IInvoice management software is transforming financial processes for businesses in 2024. If you’re looking to streamline your invoicing, you’re making a smart move that could save your company time and money.

Many businesses face challenges with invoice processing—from data entry errors to delayed payments. These issues can impact cash flow and overall efficiency. Fortunately, there’s a solution.

Modern invoice management tools automate much of the process. They can extract data from invoices, match them to purchase orders, route them for approval, and integrate with your accounting system. This automation can significantly reduce processing time and errors.

With numerous options available, choosing the right software for your needs can be challenging. That’s why we’ve created this guide to the top 10 invoice management solutions of 2024. We’ll compare features, pricing, and pros and cons to help you make an informed decision. Let’s get started.

What is Invoice Management Software?

What is invoice management software

An invoice management platform is designed to manage the invoicing process, including invoice creation, delivery, payment tracking, and reporting. By automating manual tasks, invoice management systems save time, reduce errors, and improve cash flow. They ensure timely, accurate payments, fostering better vendor relationships. Plus, they offer real-time visibility into your financial status, empowering you to make informed decisions.

At its core, invoice management software tackles these essential functions:

Invoice capture: Automatically extracts data from incoming invoices, whether they’re paper, PDF, or electronic.Data validation: Checks for errors and inconsistencies, ensuring accuracy.Approval routing: Sends invoices to the right people for review and approval.Payment processing: Facilitates timely payments, often integrating with your existing financial systems.Reporting and analytics: Provides insights into your cash flow and spending patterns.

Invoice management systems aren’t just for large corporations. Businesses of all sizes can benefit from them. Ready to explore your options?

Best 10 Invoice Management Software for businesses

Invoice management software solutions come in all shapes and sizes, each with its unique strengths. We’ve done the legwork to help you find the best fit for your business.

Let’s look into the top 10 picks for 2024.

#1. Nanonets

Nanonets is an all-in-one invoice management solution that streamlines invoice processing with intelligent automation. It offers built-in OCR, no-code workflows, a global payment platform, and 5000+ integrations that can automate data extraction, PO matching, invoice payments, reminders, invoice approvals, and more with little to no effort.

Free Trial: Available

Pricing: Starts from $499/month (Pay as you go plans available)

Invoice Data Extraction on Nanonets

Top Features:

The invoice OCR template extracts data from invoices with 95%+ accuracy.Reconcile invoices with 2, 3, and 4-way matching.Upload invoices from email, desktop, drive, or any other source automatically.Automatically update financial records in the balance sheet, general ledger, PnL, and more.Automate invoice approvals, invoice review, invoice payment reconciliation, and invoice payments with automated workflows.Classify all your invoices into different categories using a document classifier.Automate manual data entry processes using a workflow management system.Integrates with popular gateways for easy global payments

Pros:

Easy to use.1-Day Setup24x7 SupportFree Migration AssistanceDedicated Customer ManagerNo-code workflow platformFree Trial and a Forever Free plan

Cons:

Can’t generate invoices.

Here’s what customers say about Nanonets.

Rated 4.9 on Capterra and G2. Try Nanonets today. Start your free trial without any credit card details.

#2. QuickBooks Online

QuickBooks Online is a cloud-based accounting software that’s become a popular choice among many small to medium-sized businesses. It’s designed to simplify financial management, from basic bookkeeping to more complex accounting tasks.

Top Features

Generate professional-looking invoices using custom templatesSend payment reminders for overdue invoices to customersIntegrates with payment gateways for online paymentsReal-time financial reports.

Pros:

Easy to use and intuitive interfaceStreamlines and simplifies invoice management processesCan provide valuable insights and data for decision making

Cons:

Need a full subscription to use full featuresCustomer support can be slowThe subscription price is high and not flexible (Downgrading a plan is not possible)Data export is an issueThe learning curve is steep, and need a lot of training to use the platform to its full potential

Quickbooks and Nanonets integration

#3. FreshBooks

Freshbooks help small businesses organize their invoice and accounting processes from a single platform. FreshBooks allows users to create, send, track and pay invoices.

Top features:

Automatically capture and tag expensesEasily create professional invoices (Removing branding is paid add-on)Easy to time track individualsAutomatic invoicing

Pros:

Reduces time spent on administrative tasksEasy to set up

Cons:

Complicated for first-time usersIntegrations can be trickyExpensive as compared to other platformsLogin page glitches frequentlyReaching customer support is difficultNo invoice processing automation

#4. Xero

Xero is a small business accounting software that handles all financial processes for accountants and bookkeepers.

Top features:

Easy expense claims and reimbursement processes.Provides advanced financial analytics to track business progress.Easy invoice tracking featuresSecure platform

Pros:

Good customer serviceEasy integrations

Cons:

The workflow automation features are very basicNot very user-friendly for nonfinancial professionalsBank reconciliation is difficultEditing line items is difficult.Not best suited for complex financial processes

Xero and Nanonets integration on NanonetsÂ

#5. Sage

Sage accounting automation software is designed to help small to medium-sized businesses track payments and expenses, send invoices, and calculate what they owe during tax season.

Top Features

Create professional invoicesVAT calculations are easyEasy invoice tracking featuresSupports multi-currency invoices

Pros

Easy to use and setup24x7 support (Paid customer support)Easy for non-accountants to use the platformGreat user community

Cons

Payroll is a separate productNo time-tracking or collaboration toolsfewer integrationsAdding users is costlyOutdated UIA downgrade is not possible

Nanonets and Sage integration on Nanonets

#6. SAP ConcurÂ

SAP Concur offers a robust invoice management solution as part of its comprehensive spend management platform. It’s designed to streamline the entire accounts payable process for businesses of all sizes.

SAP Concur analytics | Source

Best for: Medium to large enterprises looking for a scalable, feature-rich invoice management system with strong automation capabilities.

Top Invoice Features:

• AI-powered invoice capture and data extraction

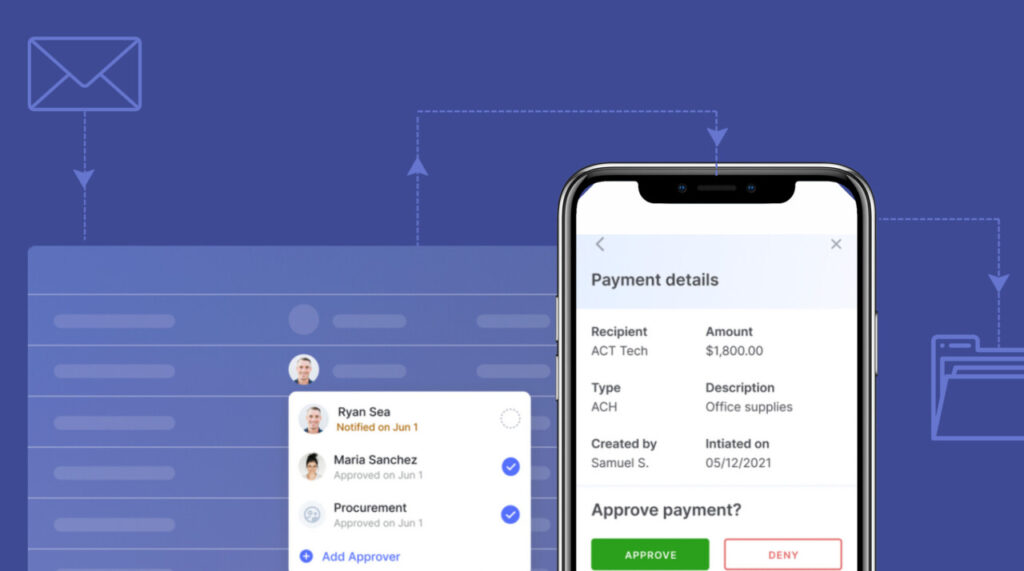

• Automated invoice matching and approval workflows

• Integration with major ERP systems

• Mobile app for on-the-go invoice approvals

• Vendor management portal

Pros for Invoicing:

High accuracy in automated data captureStreamlined approval processes reduce invoice processing timeStrong compliance and audit trail featuresGlobal currency and tax support

Cons for Invoicing:

Can be complex to set up and configureHigher price point may not suit smaller businessesOccasional delays in processingLearning curve may be steep for new users

#7. BILL AP/AR

Bill offers a comprehensive invoice management platform designed for small to mid-sized businesses, streamlining both accounts payable and receivable processes.

BILL AP/AR’s interface | Source

Best for: Medium to large enterprises looking for a scalable, feature-rich invoice management system integrated with travel and expense management.

Key Invoice Features:

AI-powered invoice capture and data extractionCustomizable approval workflowsIntegration with major accounting software (e.g., QuickBooks, Xero)International payments in multiple currenciesVendor management portal

Pros for Invoicing:

User-friendly interface with intuitive navigationEfficient automated bill payment systemStrong security measures, including fraud detectionMobile app for managing invoices on-the-go

Cons for Invoicing:

Syncing issues with accounting softwareLimited customization options for invoice templates

#8. Tipalti

Tipalti offers an end-to-end accounts payable automation solution with strong invoice management capabilities, particularly suited for global businesses.

Tipalti |Source

Best for: Mid-market to enterprise-level companies with complex invoicing needs, especially those dealing with global payments and multiple entities.

Key Invoice Features:

AI-powered OCR for invoice data extractionMulti-entity and multi-subsidiary supportAdvanced approval workflows3-way PO matchingBuilt-in tax compliance for over 190 countries

Pros for Invoicing:

Excellent for managing global paymentsStrong fraud detection and prevention featuresSeamless integration with major ERP systems

Cons for Invoicing:

Can be complex for small businessesImplementation may require significant time investmentSync issues with accounting software

#9. Stampli

Stampli is an accounts payable automation platform that focuses on streamlining invoice processing and approval workflows. Its bot, Billy , learns from user behavior to automate coding and routing.

Stampli| Source

Best for: Small to large businesses looking to automate their entire AP process while maintaining existing ERP systems and improving cross-department collaboration.

Key Features:

Intelligent data capture and extraction Centralized communication hub on each invoiceCustomizable approval workflowsIntegration with 70+ ERPsAdvanced vendor management

Pros:

Intuitive interface requiring minimal trainingSignificantly reduces invoice processing timeStrong audit trail and real-time visibilityFlexible adaptation to existing AP processes

Cons:

Sync issues with some ERPsLimited customization for certain fieldsLow OCR accuracy

#10. AvidXchange

AvidXchange is a comprehensive accounts payable automation platform designed for middle-market businesses, offering end-to-end AP and payment solutions.

AvidXchange | Source

Best for: Middle-market businesses looking for a comprehensive AP automation solution with strong payment capabilities and ERP integrations.

Key Features:

AI-powered invoice capture and data extractionCustomizable approval workflowsIntegration with 240+ accounting systems and ERPsVendor payment portal with multiple payment optionsRobust reporting and analytics

Pros:

Significantly reduces invoice processing time and paper usageStrong integration capabilities with major accounting systemsFlexible approval workflows adaptable to existing processesVendor self-service portal improves supplier relationshipsComprehensive spend visibility and reporting

Cons:

System outages and glitchesLearning curve for advanced features and reportingImplementation can be complex for some organizations

Nanonets – The Best Invoice Management Platform

Nanonets is the perfect choice for businesses of all sizes looking to gain complete control over the invoice processing lifecycle.

Nanonets is an invoice management system that everyone can use, not just the finance team. Nanonets’ customizable platform allows organizations to use the platform for various use cases, including and not limited to

Automatic invoice uploadInvoice approval workflow automationAutomatic GL coding, invoice de-duplication, notification & data extractionEmployee reimbursement & expense reports automationPO matchingInvoice reconciliationTouchless invoice processingAutomate data entry into ERPsInvoice PaymentsVendor verification & notifications

And more.

What makes Nanonets stand out?

Nanonets allow organizations to get a complete overview of their financial processes and automate them to increase the efficiency and productivity of teams. Automate manual, time-consuming tasks such as GL coding, approvals, vendor notifications, duplicate invoices, and more with no-code workflow automation. Nanonets also integrate with popular ERPs like Oracle, Sage Intacct, QuickBooks, and more for efficient data transfer.

Best-in-class OCR

Invoice Data Extraction on Nanonets

Nanonets OCR software can extract data from invoices with 98%+ accuracy. With the pre-built invoice OCR model, you can start extracting invoice data as soon as you sign into the platform.

No-code workflow automation

Approval Workflow on Nanonets

Nanonets’ no-code workflow can automate manual data entry, transformation, enhancement, or transfer tasks.

Excellent Customer Support

Nanonets provides complete support at every step of the journey. Be it a technical or non-technical query, our team is here to help you to use Nanonets to their full potential for your organization. Nanonets provides 24×7 live customer support and free migration and training support.

Fully customizable platform

Have complex financial processes? Nanonets’ platform is entirely customizable to your needs.

Get started with Nanonets’ pre-trained invoice workflows or build your custom invoicing workflow. You can also schedule a demo to learn more about your use cases!

Here’s what customers say about Nanonets.

Rated 4.9 on Capterra and G2. Try Nanonets today. Start your free trial without any credit card details.

What are some of the features of Invoice Management Software?

While looking for the following invoice management software, you should keep these features in mind. An efficient invoice management software has the following features:

Invoice Processing

Invoice management software should allow you to process invoices easily. It should have OCR software that can perform invoice ocr in seconds and extract information accurately. It should also allow document data matching (PO matching) using the extracted data.

Payment Tracking

The software should allow users to track the status of invoices, including whether they have been paid or are overdue.

An invoice management system’s major benefit is automating manual aspects of invoice processes. The software should have workflow automation to automate data entry into ERPs, and accounting software, automate invoice approvals, invoice matching, GL coding, and data enhancements like updating currency fields or more.

Reporting and Analytics

The software should provide tools for generating reports and analyzing data. Visual reports to track invoice stages would help businesses get a correct idea about their cashflows.

Integrations

Any software you use should integrate with your existing business software. The software should be able to integrate with other business systems, such as accounting software, to streamline the invoicing process and avoid duplication of data entry.

Payment Processing

The software should have global payment gateways to allow global payments without leaving the platform.

Efficient Document Management

Invoices are essential documents that need to be handled with care. The invoice management system should have all features of a document management system to allow for secure storage of your document in case of an audit.

How to Choose Your Invoice Management Software?

When choosing Invoice Management Software, there are a few key factors that businesses should consider. These include

Ease of use: The invoice management software should be easy to use, intuitive, and mostly, a no-code platform so everyone can use it efficiently.Features: Check your requirements and map your requirements with the features of the platform. The invoice management platform should allow invoice automation, invoice matching, delivery, payment tracking, and reporting.Integration Capabilities: The software should be able to integrate with the business’s existing systems, such as accounting software, to avoid the need for manual data entry. Look for solutions with a wide range of pre-built integrations to minimize implementation challenges.Customization and Flexibility: Look for solutions that allow you to customize workflows to match your existing processes. Ensure the software can adapt to your specific industry needs and company structure.Cost: The cost of the software should be reasonable, and the business should consider the long-term benefits of using the software versus the upfront cost.Security: The software should provide robust security measures to protect sensitive financial data and prevent unauthorized access.Customer support: The software provider should offer timely and helpful customer support to assist users with any questions or issues that may arise.Automation capabilities: To use automation to it’s full potential, your invoice management software should have advanced workflow management capabilities which can automate manual processes.

Final thoughts

The right invoice management software can slash processing times, reduce errors, improve cash flow visibility, and free up resources for strategic tasks. When choosing, consider factors like integration capabilities, ease of use, customization options, and scalability.

Remember, the ideal solution should meet your current needs and grow with your business. Take advantage of free trials to test-drive options before committing.

Investing in the right invoice management software is an investment in your company’s efficiency and financial health. By optimizing your invoice processes, you’re positioning your business for success in our increasingly digital world.

Automate every aspect of invoice management with automated workflows, OCR, and a global payment platform at fraction of the cost!

FAQs

Who uses Invoice Management Software?

Invoice Management Software is used by businesses of all sizes across various industries. This includes retail stores, service-based businesses (like law and accounting firms), freelancers, e-commerce companies, and more. Essentially, any business that regularly invoices clients or customers can benefit from streamlining their invoicing process with this software.

What are the different kinds of Invoice Management Software?

Invoice Management Software comes in three main types:

Cloud-based: Accessed online, ideal for remote work.On-premises: Installed locally, suitable for businesses prioritizing on-site data control.Customizable: Tailored to specific business needs, allowing feature additions or removals.

What software should I use for invoicing?

The best invoicing software depends on your specific business needs. But, Nanonets is a great option. It offers advanced features like OCR software, workflow automation, document management, and seamless integrations. With a free trial, excellent customer support and transparent pricing options, Nanonets is the best bet for organizations looking to optimize their invoice processes.Â

Why use invoice management software?

Invoice management software offers multiple benefits:

Improves cash flow by automating invoicing and payment tracking.Reduces lost or overdue invoices through better tracking and reminders.Enhances financial visibility, allowing for better decision-making.Boosts productivity by automating manual processes.Increases accuracy and ensures compliance with regulations.

Which is the best billing software?

There’s no one-size-fits-all “best” billing software. However, standout options include:

Nanonets for its all-in-one AP automation and AI capabilitiesQuickBooks Online for small businesses needing integrated accountingSAP Concur for large enterprises with complex needsTipalti for businesses with global payment requirementsAvidXchange for middle-market companies seeking comprehensive AP automation

How do you manage invoices?

Effective invoice management involves:

Capturing invoice data accurately (often using OCR technology)Validating invoice informationRouting invoices for approvalProcessing paymentsReconciling invoices with paymentsStoring invoice data securely for future reference

Modern invoice management software automates many of these steps, improving efficiency and accuracy.

What is the invoice process?

The invoice process typically includes:

Receiving the invoice (electronically or physically)Extracting and validating invoice dataMatching the invoice to purchase orders or contractsRouting the invoice for approvalProcessing paymentRecording the transaction in the accounting systemStoring the invoice for record-keeping

What is invoice flow management?

Invoice flow management refers to the systematic handling of invoices from receipt to payment. It involves:

Establishing clear processes for invoice handlingAutomating repetitive tasksSetting up approval workflowsTracking invoice status throughout the processEnsuring timely paymentsMaintaining audit trailsAnalyzing invoice data for business insights

Effective invoice flow management aims to streamline the entire invoicing process, reduce errors, improve cash flow, and provide better financial visibility.

Source: Read MoreÂ