavigationValidates full operability without a mouseChecks focus states and tab orderTools: Keyboard-only testingColor Contrast RatiosEnsures minimum 4.5:1 contrast for normal textVerifies color isn’t the sole information carrierTools: axe DevTools, Color Contrast AnalyzerForm AccessibilityTests label associationsValidates error identificationVerifies timeouts/adjustable timingsImplementation RecommendationsAutomate Where PossiblePerformance: Integrate Lighthouse CISecurity: Schedule weekly OWASP ZAP scansAccessibility: Add axe-core to your test suiteLeverage Real User MonitoringCapture performance metrics from actual trafficIdentify accessibility issues through user reportsRegional Testing StrategyUse proxy services to test from target countriesEmploy native speakers for linguistic validationCompliance DocumentationMaintain PCI-DSS Attestation of CompliancePublish Voluntary Product Accessibility Template (VPAT)By implementing these advanced testing practices, e-commerce businesses can achieve:30-50% reduction in performance-related bounce rates99.9% security vulnerability detection rate95%+ WCAG compliance scoresSeamless global customer experiencesPro Tip: Combine automated checks with quarterly manual audits for comprehensive coverage.Test Automation StrategyRecommended Framework:Functional Tests: Selenium WebDriver + TestNGAPI Tests: RestAssuredPerformance Tests: JMeterVisual Tests: ApplitoolsCritical Automation Scenarios:End-to-end purchase journeyCart calculation validationsSearch relevance testingPayment gateway integrationsMobile responsiveness checksReal-World Testing InsightsCommon Pitfalls to Avoid:Underestimating mobile test coverageNeglecting edge cases in discount logicOverlooking timezone handlingMissing inventory synchronization testsProven Best Practices:Implement test data managementPrioritize critical path test casesEstablish performance baselinesConduct regular security auditsConclusionA comprehensive e-commerce testing strategy combines:Rigorous functional validationRobust security measuresStrict performance standardsInclusive accessibility checksBy implementing this test case framework, QA teams can:Reduce production defects by 60-80%Improve conversion rates by 15-25%Decrease cart abandonment by 20-30%Enhance customer satisfaction scoresNext Steps:Customize this framework for your platformEstablish test automation pipelinesImplement continuous monitoringRegularly update test cases for new features

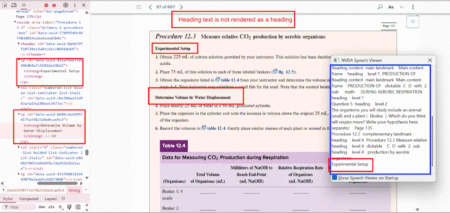

Ensuring accessibility is not just a compliance requirement but a responsibility. According to the World Health Organization (WHO), over 1 in 6 people globally live with some form of disability. These users often rely on assistive technologies like screen readers, keyboard navigation, and transcripts to access digital content. Unfortunately, many websites and applications fall short

The post Common Accessibility Issues: Real Bugs from Real Testing appeared first on Codoid.

1. Selenium Architecture & Core ConceptsQ1: Explain Selenium WebDriver’s architecture in detailAnswer:Selenium WebDriver follows a client-server architecture with these key components:Client Libraries (Language Bindings)Available in Java, Python, C#, JavaScript, etc.Convert test script commands into HTTP requests via JSON Wire Protocol (or W3C WebDriver Protocol)Browser DriversChromeDriver (for Chrome), GeckoDriver (Firefox), etc.Act as intermediaries that translate HTTP requests into browser-specific actionsEach browser has its own driver implementationReal BrowsersReceive commands from their respective driversExecute actions like click(), sendKeys() nativelyVisual Flow:Test Script → Language Binding → JSON Wire Protocol → Browser Driver → Actual BrowserKey Protocols:Legacy: JSON Wire Protocol (Selenium 3)Modern: W3C WebDriver Protocol (Selenium 4+)Q2: How does Selenium interact with headless browsers?Answer with Technical Details:Headless browsers execute without GUI for faster performance. Implementation:javaChromeOptions options = new ChromeOptions();

options.addArguments(“–headless”, “–disable-gpu”);

// ‘–disable-gpu’ avoids potential rendering issues

options.addArguments(“–window-size=1920,1080”);

// Sets viewport size for consistent rendering

WebDriver driver = new ChromeDriver(options);Why Use Headless?2-3x faster execution (no UI rendering overhead)Ideal for CI/CD pipelines (Jenkins, GitHub Actions)Better for Linux servers without GUI environmentsLimitations:Harder to debug (no visual feedback)Some anti-bot systems detect headless modeAlternatives:Firefox Headless: options.addArguments(“–headless”)PhantomJS (deprecated)2. Advanced WebDriver TechniquesQ3: How would you handle a StaleElementReferenceException?Deep Dive Solution:This occurs when the DOM changes after element location but before interaction. Robust handling:javapublic void safeClick(By locator, int maxRetries) {

int attempts = 0;

while (attempts < maxRetries) {

try {

driver.findElement(locator).click();

break;

} catch (StaleElementReferenceException e) {

attempts++;

if (attempts == maxRetries) throw e;

// Optional: Add small wait

try { Thread.sleep(200); } catch (InterruptedException ie) {}

}

}

}

// Usage:

safeClick(By.id(“dynamic-button”), 3);Root Causes:Page refresh/AJAX updatesDOM re-rendering (common in React/Angular apps)Navigation between pagesPrevention Strategies:Use Page Object Model with re-initialized elementsImplement custom ExpectedConditions for dynamic elementsPrefer relative locators over absolute XPathsQ4: Automate file download without third-party toolsComprehensive Solution:java// Chrome Configuration

ChromeOptions options = new ChromeOptions();

// Set download directory (escape backslashes in Windows)

String downloadPath = “C:\test_downloads”;

options.setExperimentalOption(“prefs”, Map.of(

“download.default_directory”, downloadPath,

“download.prompt_for_download”, false,

“download.directory_upgrade”, true,

“safebrowsing.enabled”, true // Disables security warnings

));

// Disable PDF viewer to force downloads

options.addArguments(“–disable-extensions”);

options.addArguments(“–disable-print-preview”);

WebDriver driver = new ChromeDriver(options);

// Trigger download

driver.get(“https://example.com/file.pdf”);

// Verification (Java 11+)

long waitTime = 30; // seconds

Path file = Path.of(downloadPath, “file.pdf”);

boolean isDownloaded = Files.waitUntilExists(file, waitTime);Key Considerations:Browser-specific configurations (Chrome vs Firefox)Network speed impacts download completionCleanup downloaded files between testsEdge Cases:Handling “Save As” dialogs (requires OS-level automation)Large file timeouts3. Framework Design & PatternsQ5: Explain the Hybrid Framework in SeleniumDetailed Architecture:Component Breakdown:Page Object Model (POM)Each page as a Java class (LoginPage.java)Elements stored as @FindBy annotationsMethods for page actions (login(String user, String pass))Data-Driven TestingExternalize test data to JSON/ExcelTestNG @DataProvider feeds multiple datasetsjava@DataProvider

public Object[][] loginData() {

return new Object[][] {

{“user1”, “pass123”},

{“user2”, “pass456”}

};

}Keyword-DrivenNon-technical test cases in Excel:ActionLocatorValueclickid=submit-btntypename=emailtest@demo.comAdvantages:60-70% less code maintenanceEnables parallel executionBusiness-readable test cases4. Performance OptimizationQ6: How to reduce flaky tests?Proven Strategies with Examples:Smart Waitsjavapublic WebElement waitForClickable(By locator, int timeout) {

return new WebDriverWait(driver, Duration.ofSeconds(timeout))

.until(ExpectedConditions.elementToBeClickable(locator));

}Retry Mechanismjava@Test(retryAnalyzer = RetryAnalyzer.class)

public void flakyTest() { … }Locator StabilityAvoid XPaths like //div[3]/button[1]Prefer CSS selectors: button.submit-btnTest IsolationClear cookies between testsUse fresh user sessionsMonitoring:Track flakiness percentageQuarantine unstable tests5. Real-World ScenariosQ7: Automate testing for a real-time stock dashboardSolution Architecture:Implementation Steps:WebSocket Testingjava// Using Java-WebSocket library

WebSocketClient client = new WebSocketClient(new URI(“wss://stocks”)) {

@Override

public void onMessage(String message) {

// Parse JSON and assert values

}

};

client.connect();Visual RegressionjavaBufferedImage current = new AShot()

.shootingStrategy(ShootingStrategies.viewportPasting(1000))

.takeScreenshot(driver)

.getImage();

ImageIO.write(current, “PNG”, new File(“current.png”));Database AssertionsjavaStatement stmt = dbConnection.createStatement();

ResultSet rs = stmt.executeQuery(“SELECT price FROM stocks”);

assertTrue(rs.next());

assertEquals(150.25, rs.getDouble(“price”), 0.01);Challenges:High-frequency updatesTime synchronizationDynamic chart renderingQ8: Parallel Test Execution Implementation (Deep Dive)TestNG Parallel Execution Explained:The TestNG XML configuration enables parallel execution at multiple levels:xml<suite name=”ParallelSuite” parallel=”tests” thread-count=”4″ configfailurepolicy=”continue”>

<!– Suite-level parallel execution –>

<test name=”ChromeTests” parallel=”classes” thread-count=”2″>

<parameter name=”browser” value=”chrome”/>

<classes>

<class name=”com.tests.LoginTest”/>

<class name=”com.tests.CheckoutTest”/>

</classes>

</test>

<test name=”FirefoxTests”>

<parameter name=”browser” value=”firefox”/>

<packages>

<package name=”com.module1.tests.*”/>

</packages>

</test>

</suite>Key Attributes:parallel=”tests|classes|methods|instances”:tests: Parallel test tagsclasses: Parallel test classesmethods: Parallel test methodsthread-count: Maximum concurrent threadsconfigfailurepolicy=”continue”: Continue execution after failed configurationsImplementation Best Practices:Use @BeforeClass for browser initializationMake tests independent with proper cleanupUtilize ThreadLocal<WebDriver> for thread-safe driver managementBalance thread count with system resources (optimal is CPU cores × 1.5)Advanced Scenario: Cross-Browser Parallelismxml<test name=”CrossBrowser”>

<methods>

<include name=”testLogin” invocation-count=”3″>

<parameter name=”browser” value=”chrome”/>

<parameter name=”browser” value=”firefox”/>

<parameter name=”browser” value=”edge”/>

</include>

</methods>

</test>Q9: BDD Framework Advantages (Expanded)Cucumber/Gherkin Workflow:textFeature: Login functionality

Scenario: Successful login

Given I navigate to login page

When I enter valid “testuser” and “Pass123”

Then I should see dashboardTechnical Benefits:Living Documentation:Feature files serve as always-updated specsAutomated generation of documentation (e.g., with Pickles)Step Reusability:java@When(“I enter valid {string} and {string}”)

public void enterCredentials(String user, String pass) {

loginPage.enterCredentials(user, pass);

}CI/CD Integration:JSON/HTML reports integration with JenkinsTag-based execution (@smoke, @regression)Test Data Management:Scenario outlines with examples tables:textExamples:

| username | password |

| user1 | Password1! |

| user2 | Password2! |Collaboration Impact:Product owners can validate scenariosDevelopers and QA share step definitionsReduces misinterpretation of requirementsQ10: Flaky Test Solutions (Comprehensive Guide)Root Cause Analysis Matrix:CauseSolutionCode ExampleElement StalenessRe-locate element before interactionnew WebElementProxy(driver, locator).click()Timing IssuesSmart waits with custom conditionswait.until(d -> element.isDisplayed())Test Order DependencyIndependent test data@BeforeMethod void cleanCookies()Environment VarianceDockerized consistent environmentsdocker-compose up selenium-hubAdvanced Techniques:Retry Analyzer:javapublic class RetryAnalyzer implements IRetryAnalyzer {

private int count = 0;

private static final int MAX_RETRY = 2;

public boolean retry(ITestResult result) {

return count++ < MAX_RETRY &&

result.getThrowable() instanceof StaleElementReferenceException;

}

}Element State Monitoring:javapublic void safeClick(By locator) {

wait.until(d -> {

try {

WebElement el = d.findElement(locator);

return el.isDisplayed() && el.isEnabled();

} catch (StaleElementReferenceException e) {

return false;

}

}).click();

}Q11: Test Speed Optimization (Professional Approach)Performance Benchmarking Table:TechniqueSpeed GainImplementationHeadless Mode40-60% fasteroptions.addArguments(“–headless”)CDP Mocking30% faster API callsdevTools.send(Network.enable())Disable Images25% faster loadsprefs.put(“profile.managed_default_content_settings.images”, 2)DOM Freeze DetectionPrevent wasted waits((JavascriptExecutor)driver).executeScript(“return document.readyState”)Chrome DevTools Protocol Example:javaDevTools devTools = ((ChromeDriver)driver).getDevTools();

devTools.createSession();

devTools.send(Network.enable(Optional.empty(), Optional.empty(), Optional.empty()));

devTools.send(Network.emulateNetworkConditions(

false, 100, 5000, 2000,

Optional.of(ConnectionType.CELLULAR3G)

);Advanced Configurations:javaChromeOptions options = new ChromeOptions();

options.setCapability(“goog:loggingPrefs”, new LoggingPreferences());

options.addArguments(“–disable-extensions”);

options.addArguments(“–disable-notifications”);

options.addArguments(“–disable-web-security”);

options.setExperimentalOption(“excludeSwitches”,

new String[]{“enable-automation”});Q12: Jenkins Integration (Production-Grade Setup)Pipeline Script Example:groovypipeline {

agent any

stages {

stage(‘Checkout’) {

steps {

git branch: ‘main’, url: ‘https://github.com/your/repo.git’

}

}

stage(‘Test’) {

parallel {

stage(‘Chrome’) {

steps {

sh “mvn test -Dbrowser=chrome -Dgroups=smoke”

}

}

stage(‘Firefox’) {

steps {

sh “mvn test -Dbrowser=firefox -Dgroups=smoke”

}

}

}

}

stage(‘Report’) {

steps {

allure includeProperties: false, jdk: ”, results: [[path: ‘target/allure-results’]]

}

}

}

post {

always {

archiveArtifacts artifacts: ‘target/surefire-reports/**/*’, fingerprint: true

}

}

}Key Plugins:Allure Reporting: Trend analysis and historical comparisonsTest Results Analyzer: Identify flaky testsBuild Pipeline: Visualize test stagesSlack Notification: Alert on failuresQ13: Dockerized Selenium (Enterprise Architecture)Production-Ready docker-compose.yml:yamlversion: ‘3.8’

services:

hub:

image: selenium/hub:4.1.0

ports:

– “4442:4442” # Grid console

– “4443:4443” # Live sessions

environment:

– SE_EVENT_BUS_HOST=hub

– SE_NODE_MAX_SESSIONS=5

deploy:

resources:

limits:

cpus: ‘1’

memory: 2G

chrome:

image: selenium/node-chrome:4.1.0

shm_size: 2gb

environment:

– SE_EVENT_BUS_HOST=hub

– SE_NODE_MAX_SESSIONS=3

depends_on:

– hub

volumes:

– /dev/shm:/dev/shm # Critical for Chrome stabilityScaling with Kubernetes:bashkubectl create deployment selenium-hub –image=selenium/hub

kubectl scale deployment selenium-node –replicas=5Best Practices:Use –shm-size for Chrome containersImplement health checks with SE_NODE_HEALTHCHECK_INTERVALConfigure session timeout with SE_NODE_SESSION_TIMEOUTQ14: CAPTCHA Testing Strategies (Compliance-Friendly)Enterprise Solutions:Test Environment Bypass:Development flag: ?disable_captcha=trueMock service response:java@Mock

CaptchaService captchaService;

when(captchaService.verify(anyString())).thenReturn(true);Third-Party Services:2Captcha API integrationAnti-Captcha services with Selenium bindingsLegal Compliance:Whitelist test IPs in CAPTCHA configurationUse enterprise bypass tokensAutomation Workaround Example:javapublic void bypassCaptcha() {

if (isTestEnvironment()) {

driver.executeScript(

“document.getElementById(‘captcha’).value = ‘BYPASSED'”);

} else {

solveRealCaptcha();

}

}Q15: Real-Time Dashboard Testing (Financial Grade)WebSocket Testing Framework:javapublic class StockTickerTest {

private WebSocketClient client;

@BeforeMethod

public void connect() throws URISyntaxException {

client = new WebSocketClient(new URI(“wss://api.stock.com”)) {

@Override

public void onMessage(String message) {

StockData data = new Gson().fromJson(message, StockData.class);

assertTrue(data.getPrice() > 0);

}

};

client.connect();

}

@Test

public void testPriceUpdates() {

driver.findElement(By.id(“refresh”)).click();

await().atMost(5, SECONDS).untilAsserted(() -> {

assertNotNull(lastMessage);

});

}

}Visual Regression Pipeline:Baseline capture on releasePixel-by-pixel comparison with tolerance thresholdsDynamic element masking (timestamps, moving averages)AI-based anomaly detection (Applitools Eyes)Data Validation Approach:sqlSELECT stock_symbol, COUNT(*)

FROM price_updates

WHERE timestamp > NOW() – INTERVAL ‘1 minute’

GROUP BY stock_symbol

HAVING COUNT(*) < 10; — Expecting 10+ updates per minuteConclusionThese detailed explanations demonstrate deep technical understanding that interviewers value. These expanded explanations provide the technical depth and real-world implementation details that senior automation engineers having experience 4 to 10 years need during interviews.Pro Tip: Always relate answers to your project experience during interviews.#Selenium #Testing #InterviewPrep 🚀

IntroductionVisual testing is crucial for ensuring UI consistency across releases. While commercial tools exist, sometimes you need a custom solution tailored to your specific needs. This guide walks you through creating your own visual testing tool using Selenium and Python.Table of ContentsIntroductionWhy Build a Custom Visual Testing Tool?Core ComponentsImplementation GuideAdvanced FeaturesIntegration & ScalingReporting & AnalysisCommon Challenges & SolutionsLimitations & ConsiderationsConclusion & Next StepsWhy Build a Custom Solution?Specific requirements not met by commercial toolsCost savings for simple projectsComplete control over comparison logicLearning opportunity about image processingCore Components1. Screenshot Capture with Seleniumpythonfrom selenium import webdriver

import os

def capture_screenshot(url, filename):

“””Capture screenshot of a webpage”””

driver = webdriver.Chrome()

driver.get(url)

# Ensure screenshot directory exists

os.makedirs(“screenshots”, exist_ok=True)

screenshot_path = f”screenshots/{filename}”

driver.save_screenshot(screenshot_path)

driver.quit()

return screenshot_path2. Image Comparison Enginepythonfrom PIL import Image, ImageChops

import math

def compare_images(baseline_path, current_path, diff_path=None, threshold=0.95):

“””

Compare two images with similarity threshold

Returns: (is_similar, similarity_score)

“””

baseline = Image.open(baseline_path).convert(‘RGB’)

current = Image.open(current_path).convert(‘RGB’)

# Check dimensions

if baseline.size != current.size:

return False, 0

# Calculate difference

diff = ImageChops.difference(baseline, current)

diff_pixels = sum(

sum(1 for pixel in diff.getdata() if any(c > 0 for c in pixel))

)

total_pixels = baseline.size[0] * baseline.size[1]

similarity = 1 – (diff_pixels / total_pixels)

# Save diff image if needed

if diff_path and diff_pixels > 0:

diff.save(diff_path)

return similarity >= threshold, similarity3. Baseline Management Systempythonimport json

from datetime import datetime

class BaselineManager:

def __init__(self, baseline_dir=”baselines”):

self.baseline_dir = baseline_dir

os.makedirs(baseline_dir, exist_ok=True)

def save_baseline(self, name, image_path):

“””Save a new baseline with metadata”””

timestamp = datetime.now().isoformat()

baseline_path = f”{self.baseline_dir}/{name}.png”

metadata = {

“created”: timestamp,

“source”: image_path

}

# Save image

Image.open(image_path).save(baseline_path)

# Save metadata

with open(f”{baseline_dir}/{name}.json”, ‘w’) as f:

json.dump(metadata, f)

return baseline_pathAdvanced Features1. Region-Specific Comparisonpythondef compare_regions(baseline_path, current_path, regions, threshold=0.95):

“””

Compare specific regions of images

regions: List of (x, y, width, height) tuples

“””

baseline = Image.open(baseline_path)

current = Image.open(current_path)

results = []

for region in regions:

x, y, w, h = region

baseline_crop = baseline.crop((x, y, x+w, y+h))

current_crop = current.crop((x, y, x+w, y+h))

is_similar, score = compare_images(

baseline_crop, current_crop, threshold=threshold

)

results.append((region, is_similar, score))

return results2. Dynamic Content Maskingpythondef mask_dynamic_regions(image_path, regions, output_path=None):

“””

Mask dynamic content regions with black rectangles

“””

img = Image.open(image_path)

draw = ImageDraw.Draw(img)

for region in regions:

x, y, w, h = region

draw.rectangle((x, y, x+w, y+h), fill=’black’)

if output_path:

img.save(output_path)

return imgPutting It All Togetherpythondef run_visual_test(url, test_name, threshold=0.95):

“””Complete visual test workflow”””

# Setup

bm = BaselineManager()

current_path = capture_screenshot(url, f”current_{test_name}.png”)

# Check if baseline exists

baseline_path = f”baselines/{test_name}.png”

if not os.path.exists(baseline_path):

print(f”Creating new baseline for {test_name}”)

bm.save_baseline(test_name, current_path)

return True

# Compare images

diff_path = f”diffs/diff_{test_name}.png”

is_similar, score = compare_images(

baseline_path, current_path, diff_path, threshold

)

# Generate report

report = {

“test_name”: test_name,

“passed”: is_similar,

“similarity_score”: score,

“diff_image”: diff_path if not is_similar else None,

“timestamp”: datetime.now().isoformat()

}

return reportHandling Common ChallengesCross-Browser VariationsCreate separate baselines per browserAdjust similarity thresholds per browserResponsive TestingTest at multiple viewport sizesUse device emulation in SeleniumTest MaintenanceImplement baseline versioningAdd approval workflow for new baselinesPerformance OptimizationCache screenshotsParallelize testsIntegration with Test Frameworkspythonimport unittest

class VisualTestCase(unittest.TestCase):

@classmethod

def setUpClass(cls):

cls.bm = BaselineManager()

def test_homepage_layout(self):

report = run_visual_test(

“https://example.com”,

“homepage_desktop”,

threshold=0.98

)

self.assertTrue(report[‘passed’],

f”Visual regression detected. Similarity: {report[‘similarity_score’]}”)Reporting and Analysispythondef generate_html_report(test_reports):

“””Generate visual test HTML report”””

html = “””

<html><head><title>Visual Test Report</title></head>

<body><h1>Visual Test Results</h1>

<table border=”1″>

<tr>

<th>Test</th>

<th>Status</th>

<th>Similarity</th>

<th>Diff</th>

</tr>

“””

for report in test_reports:

status = “PASS” if report[‘passed’] else “FAIL”

color = “green” if report[‘passed’] else “red”

diff_link = f'<a href=”{report[“diff_image”]}”>View</a>’ if report[“diff_image”] else “None”

html += f”””

<tr>

<td>{report[‘test_name’]}</td>

<td style=”color:{color}”>{status}</td>

<td>{report[‘similarity_score’]:.2%}</td>

<td>{diff_link}</td>

</tr>

“””

html += “</table></body></html>”

return htmlScaling Your SolutionParallel ExecutionUse Selenium GridImplement multiprocessingBaseline ManagementStore baselines in cloud storageAdd metadata taggingCI/CD IntegrationAdd as a test step in your pipelineConfigure failure thresholdsLimitations to ConsiderMaintenance overhead for baseline updatesBrowser-specific rendering differencesPerformance impact of image processingLimited to pixel comparison (no semantic understanding)ConclusionBuilding a custom visual testing tool gives you flexibility but requires careful implementation. Start small with critical pages, then expand as needed. Consider these enhancements:Add machine learning for smarter diff detectionImplement cloud storage for baselinesCreate a dashboard for trend analysisAdd support for component-level testingRemember that commercial tools might become more cost-effective as your needs grow, but a custom solution can be perfect for specific requirements.

Visual testing is an essential part of UI validation, ensuring that web applications appear and function as intended across different browsers, devices, and screen resolutions. While Selenium is primarily used for functional testing, it can also be leveraged for visual regression testing with the help of additional tools and libraries.In this blog, we’ll explore how to perform visual testing using Selenium, covering key concepts, tools, and step-by-step implementation.Table of ContentsWhat is Visual Testing?Why Use Selenium for Visual Testing?Tools for Visual Testing with SeleniumStep-by-Step Guide to Perform Visual TestingPrerequisitesSetting Up Selenium WebDriverCapturing ScreenshotsComparing ScreenshotsGenerating Test ReportsGeneral Steps to Perform Visual TestingBest Practices for Visual TestingConclusion1. What is Visual Testing?Visual testing (or visual regression testing) compares screenshots of a web application’s UI against baseline images to detect unintended visual changes. It helps identify issues like:Layout shiftsBroken fonts or imagesOverlapping elementsResponsive design failuresUnlike functional testing, which verifies behavior, visual testing ensures the UI looks correct.2. Why Use Selenium for Visual Testing?Selenium WebDriver is widely used for automating browser interactions. While it doesn’t natively support visual comparisons, it can:Capture screenshots of web pages.Integrate with visual testing libraries (e.g., Applitools, Percy, or OpenCV).Run cross-browser tests to ensure consistency.3. Tools for Visual Testing with SeleniumHere are some popular tools for visual testing with Selenium:ToolDescriptionApplitoolsAI-powered visual testing with automatic baseline management.PercyCloud-based visual testing by BrowserStack.AShotJava-based screenshot comparison library.OpenCVOpen-source computer vision library for image processing.SikuliXUses image recognition for UI testing.We’ll use AShot (for Java) and Pillow (for Python) in this guide.4. Step-by-Step Guide to Perform Visual TestingPrerequisites Java/Python installedSelenium WebDriverMaven/Gradle (for Java) or pip (for Python)A testing framework (JUnit/TestNG for Java, pytest for Python)Setting Up Selenium WebDriverJava (Maven)xml<dependency>

<groupId>org.seleniumhq.selenium</groupId>

<artifactId>selenium-java</artifactId>

<version>4.10.0</version>

</dependency>

<dependency>

<groupId>ru.yandex.qatools.ashot</groupId>

<artifactId>ashot</artifactId>

<version>1.5.4</version>

</dependency>Python (pip)bashpip install selenium pillow opencv-pythonCapturing ScreenshotsJava (Using AShot)javaimport org.openqa.selenium.WebDriver;

import org.openqa.selenium.chrome.ChromeDriver;

import ru.yandex.qatools.ashot.AShot;

import ru.yandex.qatools.ashot.Screenshot;

import javax.imageio.ImageIO;

import java.io.File;

public class VisualTest {

public static void main(String[] args) throws Exception {

WebDriver driver = new ChromeDriver();

driver.get(“https://example.com”);

// Capture screenshot

Screenshot screenshot = new AShot().takeScreenshot(driver);

ImageIO.write(screenshot.getImage(), “PNG”, new File(“screenshot.png”));

driver.quit();

}

}Python (Using Pillow)pythonfrom selenium import webdriver

from PIL import Image

driver = webdriver.Chrome()

driver.get(“https://example.com”)

# Capture screenshot

driver.save_screenshot(“screenshot.png”)

driver.quit()Comparing ScreenshotsJava (Using AShot)javaimport java.awt.image.BufferedImage;

import javax.imageio.ImageIO;

public class ImageComparator {

public static boolean compareImages(String img1Path, String img2Path) throws Exception {

BufferedImage img1 = ImageIO.read(new File(img1Path));

BufferedImage img2 = ImageIO.read(new File(img2Path));

if (img1.getWidth() != img2.getWidth() || img1.getHeight() != img2.getHeight()) {

return false;

}

for (int y = 0; y < img1.getHeight(); y++) {

for (int x = 0; x < img1.getWidth(); x++) {

if (img1.getRGB(x, y) != img2.getRGB(x, y)) {

return false;

}

}

}

return true;

}

}Python (Using OpenCV)pythonimport cv2

import numpy as np

def compare_images(img1_path, img2_path):

img1 = cv2.imread(img1_path)

img2 = cv2.imread(img2_path)

if img1.shape != img2.shape:

return False

difference = cv2.subtract(img1, img2)

return not np.any(difference)Generating Test Reports Use testing frameworks like TestNG (Java) or pytest (Python) to log results:java@Test

public void testVisualComparison() throws Exception {

Assert.assertTrue(ImageComparator.compareImages(“expected.png”, “actual.png”));

}5. General Steps When Using a Visual Testing PlatformWhen using a dedicated visual testing platform (e.g., Percy, Applitools), follow these steps:1. Set Up Your Selenium ProjectEnsure you have a working Selenium automation framework in your preferred language (Java, Python, C#, JavaScript, etc.).2. Integrate the Visual Testing SDKInstall the SDK provided by your chosen platform. Examples:Python (Percy)bashpip install percy-seleniumJavaScript (Percy)bashnpm install @percy/selenium-webdriver3. Capture BaselinesThe first time you run visual tests, the tool captures “baseline” screenshots (expected UI state).Example (Python with Percy)pythonfrom selenium import webdriver

from percy import percy_snapshot

driver = webdriver.Chrome()

driver.get(“https://your-application.com”)

percy_snapshot(driver, “Homepage – Initial State”)

# Perform actions

driver.get(“https://your-application.com/some-other-page”)

percy_snapshot(driver, “Another Page – After Interaction”)

driver.quit()4. Run Tests and CompareIn subsequent runs, the tool compares new screenshots against baselines.5. Review and Approve ChangesDifferences are highlighted in a dashboard.Approve intentional changes (updates baseline).Flag unintended changes as bugs.6. Integrate with CI/CDRun visual tests in pipelines (e.g., GitHub Actions, Jenkins) for continuous feedback.6. Best Practices for Visual Testing1. Strategic SnapshottingFocus on critical UI components (headers, forms, key interactions) rather than capturing every element.Prioritize page layouts and areas prone to visual regressions (e.g., responsive breakpoints).2. Handle Dynamic ContentIgnore/Mask dynamic elements (e.g., ads, timestamps, user-generated content) to avoid false positives.Use tools like Percy’s ignoreRegions or Applitools’ ignoreDisplacements to exclude volatile areas.3. Maintain BaselinesReview baselines regularly and update them only for intentional UI changes.Store baselines in version control (e.g., Git) to track historical changes.4. Cross-Browser & Device TestingTest across multiple browsers (Chrome, Firefox, Safari) and viewport sizes (desktop, tablet, mobile).Leverage cloud platforms (e.g., BrowserStack, Sauce Labs) for broader coverage.5. Configure Thresholds & SensitivityAdjust pixel-matching thresholds to balance between catching bugs and reducing noise.Example: Set a 5% difference threshold for minor anti-aliasing changes.6. Component-Level TestingTest isolated UI components (buttons, modals, cards) for design system consistency.Tools like Storybook + Percy enable visual testing of individual components.Bonus: CI/CD IntegrationRun visual tests automatically in pipelines (GitHub Actions, Jenkins) to catch regressions early.Fail builds on critical visual deviations but allows manual review for minor changes.7. ConclusionVisual testing with Selenium helps ensure UI consistency across releases. While Selenium itself doesn’t support visual comparisons, integrating tools like AShot, OpenCV, or Applitools makes it possible.By following this guide, you can implement automated visual regression testing and catch UI bugs early in development.🚀 Next Steps: Try integrating visual testing into your CI/CD pipeline for seamless validation!Have questions? Drop them in the comments!#Selenium #VisualTesting #Automation #QA

This is a bit of a general question. I’m trying to practice my testing skills and perhaps get some better experience with manual testing mature applications. In particular, I’m interested in desktop applications. One good place to do this is with open source projects, particularly those in need of dedicated/semi-dedicated testers. While I know every open source project has its own culture around it, with differing levels of maturity, are there any general tips for OSS testing?

Modern web and mobile applications live or die by their speed, stability, and scalability. Users expect sub-second responses, executives demand uptime, and DevOps pipelines crank out new builds faster than ever. In that high-pressure environment, performance testing is no longer optional; it is the safety net that keeps releases from crashing and brands from burning.

The post JMeter Tutorial: An End-to-End Guide appeared first on Codoid.