Introduction: Why Enterprises Need an ADP Layer Now

Enterprise document volumes are exploding, yet back-office workflows are still clogged with manual routing, data re-entry, and error-prone approvals. Finance teams waste hours reconciling mismatched invoices. Operations pipelines stall when exceptions pile up. IT leaders struggle to maintain brittle integrations every time a vendor shifts a template or updates a portal interface. The result? Higher costs, slower closes, and mounting compliance risk.

The scale of the challenge is sobering: research shows that 80–90% of enterprise data remains trapped in documents, much of it keyed manually into ERPs and CRMs. Even with templates, break/fix cycles persist—finance leaders report spending up to 30% of their time on exceptions.

This article focuses narrowly on ADP as a platform capability: rules, validations, routing, and integrations. For insights into AI-powered intelligence, see our companion guide on Intelligent Document Processing (IDP). For a complete view of the document processing maturity curve, visit our in-depth guide on Document Processing.

What Is (and Isn’t) Automated Document Processing?

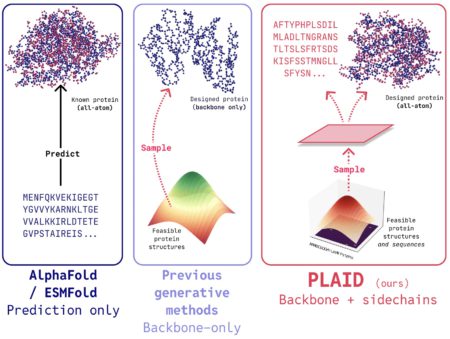

At its core, ADP is a platform capability—not a maturity stage. It bundles document ingestion, templates, business rules, routing logic, and integrations into a rule-based platform. Optimized for structured documents like tax forms and semi-structured documents like invoices, bills of lading, or FNOL claims, ADP provides what enterprises need most: determinism, speed, and auditability. Unlike IDP, it does not learn, adapt, or understand context—it applies rules consistently, every time.

ADP excels where inputs are predictable and governance is paramount: fixed-format invoices from telecom vendors, purchase orders with stable layouts, or discharge summaries from approved provider networks. These are environments where audit trails and SLA enforcement matter more than adaptability.

Industry adoption reflects this focus. Gartner (2024) notes that ADP remains the dominant platform in document-heavy functions like AP, procurement, logistics, and HR onboarding. While IDP adoption is accelerating, it is layered on top of ADP foundations, not replacing them. OCR and RPA still play roles—OCR for text capture, RPA for system navigation—but neither can deliver end-to-end workflow automation on their own.

ADP is the stable base; IDP adds flexibility; OCR and RPA are enabling components—not end-to-end solutions.

| Term | What It Does | What It Doesn’t Do | Enterprise Example |

|---|---|---|---|

| ADP | Processes uniform, high-volume docs with rules/templates/connectors | Handle layout variability, adapt over time | Telecom invoices → ERP posting |

| IDP | Learns formats, applies AI-based context | Guarantee deterministic outputs | Multi-vendor invoices with different layouts |

| OCR | Extracts text from images/scans | Apply rules or routing | Scanned ID card capture |

| RPA | Moves data between systems (UI automation) | Interpret or validate content | Bot pastes invoice totals into SAP |

Takeaway: ADP provides enterprises with a stable foundation for scale—especially where document inputs are standardized and rule-driven. For intelligence, flexibility, and unstructured data, enterprises can layer in IDP, but ADP is where stability begins.

With scope and boundaries set, let’s unpack how an ADP platform is actually built to deliver that determinism at scale.

How ADP Platforms Work: Core Architecture

Automated Document Processing (ADP) platforms are often mistaken for glorified OCR engines or RPA scripts. In reality, enterprise-grade ADP functions as a layered architecture—a blend of ingestion, extraction, validation, routing, integration, and monitoring. Its value lies not in intelligence, but in mechanical reliability and integration strength—attributes that CFOs, COOs, and IT buyers care about when scaling mission-critical document workflows.

Ingestion Mesh

Modern enterprises process documents through a tangled web of channels: invoices arriving by email, purchase orders uploaded via procurement portals, field expense receipts captured through mobile apps, customs documents dropped via SFTP, or claims submitted through scanning kiosks. According to AIIM, 70% of organizations use three or more intake channels per department, and large enterprises often juggle five to seven.

A robust ADP platform consolidates these diverse flows by supporting multiple ingestion methods out of the box:

- Email ingestion: with auto-parsing of attachments and inbox routing rules.

- SFTP drops: for high-volume vendor feeds or batch submissions.

- APIs and webhooks: for system-generated documents requiring real-time intake.

- Portal uploads: from suppliers, customers, or field teams.

- Scanner integrations: to capture and digitize paper-based inputs.

This “ingestion mesh” allows ADP to act as a single control point, eliminating the need for manual triage or departmental workarounds. Whether it’s a vendor sending 1,000 invoices via SFTP or a field team uploading receipts through a mobile app, the workflow starts in the same structured pipeline.

Template-Driven Extraction

Once ingested, ADP applies OCR combined with positional zones, regex, and keywords to extract fields. This method is deterministic, making it ideal for stable layouts: utility invoices, standardized claim forms, or purchase orders from repeat vendors. Image preprocessing steps like de-skewing and noise reduction improve scan accuracy.

The tradeoff: template fatigue. If layouts shift, extraction breaks. But in controlled environments—AP invoices from known suppliers, discharge summaries from approved hospitals—ADP delivers speed and predictability unmatched by flexible but slower AI-driven tools.

Validation & Business Rules Engine

The real power of ADP emerges in the validation layer. Unlike OCR-only or RPA-only approaches, ADP cross-checks extracted data against core systems:

- ERP: Match invoice totals against POs, validate GL codes.

- CRM: Confirm policyholder IDs or customer accounts.

- HRIS: Validate employee IDs and roles.

Rules are configurable: conditional logic (“If > $10K → escalate”), threshold tolerances (±2% tax deviation), or exception queues for mismatches. This makes ADP the policy enforcement layer of automation—ensuring that what flows downstream is accurate and compliant.

Workflow Orchestration

ADP platforms don’t just capture data—they route and govern it. SLA timers enforce deadlines (“Resolve within 2 hours”), approval chains handle sensitive amounts, and exceptions flow into structured review queues. Workflows can split dynamically: <$500 invoices post automatically, while those >$50K escalate to controllers.

For COOs, this means throughput without headcount. For CFOs, it means governance without bottlenecks.

Integration Layer

ADP is only as valuable as the systems it connects to. Leading platforms provide native connectors to ERP (SAP, Oracle NetSuite, Microsoft Dynamics), CRM (Salesforce, ServiceNow), and DMS (SharePoint, Box, S3).

Preferred integration is via APIs or webhooks for real-time sync. Where APIs don’t exist, batch export/import bridges legacy environments. As a fallback, RPA bots may push data into UI fields—but with health checks, change detection, and alerting.

Best practice: Minimize reliance on RPA. APIs ensure stability and scalability; RPA should be the exception, not the norm.

Observability & Audit

Every document in an ADP workflow has a traceable journey: ingestion timestamp, rules applied, exceptions triggered, approvals logged. Outputs include immutable audit logs, exportable compliance packs (SOX, HIPAA, GDPR), and SLA dashboards that track performance and rule changes over time.

For CFOs, this is audit readiness without extra effort. For IT buyers, it’s visibility that reduces governance overhead.

Reliability Patterns

Enterprise-grade ADP distinguishes itself with resilience engineering:

- Retries with exponential backoff handle ERP downtime.

- Idempotency tokens prevent duplicate postings.

- Dead-letter queues (DLQs) isolate failed documents for human review.

- Backpressure mechanisms throttle intake to avoid downstream overload.

For example, if SAP goes offline during end-of-month close, invoices aren’t lost—they queue, retry automatically, and preserve integrity when the system recovers.

This is the difference between a platform-grade ADP and brittle template scripts or bot-based automations. The former scales with confidence; the latter collapses under production pressure.

With the mechanics in place, here’s what ADP looks like in real, day-to-day operations across core functions.

Real-World Workflows ADP Powers

Automated Document Processing (ADP) delivers its greatest value in workflows where documents are high in volume, relatively stable in format, and governed by strict business rules. For CFOs, this translates into measurable ROI and fewer audit risks. For COOs, it means throughput without exception overload. And for IT buyers, it reduces reliance on brittle bots or one-off integrations.

Finance / Accounts Payable

In Accounts Payable, invoices often arrive in predictable formats—freight, utility, telecom, SaaS, or rent bills from repeat vendors. ADP intakes these documents via email or SFTP, applies template-driven OCR to capture invoice numbers, POs, totals, and taxes, and then validates them through 2- or 3-way PO matches inside ERP systems like SAP, Oracle, or NetSuite.

Clean invoices auto-post; mismatches above a defined threshold are flagged for review.

- CFO: Gains duplicate payment prevention and faster month-end closes.

- COO: Sees fewer exception escalations.

- IT Buyer: Replaces brittle invoice bots with stable ERP connectors.

Impact: High first-pass yield on repeat-vendor invoices and material reduction in duplicate payments.

Logistics & Supply Chain

Bills of lading, delivery notes, and customs forms are well-suited to ADP. Documents can be ingested as scanned PDFs or mobile uploads, parsed for carrier ID, shipment ID, weights, and consignee details, and validated against transportation or warehouse management systems.

Matching records auto-sync to booking or inventory systems, while discrepancies are flagged.

- COO: Gains faster clearances and reduced shipment bottlenecks.

- IT Buyer: Avoids fragile, per-carrier RPA scripts.

Impact: Faster clearances, fewer shipment bottlenecks, and reduced risk of detention charges.

Insurance / Claims Intake

In insurance, First Notice of Loss (FNOL) forms and discharge summaries from pre-approved clinics are repetitive enough for ADP. The system ingests documents via insurer inboxes or TPA portals, extracts claimant IDs, policy numbers, and incident dates, and validates them against active policies and provider directories.

Clean claims flow straight into adjudication; anomalies are escalated.

- COO: Ensures SLA-compliant claim triage.

- IT Buyer: Simplifies intake through portal and API connectors.

Impact: Clean claims flow straight through to adjudication, with audit-ready compliance baked in.

Procurement & Vendor Onboarding

Procurement teams often handle standardized forms such as POs, W9s, or vendor registration documents. ADP ingests these from portals or email, extracts vendor name, registration ID, and banking details, and validates against the vendor master database to avoid duplicates or fraud.

Valid submissions flow directly into ERP onboarding; anomalies route to procurement staff for manual review.

- CFO: Reduces fraud and duplication exposure.

- IT Buyer: Populates ERP/DMS systems with clean metadata automatically.

Impact: Stronger compliance on 3-way match processes and faster vendor approval cycles..

Across all these workflows, the success factors are the same:

- High document volumes

- Low variability in format

- Rule-governed actions

This is where ADP shines—not as AI-driven intelligence, but as a deterministic platform that makes workflows faster, more reliable, and easier to govern.

Positioned correctly in the stack, ADP translates into concrete executive outcomes.

Business Value for CFOs, COOs & IT Buyers

Automated Document Processing (ADP) only matters to executives if it ties directly to outcomes they care about: cost predictability, operational scalability, and IT stability. By translating platform mechanics—rules, templates, validation engines—into tangible KPIs, ADP becomes a board-level enabler, not just a back-office tool.

CFO Lens: Predictability, Accuracy & Financial Guardrails

For CFOs, ADP addresses three persistent pain points: unpredictable costs, error-prone reconciliations, and compliance exposure.

- Cost predictability: A stable, per-document cost curve replaces linear FTE scaling.

- Faster closes: Automated validation compresses AP cycles and improves working capital.

- Error reduction: Duplicate detection and ERP-linked checks align invoices with POs and GL codes.

Takeaway: Audit-ready books, cleaner balance sheets, and stronger controls—without adding staff.

See the ROI section below for benchmarks and payback math.

COO Lens: Throughput & SLA Reliability

For COOs, the battle is throughput and exception management.

- Throughput scaling: Rules-driven routing processes large volumes without proportional headcount.

- Exception handling: Low-value items auto-post; anomalies route cleanly to review.

- SLA reliability: Timers, escalation chains, and prioritized queues keep operations on track.

Takeaway: Confidence in consistently hitting operational KPIs without firefighting template failures.

See the ROI section below for quantified impact.

IT Buyer Lens: Stability, Governance & Reduced Maintenance

For IT leaders, ADP solves the brittleness of legacy automations.

- Stable integrations: API/webhook-first design avoids fragile UI bots.

- Configurable rules: Low-code/no-code updates reduce change-request backlogs.

- Lower break/fix burden: Centralized templates make updates predictable.

- Governance baked in: RBAC, immutable logs, and audit packs align with enterprise security and compliance.

Takeaway: A stable, compliant automation backbone that reduces technical debt and unplanned maintenance.

Detailed efficiency metrics are summarized in the ROI section.

Collective Value Across Personas

- CFO: Predictable costs, reduced error exposure, audit-ready controls.

- COO: Scalable throughput, SLA adherence, fewer escalations.

- IT Buyer: Secure integrations, maintainable rules, less firefighting.

Bottom line: ADP turns document-heavy operations into predictable, compliant, and scalable processes. For quantified benchmarks (cost per document, payback windows, and case results), see the “ROI & Risk Reduction” section.

Where ADP Fits in the Automation Stack

Executives often hear OCR, RPA, ADP, and IDP used interchangeably. This creates mismatched expectations and wasted investments. Some teams over-invest in IDP too early, only to realize they didn’t need AI for uniform invoices. Others lean too heavily on brittle RPA bots, which collapse with every UI change. To avoid these pitfalls, it’s essential to draw clear role boundaries.

- ADP = rules and validation layer → deterministic throughput and policy enforcement.

- IDP = intelligence → context, adaptability, unstructured data.

- RPA = execution → UI/system navigation when APIs aren’t available.

The Automation Stack — Role Mapping

| Stack Layer | Description | Example |

|---|---|---|

| Input Layer | Document intake via email, API, portals, SFTP, mobile uploads | FNOL forms via email; invoices via SFTP |

| ADP (Rules Engine) | Templates, rules, validation, routing, integrations | Match invoice to PO; route >$10K invoices to controller |

| IDP (Intelligence Layer) | AI-driven extraction, semantic/context understanding | Extract legal clauses; adapt to multi-vendor invoice layouts |

| RPA (Action Layer) | Automates UI/system tasks when APIs don’t exist | Paste extracted totals into a legacy claims system |

| ERP / BPM / DMS | Destination systems where clean data is consumed | SAP, Oracle, Salesforce, SharePoint |

Role Clarity Across Layers

| Platform | Role | Best For |

|---|---|---|

| ADP | Throughput + rule execution | Structured/semi-structured workflows (AP invoices, bills of lading, FNOL forms) |

| IDP | Flexibility + adaptability | Unstructured or variable layouts (contracts, diverse vendor invoices) |

| RPA | System navigation + bridging | Legacy UIs where no API/webhook exists |

Insight: IDP rides on the structured data ADP produces; without ADP’s determinism, IDP reliability suffers.

How to Get Started?

- Start with ADP: Best fit for high-volume, rule-based workflows like AP, logistics, and procurement.

- Layer IDP as diversity grows: Add intelligence only when unstructured or variable formats increase.

- Use RPA selectively: Apply bots only when APIs are absent; recognize that RPA adds fragility.

⚠️ Strategic warning: Leading with IDP in structured environments is overkill—slower deployments, higher costs, and little incremental ROI.

Persona Lens

- CFO: ADP delivers cost control and audit-ready compliance; IDP is only needed when document diversity creates financial risk.

- COO: ADP secures throughput and SLA adherence; IDP manages exceptions; RPA bridges edge cases.

- IT Buyer: ADP minimizes break/fix cycles; IDP adds oversight complexity; RPA is brittle and should be limited.

Takeaway: Enterprises succeed when they position ADP as the backbone—layering IDP for variability and using RPA only as a fallback. Clear positioning prevents overspend, avoids fragility, and ensures document automation evolves strategically.

If these outcomes match your priorities, use the checklist below to separate platform-grade ADP from brittle automation.

Evaluating ADP Platforms

For executives evaluating Automated Document Processing (ADP) platforms, the challenge isn’t comparing features in isolation—it’s aligning capabilities with business priorities.

- CFOs seek ROI clarity and audit-ready assurance.

- COOs need throughput, SLA reliability, and fewer exceptions.

- IT buyers prioritize integration stability, security, and maintainability.

A strong evaluation framework balances these perspectives, highlighting must-have capabilities while exposing red flags that can undermine scale.

Must-Have Capabilities (Checklist)

| Capability | Why It Matters | Buyer Lens |

|---|---|---|

| Workflow Configurator | Configure routing and rules without waiting on developers. | COO (exception handling), IT (maintainability) |

| Multi-Channel Ingestion | Capture from email, SFTP, APIs, portals, and scanners to avoid silos. | COO (scale), IT (system flexibility) |

| ERP/CRM/DMS Connectors | Native adapters reduce IT lift and speed up ERP reconciliation. | IT Buyer (integration), CFO (financial accuracy) |

| Confidence Thresholds & Exception Routing | Automate 80–90% straight-through while flagging edge cases. | COO (SLA reliability), CFO (accuracy assurance) |

| Batch + Real-Time Support | Run end-of-month reconciliations alongside real-time claims or logistics flows. | COO (operational agility) |

| Visibility & Analytics | Dashboards for throughput, SLA breaches, and exception trends. | CFO (ROI tracking), COO (ops reporting) |

| Time-to-Change (Templates/Rules) | Shows how fast new vendor formats are added. | COO (SLA), IT (agility), CFO (hidden cost) |

Hidden Pitfalls (Red Flags)

Not every ADP solution scales. Key risks to flag during evaluation:

- Template upkeep: Fragile rules break with every vendor format change, leading to constant rework.

- Bot fragility: RPA-heavy platforms collapse when UIs change, consuming IT resources.

- Per-document fees: Low entry cost, but total cost of ownership balloons with volume.

- Black-box systems: Limited configurability; every adjustment requires vendor professional services.

⚠️ Red flag for CFOs & IT: If a vendor cannot demonstrate time-to-change metrics (e.g., adding a new vendor template), hidden costs will accumulate fast.

Proof-of-Value Pilot Approach

The best way to de-risk an ADP rollout is a 4–6 week pilot in one department.

- Scope: Finance (AP invoices), logistics (bills of lading), or insurance (claims intake).

- KPIs to track:

- First-pass yield: % of docs processed without touch.

- Exception shrink: reduction in exception queue volume.

- Cycle time: intake-to-posting duration.

- Error prevention: duplicate payments avoided or claim mismatches flagged.

- Acceptance criteria:

- ≥90% of stable-format docs processed automatically.

- SLA adherence improved by ≥30%.

- Exportable audit trail demonstrated.

- Time-to-change validated: New vendor template or business rule added within hours/days (not weeks), with minimal IT involvement.

Buyer insight: Pilots give CFOs ROI evidence, COOs throughput validation, and IT buyers integration assurance—before committing to scale.

Before piloting, align on how you’ll measure payback and risk reduction.

ROI & Risk Reduction

When evaluating any enterprise automation investment, the return on investment and risk mitigation potential must be crystal clear. ADP delivers on both fronts—cutting cost, boosting throughput, and reducing compliance exposure with measurable results.

Cost Levers: Where ADP Unlocks Savings

Manual document handling is expensive—not just in labor hours, but in errors, rework, and regulatory gaps. ADP platforms replace this friction with predictable, rules-driven workflows.

Key savings drivers include:

- Reduced FTE effort: Automating intake, validation, and routing cuts manual keying by 60–80% (Gartner, 2024).

- Fewer exceptions: Rules-driven validation shrinks exception queues by 30–50% (Deloitte).

- Error prevention: Built-in checks catch mismatches and duplicates before posting, reducing overpayments and rework.

- Faster logistics flow: In supply chain operations, ADP reduces exception dwell time by 30–50%, accelerating shipments and cutting detention/demurrage fees (Deloitte, 2024).

- Compliance protection: Immutable logs, approval attestations, and segregation of duties lower regulatory and audit risk.

📊 Example: If your AP team processes 100,000 invoices annually at 3 minutes each, that’s 5,000 staff hours. With ADP, ~80% can be automated—saving ~4,000 hours per year.

ROI Model: From Cost Per Document to Payback

| Step | Calculation |

|---|---|

| Baseline | Manual invoice handling costs $10–$15 per invoice (Levvel Research, 2025); up to $40 in complex cases (Ardent Partners, 2023). |

| With ADP | Costs drop to $2–$3 per invoice on average; ~$5 for complex cases. |

| Annualized | 100,000 invoices at $12 = $1.2M. With ADP at $3 = $300K. |

| Savings | ~$900K per year → 75% cost reduction. Typical deployments pay back in 3–6 months, yielding 3–5x ROI in year one. |

(Assumptions vary by industry, invoice complexity, and baseline error rates—use the pilot to calibrate your figures.)

Risk Lens: Compliance & Governance Benefits

Beyond efficiency, ADP reinforces enterprise risk controls:

- Approval attestations: Route high-value invoices (e.g., >$10K) for dual sign-off.

- Segregation of duties: Ensure initiator ≠ approver to meet SOX requirements.

- Immutable audit logs: Every document is traceable—timestamped, rules applied, approvals captured.

✅ Persona POV:CFOs: Audit-ready books by design.COOs: Reduced SLA breaches and exception bottlenecks.IT Buyers: Governance and compliance without patchwork scripts.

Case Example (Anonymized)

A global manufacturer processing ~150,000 AP invoices annually saw major gains:

- Before: 5-day posting cycle; quarterly duplicate payments.

- After ADP: 85% of invoices auto-posted within 24 hours, cycle time dropped to 1 day, duplicate payments eliminated.

- Impact: ~$350K annual savings plus faster reconciliation and stronger vendor relationships.

(Results will vary by industry, document mix, and baseline processes—pilot data is the best way to validate your organization’s ROI potential.)

🧮 Caption: “ADP platforms typically deliver 3–5x ROI in the first year—while slashing operational risk across finance, logistics, and compliance.”

Quick Takeaway: When ADP Is Right (and Wrong)

Not every document workflow needs machine learning. ADP shines where volume, structure, and rules dominate—and falters where variability and nuance take over.

✅ When ADP Is the Right Fit

- High-volume, uniform layouts: Telecom invoices, freight bills, standardized POs.

- Structured/semi-structured documents: FNOL forms, vendor invoices, bills of lading.

- Need for speed + predictability: Ideal for enterprises that value throughput, compliance, and audit readiness over flexibility.

- Governance-heavy environments: Where SLAs, segregation of duties, and approval chains matter more than handling variation.

🚫 When ADP Falls Short

- Variable or unstructured documents: Multi-vendor invoices, contracts, customer emails, handwritten notes.

- Semantic/contextual requirements: Extracting obligations from contracts or interpreting narrative text.

- Expectation of self-learning: ADP is deterministic and rules-driven—it does not adapt automatically when formats change.

Bottom line: ADP is the deterministic platform layer for high-volume, low-variance document workflows. For messy, multi-format, or context-heavy documents, layer IDP (or a hybrid ADP–IDP model) to achieve true scalability.

Use ADP where rules dominate; extend with IDP when variation grows.

Conclusion & Next Steps

Automated Document Processing (ADP) may not be the flashiest automation technology, but it is foundational. By applying templates, rules, and integrations, ADP ensures structured and semi-structured documents move through your business quickly, reliably, and auditably—long before AI or advanced intelligence layers come into play.

From invoice posting to vendor onboarding and freight routing, ADP is the rule-based policy engine that keeps workflows compliant, scalable, and efficient.

The next step depends on your workflow landscape:

- If your documents are high-volume, structured, and templated, ADP alone can deliver strong ROI.

- If you face variable formats or unstructured content, ADP provides the foundation for a hybrid ADP–IDP stack.

- In both cases, the smartest move is a platform evaluation that aligns technology with workflow realities.

👉 Consider starting with one of these pathways:

- ROI consultation: Get a cost-savings estimate for your document workflows.

- Integration guide: Explore how ADP platforms connect to ERP, DMS, or claims systems.

- Pilot program: Run a 4-week proof-of-value on one high-volume document type.

Bottom line: ADP is the plumbing and policy layer of digitization—an essential step toward future-proof, intelligent workflows.

Frequently Asked Questions (FAQ)

How does ADP differ from Intelligent Document Processing (IDP)?

ADP (Automated Document Processing) is deterministic: it applies rules, templates, and connectors to move structured or semi-structured documents through governed workflows with speed and consistency. IDP (Intelligent Document Processing) adds machine-learning–based flexibility to handle variable layouts and unstructured content. In practice, most enterprises start with ADP for predictable, high-volume use cases (e.g., AP, logistics, onboarding) and layer IDP as document diversity grows. IDP builds on the clean, validated data ADP produces—together forming a stable, scalable automation stack.

Is ADP the same as OCR or RPA?

No. OCR and RPA are enabling tools, not end-to-end platforms. OCR extracts text from scans and images; it doesn’t validate, route, or integrate with core systems. RPA automates clicks and keystrokes in UIs when APIs are unavailable, but it’s fragile and costly to maintain at scale. ADP is the platform layer that ingests documents, enforces business rules and validations, orchestrates approvals and exceptions, and integrates with ERP/CRM/DMS. OCR often powers ADP’s capture step; RPA is a selective bridge—neither replaces ADP.

How long does it take to deploy an ADP solution?

A typical path is a 4–6 week pilot for one high-volume workflow, followed by an initial production rollout in 8–12 weeks. Timelines vary with document diversity, number of integrations (ERP/CRM/DMS), and governance needs (RBAC, audit packs). After the first deployment, expanding to adjacent processes is faster because ingestion, validation, and integration patterns are reusable.

How do you measure success in an ADP implementation?

Focus on a small, executive-relevant scorecard:

- First-pass yield (no-touch processing rate)

- Exception reduction (smaller review queues)

- Cycle time (intake to posting)

- Error prevention (duplicate/mismatch avoidance)

- Compliance readiness (complete audit trails, approvals, SoD)Baseline these before your pilot and compare post-go-live to quantify ROI, SLA reliability, and risk reduction.

What operational KPIs improve most with ADP?

- Processing time: days → hours for invoices/claims

- Exception handling: materially smaller review queues

- Throughput: higher volumes without linear headcount

- Error prevention: fewer duplicates and mismatches at source

- Audit readiness: complete, immutable document trailsCFOs see cleaner books and predictable costs; COOs get SLA reliability; IT reduces break/fix work and governance overhead.

What types of documents are best suited for ADP—and where does it struggle?

ADP excels with structured and semi-structured documents: repeat-vendor invoices, purchase orders, bills of lading, FNOL forms, W-9s—any workflow governed by clear rules. It struggles with unstructured or highly variable inputs: contracts, handwritten notes, free-form emails, or shifting multi-vendor layouts. In those cases, keep ADP as the control layer and add IDP for flexibility and semantic understanding.

How does ADP handle template changes or new vendor formats?

Through configurable extraction zones, regex/keyword logic, and modular business rules. Evaluate vendors on time-to-change: adding a new vendor template or policy rule should take hours or days, not weeks—and should not require professional services every time. Validate this in your pilot to avoid hidden maintenance costs.

What role does RPA still play if you have ADP?

RPA remains a selective bridge when APIs are missing—think legacy ERPs, custom portals, or green-screens. Use it sparingly for UI data entry or simple triggers, and monitor with health checks. For scale and resilience, prefer native connectors and APIs. Over-reliance on bots introduces fragility and heavier IT overhead.

How do ADP and AI-based tools work together?

ADP enforces rules, validations, routing, and integrations—producing consistent, system-ready data. AI-based IDP adds learning and context to handle diverse layouts and unstructured content. Example: ADP performs 2/3-way match into SAP; IDP extracts fields reliably from varied vendor invoices. Together they form a hybrid stack: ADP for stability and control; IDP for adaptability; RPA only where APIs don’t exist.

Source: Read MoreÂ