This is the second in a two-part series about open finance and the importance of a flexible data store to open finance innovation. Check out part one here!

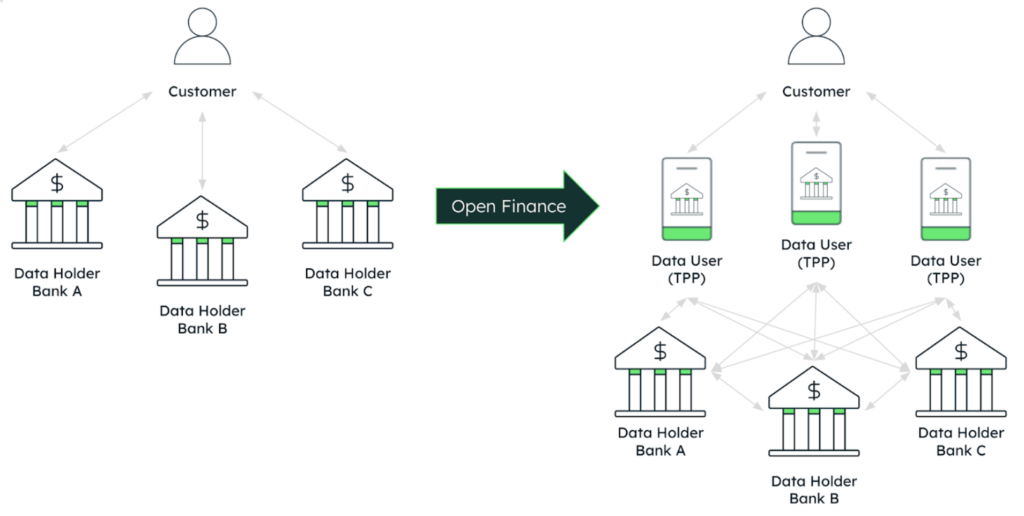

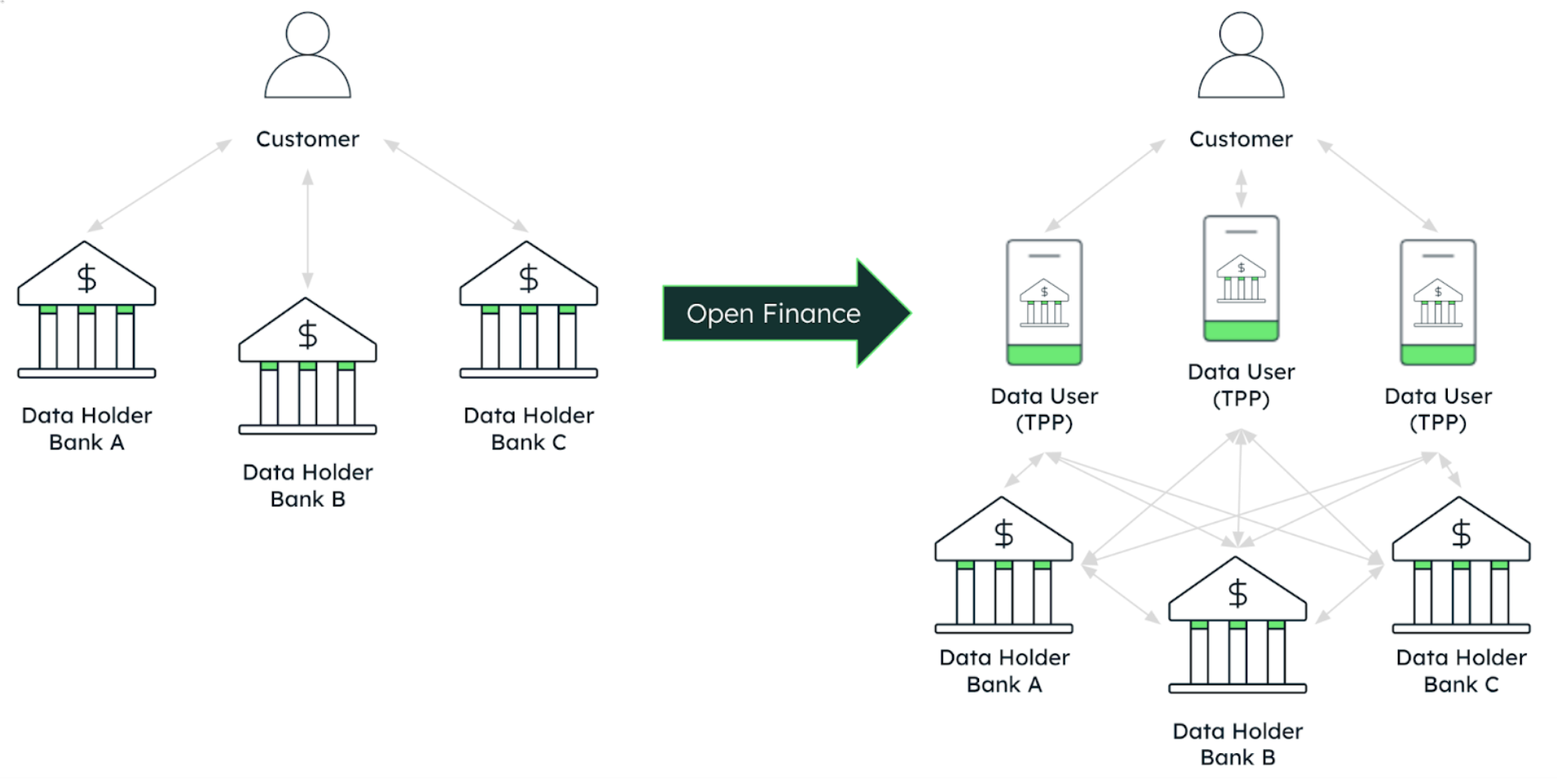

Open finance is reshaping the financial services industry, pushing traditional institutions to modernize with a data-driven approach. Consumers increasingly expect personalized experiences, making innovation key to customer retention and satisfaction. According to a number of studies1, there is an exponential increase of dynamic transformations in financial services, driven primarily by the impact of Banking-as-a-Service (BaaS), embedded banking services, and AI. All of these initiatives are mainly powered by API services intended for data sharing, and have become must-have technical capabilities for financial institutions.

Open finance can also unlock massive opportunities for continuous innovation. As a result, financial institutions must provision themselves with the right tools and expertise to be fully aware of the potential risks and challenges of embarking on such a “data-driven” journey.

Now, let’s dive deeper into an application of open finance with MongoDB.

MongoDB as the open finance data store

Integrating diverse financial data while ensuring its security, compliance, and scalability represents a series of considerable challenges for financial institutions. Bringing together data from a variety of backend systems entails a set of complex hurdles for financial ecosystem participants—banks, fintechs, and third-party providers (TPP).

First, they need to be able to handle structured, semi-structured, and increasingly unstructured data types. Then, cybersecurity and regulatory compliance concerns must be addressed. What’s more, an increase in data-sharing scenarios can open up potential vulnerabilities, which lead to the risk of breach exposure and cyber-attacks (and, therefore, possible legal penalties and/or eventual reputational damage).

To implement open finance strategies, organizations must first determine the role they will play: whether they act as data holders, are in charge of sharing the data with TPP, or whether they will be data users, the ones able to provide enhanced financial capabilities to end-users. Then, they must choose the most suitable technology for the data management strategy—and this is where MongoDB comes in, functioning as the operational data store.

Let’s explore how MongoDB can play a crucial role for both actors—data holders and data users—through an open finance functional prototype.

Open finance in action: Aggregated financial view for banking users

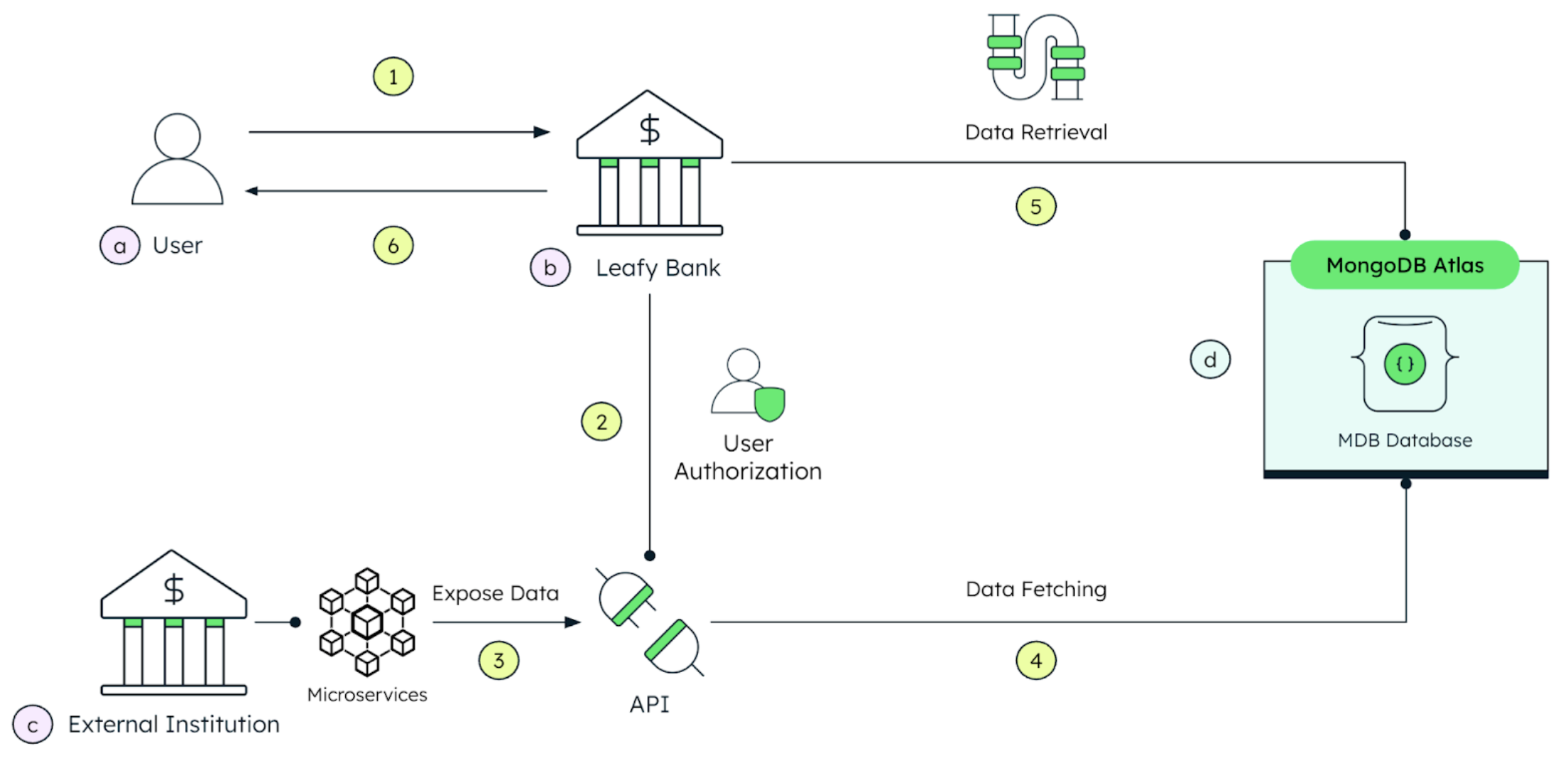

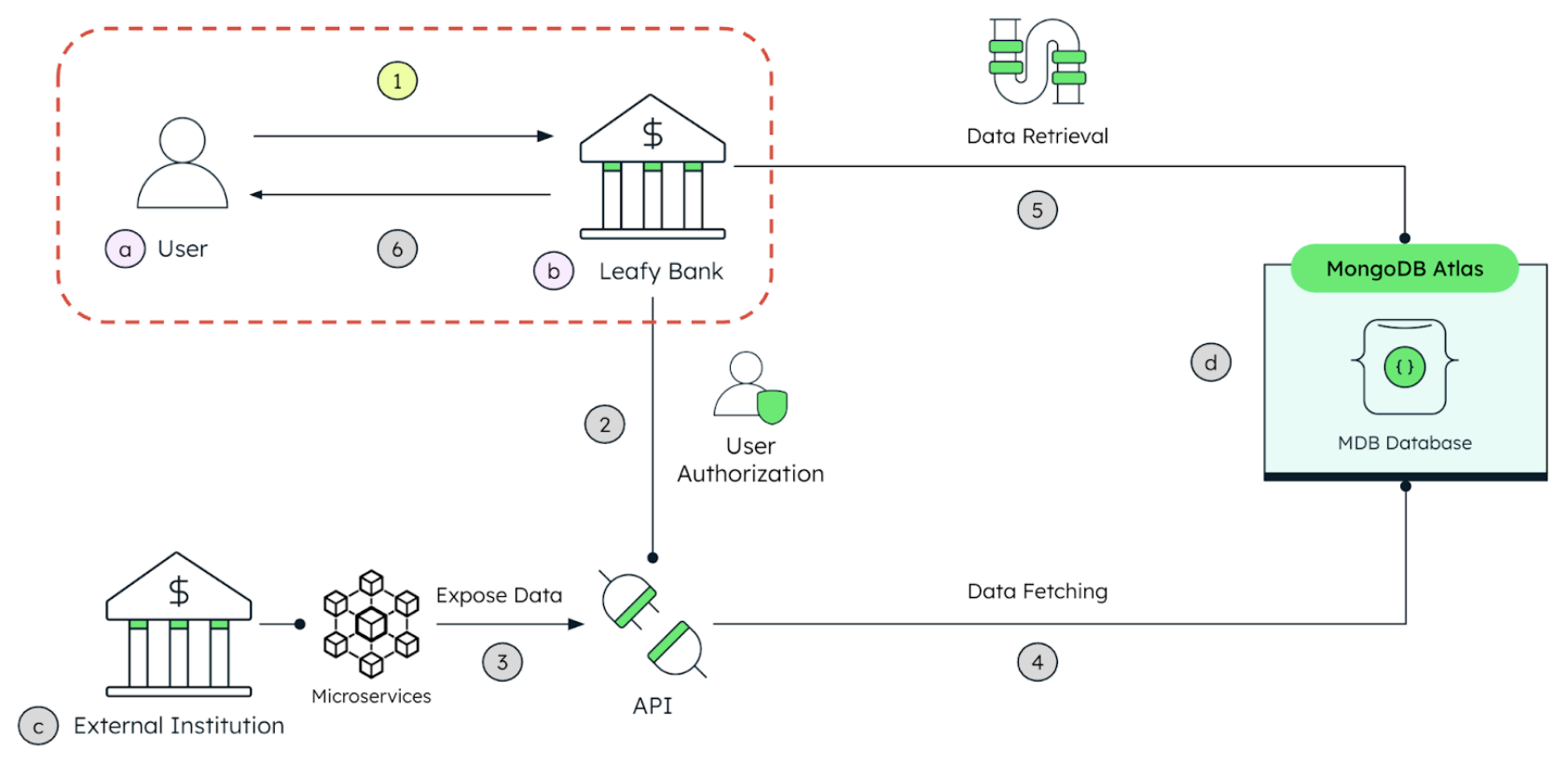

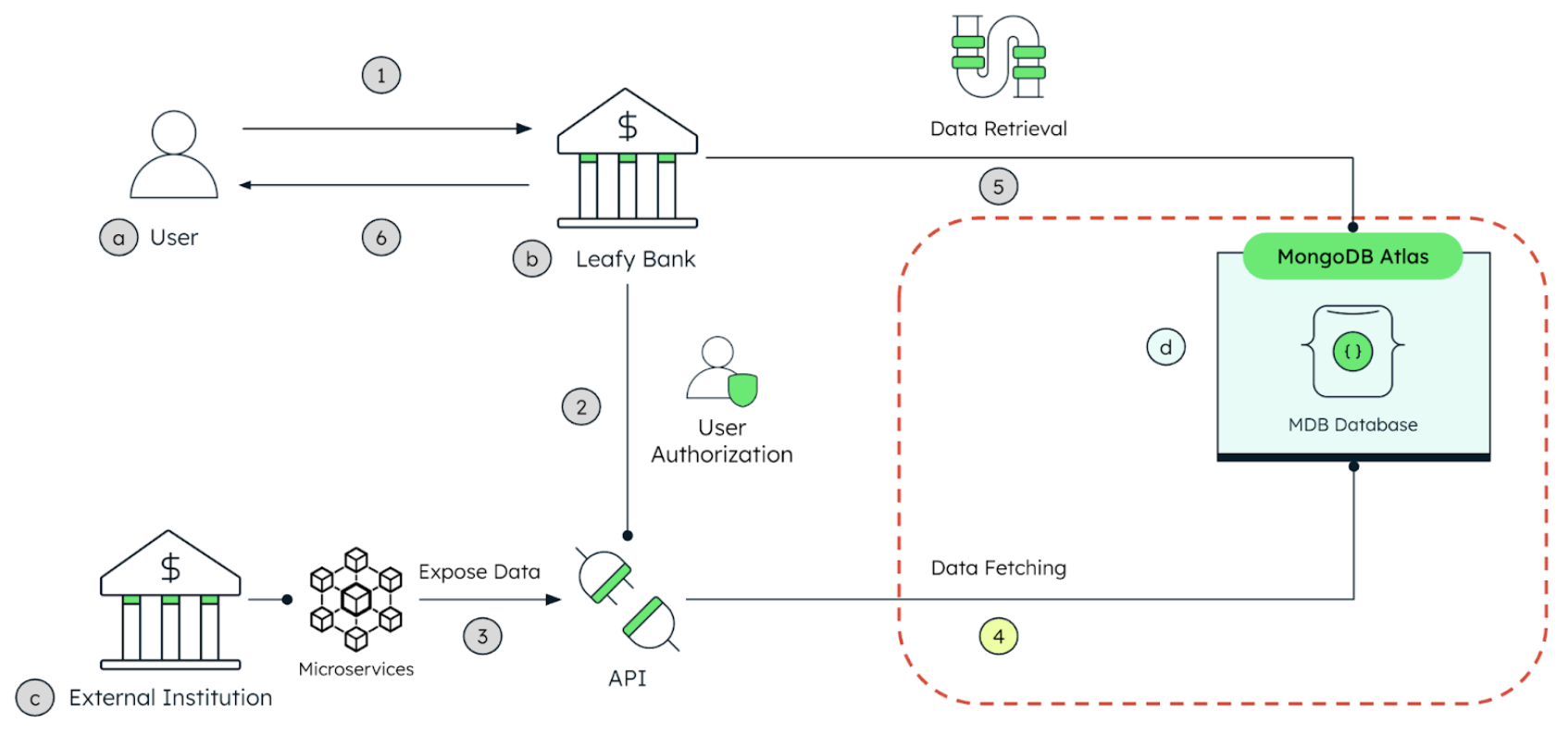

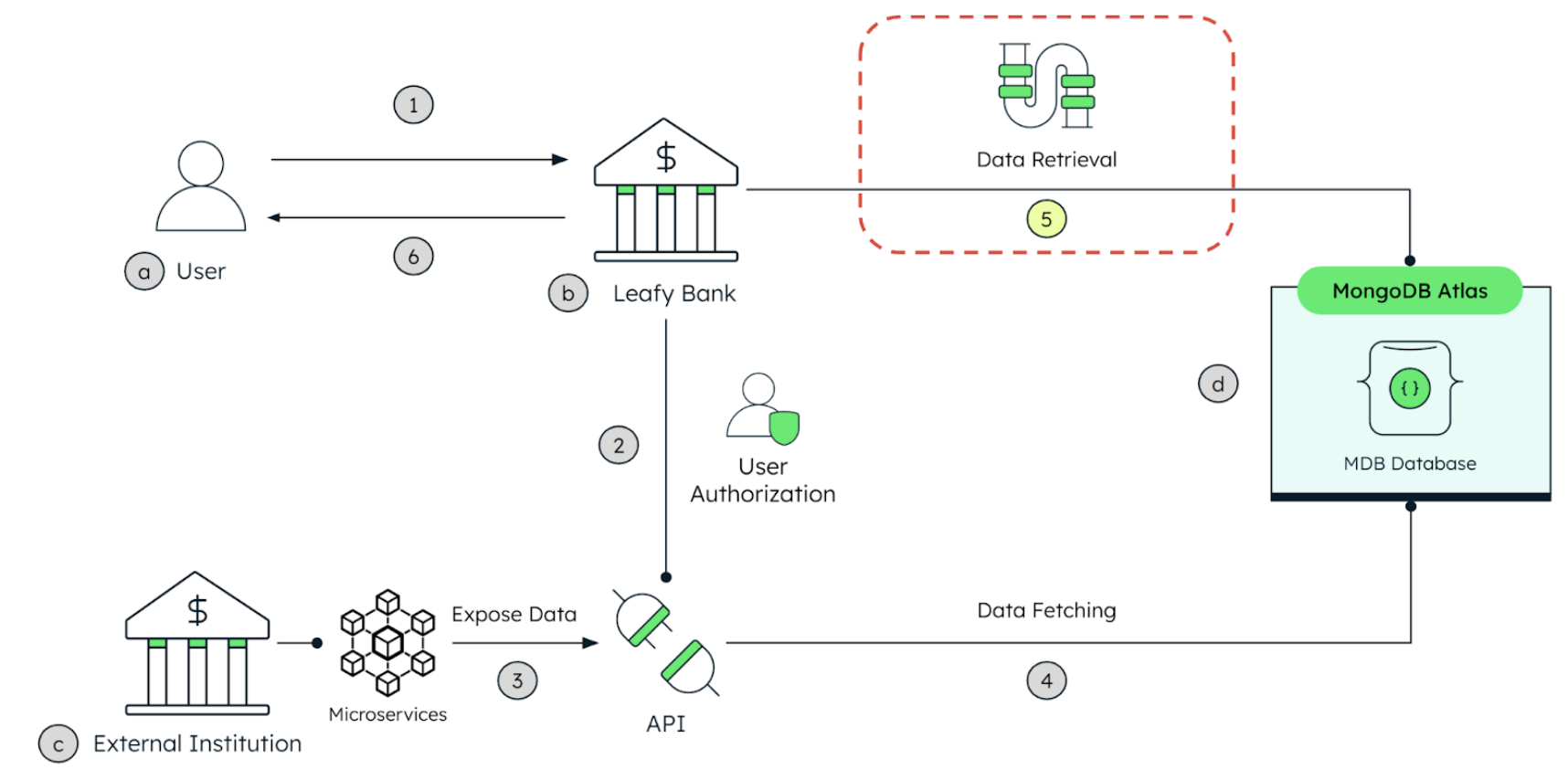

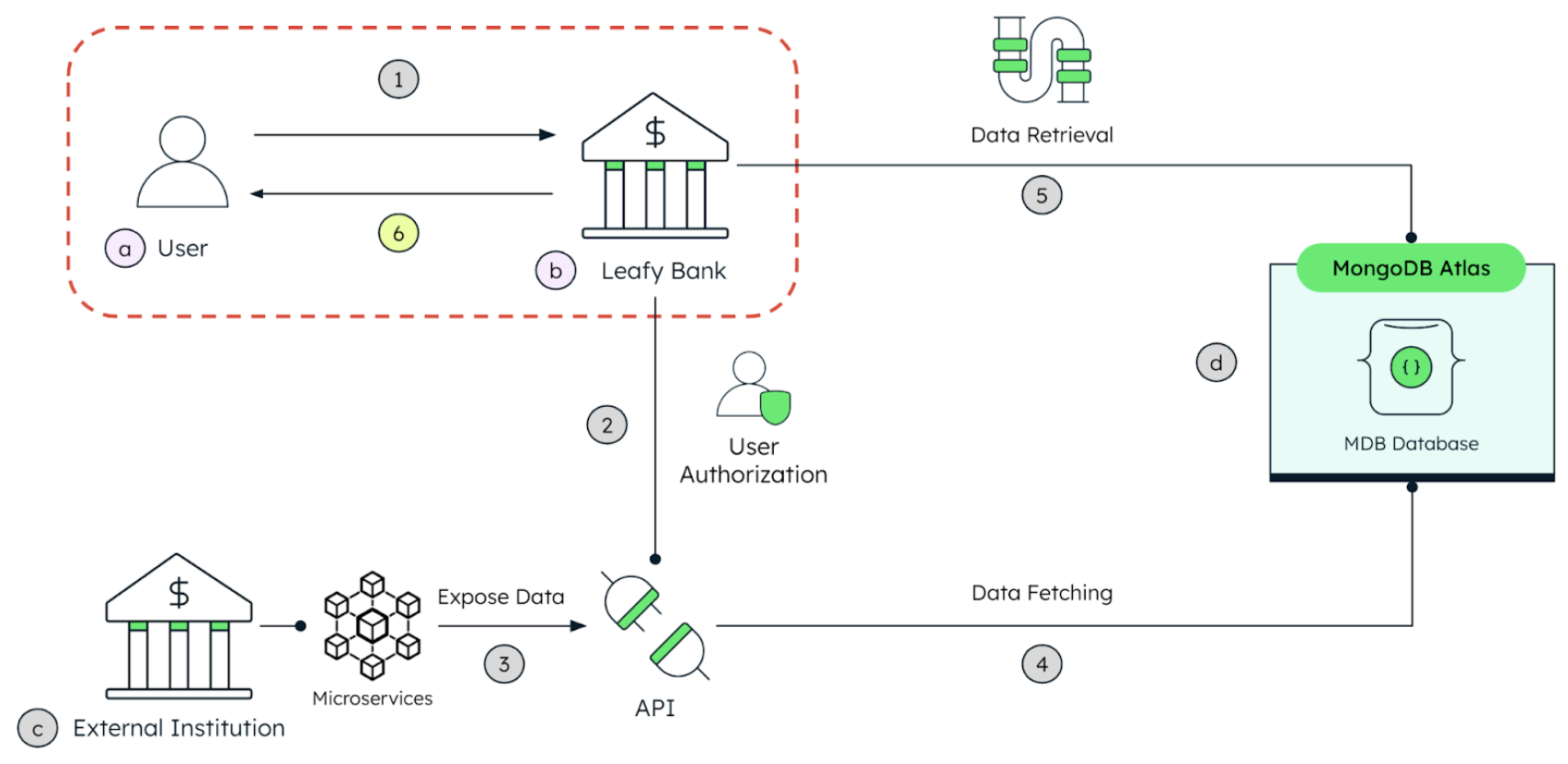

Figure 2 below shows a digital application from a fictional bank—Leafy Bank—that allows customers to aggregate all their bank accounts into a single platform.

Four actors are involved in this scenario:

a. Customer – User

b. Data Users – Leafy Bank

c. Data Holders – External Institution

d. Open Finance Data Store – MongoDB Atlas

Now let’s go through the steps from the customer experience.

Step 1. Log in to the banking application

Once logged in, the Leafy Bank digital banking application allows users to aggregate their external bank accounts. It is done behind the scenes, through a RESTFul API request that will usually interchange data in JSON format.

For the Leafy Bank prototype, we are using MongoDB and FastAPI together, exposing and consuming RESTful APIs and therefore taking advantage of MongoDB Atlas’s high performance, scalability, and flexibility.

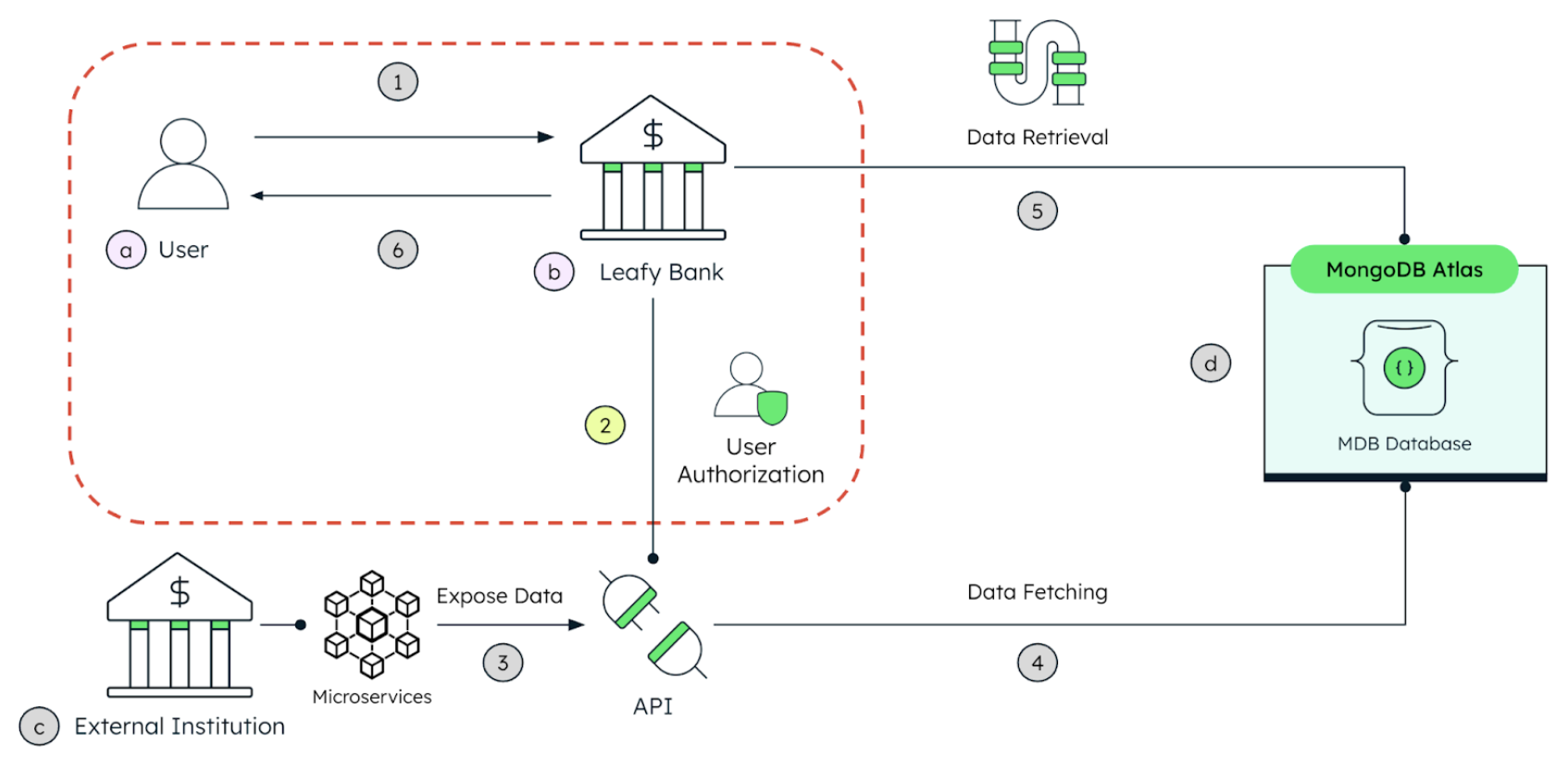

Step 2. User authentication and authorization

A crucial step to ensure security and compliance is user consent. End-users are responsible for granting access to their financial information (authorization). In our case, Leafy Bank emulates the OAuth 2.0 authentication. It generates the corresponding tokens for securing the service communication between participants.

To achieve efficient interoperability without security issues, data holders must enable a secured technological “fence” for sharing data while preventing the operational risk of exposing core systems.

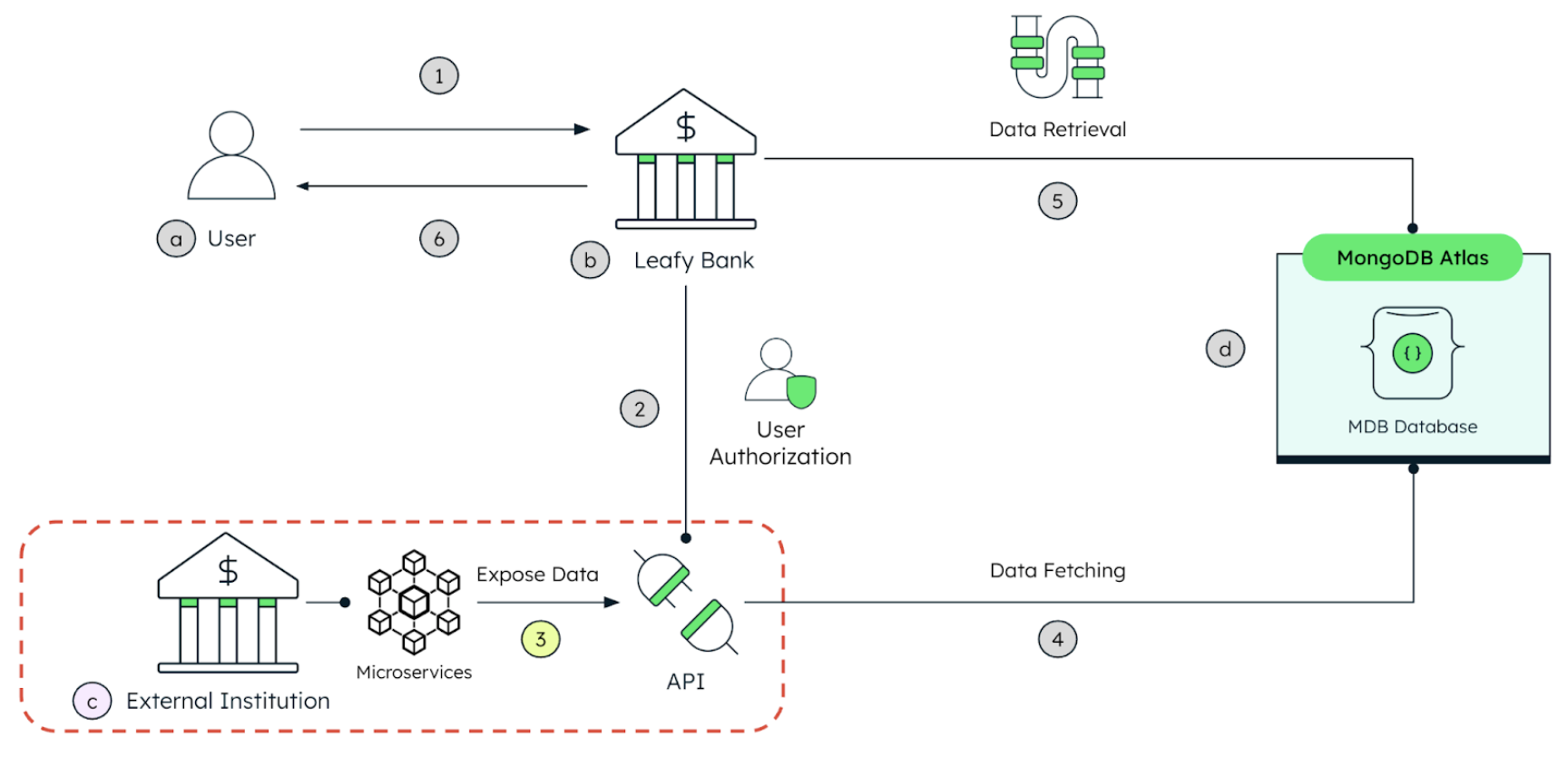

Step 3. Data exposure

After the authorization has been granted, Leafy Bank will fetch the corresponding account data from the data custodian—external banks (in our fictional scenario, Green Bank or MongoDB Bank)—via APIs. Usually, participants expose customers’ financial data (accounts, transactions, and balances) through their exposed services in JSON format to ensure compatibility and seamless data exchange.

Because MongoDB stores data in BSON, a superset of JSON, it provides a significant advantage by allowing seamless storage and retrieval of JSON-like data—making it an ideal backend for open finance.

Step 4. Data fetching

The retrieved financial data is then pushed into the open finance data store—in our case, in MongoDB Atlas—where it is centrally stored. Unlike rigid relational databases, MongoDB uses a flexible schema model, making it easy for financial institutions to aggregate diverse data structures from different sources, making it ideal for dynamic ecosystems and easy to adapt without costly migrations or downtime.

Step 5. Data retrieval

Now that the data has been aggregated in the operational data store (powered by MongoDB Atlas), Leafy Bank can leverage MongoDB Aggregation Pipelines for real-time data analysis and enrichment. To become “open finance” compliant, our Leafy Bank provides a holistic financial view and a global position accessible in a single application, thus improving individuals’ experience with their finances.

Furthermore, this set of features also benefits financial institutions. They can unveil useful insights for building unique services meant to enhance customers’ financial well-being.

Step 6. Bank connected!

In the end, customers can view all their finances in one place, while enabling banks to offer competitive, data-driven, tailored services.

Demo in action

Now, let’s combine these steps into a real-world demo application:

Advantages of MongoDB for open finance

Open finance presents opportunities for all the ecosystem participants. On the one hand, bank customers can benefit from tailored experiences. For personal financial management, it can provide end-users central visibility of their bank accounts. And open finance can enable extended payment initiation services, financial product comparison, enhanced insurance premium assessments, more accurate loan and credit scoring, and more.

From a technical standpoint, MongoDB can empower data holders, data users, and TPP to achieve open finance solutions. By offering a flexible schema, banks can adapt to open finance’s evolving requirements and regulatory changes while avoiding the complexity of rigid schemas, yet allowing a secure and manageable schema validation if required.

Furthermore, a scalable (vertical and horizontal) and cloud-native (multi-cloud) platform like MongoDB can simplify data sharing in JSON format, as it has been widely adopted as the data interchange “defacto” format, making it ideal for open finance applications. Internally, MongoDB uses BSON, the binary representation of JSON, for efficient storage and data traversal.

MongoDB’s rich extensions and connectors support a variety of frameworks to create RESTful API development. Besides FastAPI, there are libraries for Express.js (Node.js), Django (Python), Spring Boot (Java), and Flask (Python). The goal is to empower developers with an intuitive and easy-to-use data platform that boosts productivity and performance.

Additionally, MongoDB offers key features like its aggregation pipeline, which is designed to process data more efficiently by simplifying complex transformations, real-time analytics, and detailed queries. Sophisticated aggregation capabilities from MongoDB allow financial institutions to improve their agility while maintaining their competitive edge, all by having data as their strategic advantage.

Lastly, MongoDB provides financial institutions with critical built-in security controls, including encryption, role-based access controls (RBAC), and auditing. It seamlessly integrates with existing security protocols and compliance standards while enforcing privileged access controls and continuous monitoring to safeguard sensitive data, as detailed in the MongoDB Trust Center.

Check out these additional resources to get started on your open finance journey with MongoDB:

Read part-one of our series to discover why a flexible data store is vital for open finance innovation.

Explore our GitHub repository for an in-depth guide on implementing this solution.

Visit our solutions page to learn more about how MongoDB can support financial services.

Source: Read More