Introduction to Cross-Browser TestingCross-browser testing is the process of verifying that web applications function consistently across different browser-OS combinations, devices, and screen sizes. With over 25,000 possible browser/device combinations in use today, comprehensive testing is essential for delivering quality user experiences.Why Cross-Browser Testing MattersBrowser Fragmentation: Chrome (65%), Safari (18%), Edge (6%), Firefox (4%) market share (2024 stats)Rendering Differences: Each browser uses different engines (Blink, WebKit, Gecko)Device Diversity: Mobile (58%) vs Desktop (42%) traffic splitBusiness Impact: 88% of users won’t return after a bad experienceCore Cross-Browser Testing Strategies1. Browser/Device Prioritization MatrixPriorityCriteriaExample TargetsTier 180%+ user coverage + business criticalChrome (Win/macOS), Safari (iOS), EdgeTier 215-80% coverage + key featuresFirefox, Samsung InternetTier 3Edge cases + progressive enhancementLegacy IE, Opera MiniPro Tip: Use Google Analytics to identify your actual user browser distribution.2. Responsive Testing MethodologyKey Breakpoints to Test:1920px (Large desktop)1366px (Most common laptop)1024px (Small laptop/tablet landscape)768px (Tablet portrait)375px (Mobile)3. Automation Framework Architecturejava// Sample TestNG XML for parallel cross-browser execution

<suite name=”CrossBrowserSuite” parallel=”tests” thread-count=”3″>

<test name=”ChromeTest”>

<parameter name=”browser” value=”chrome”/>

<classes>

<class name=”com.tests.LoginTest”/>

</classes>

</test>

<test name=”FirefoxTest”>

<parameter name=”browser” value=”firefox”/>

<classes>

<class name=”com.tests.LoginTest”/>

</classes>

</test>

</suite>Implementation Approaches1. Cloud-Based Testing SolutionsTool Comparison:ToolParallel TestsReal DevicesPricingBrowserStack50+Yes$29+/monthSauce Labs30+Yes$39+/monthLambdaTest25+Yes$15+/monthSelenium GridUnlimitedNoFreeExample Code (BrowserStack):javaDesiredCapabilities caps = new DesiredCapabilities();

caps.setCapability(“browser”, “Chrome”);

caps.setCapability(“browser_version”, “latest”);

caps.setCapability(“os”, “Windows”);

caps.setCapability(“os_version”, “10”);

WebDriver driver = new RemoteWebDriver(

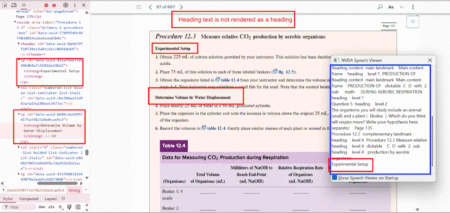

new URL(“https://USERNAME:ACCESSKEY@hub-cloud.browserstack.com/wd/hub”), caps);2. Visual Regression TestingVisual regression testing is a quality assurance method that compares visual representations of web pages or application screens to detect unintended visual changes. Unlike functional testing, which verifies behaviors, visual testing focuses on:Layout integrityColor accuracyFont renderingElement positioningResponsive behaviorHow Visual Regression Testing Works?Recommended Tools:Applitools (AI-powered)Percy (Git integration)Selenium + OpenCV (Custom solution)Critical Checks:Font renderingBox model complianceCSS animation consistencyMedia query effectiveness3. Progressive Enhancement StrategyhtmlCopyDownloadRun<!– Feature detection example –>

<script>

if(‘geolocation’ in navigator) {

// Modern browser feature

} else {

// Fallback for legacy browsers

}

</script>Best Practices for Effective Testing1. Test Case Design PrinciplesCore Functionality FirstLogin flowsCheckout processesForm submissionsBrowser-Specific QuirkscssCopyDownload/* Firefox-specific fix */

@-moz-document url-prefix() {

.element { margin: 2px; }

}Performance BenchmarkingPage load timesFirst Contentful Paint (FCP)Time to Interactive (TTI)2. Debugging TechniquesCommon Issues & Solutions:ProblemDebugging MethodCSS inconsistenciesBrowser DevTools > Computed StylesJavaScript errorsSource Maps + Console logsLayout shiftsChrome Lighthouse > DiagnosticsPerformance gapsWebPageTest.org comparisonsConclusion and Next StepsImplementation Checklist:Audit current browser usage statisticsEstablish a testing priority matrixConfigure the automation frameworkSet up CI/CD integrationImplement visual regressionSchedule regular compatibility scansBonus ResourcesPerform Visual Testing using SeleniumBuild a Custom Visual Testing Tool