Mergers and acquisitions (M&As) are complex business transactions that involve the consolidation of assets, operations, and often, databases. Databases form a key part of any enterprise and managing databases during an M&A requires careful planning and implementation to ensure a smooth transition and to maintain data integrity. Databases in the modern technological world not only serve as the data storage tier for applications, but also form the core of a complete analytics portfolio. Good preparation for database management during an M&A supports the creation of a strong data analytics platform, which opens opportunities to explore machine learning (ML), artificial intelligence (AI), and more.

Based on our experience helping customers complete M&A transactions involving databases, we have identified key considerations and patterns that arise in this process. In this post, we highlight some of the key considerations for successful database management during a merger or acquisition spanning from data assessment to integration strategies.

Data assessment and due diligence

Before initiating an M&A transaction, a complete data assessment and due diligence are essential for several reasons. The due diligence helps identify potential incompatibilities, data format discrepancies or structural differences, and regulatory compliance considerations to mitigate against potential legal or financial risks associated with non-compliance. Value assessments help determine the true value of the data assets involved. To achieve business continuity and risk mitigation, companies can evaluate data schemas, relationships, data quality metrics. Through this process, the companies can identify critical data dependencies and potential data loss risks and develop contingency plans. The involved parties must understand the structure, quality, and compliance of their existing databases. This includes a list of activities including but not limited to evaluating data schemas, relationships, and data quality metrics. This approach of having a comprehensive understanding of the data landscape aids in developing a plan for integration and reveals any potential challenges early in the process.

Aligning this assessment with risk assessments and due diligence forms the basis for aligning with regulatory requirement or compliance. You can improve M&A due diligence with AWS Audit Manager—a service that can be used to map your compliance requirements to AWS usage data with prebuilt and custom frameworks and automated evidence collection.

Compatibility and interoperability: Know your goals

Most M&As involve different kinds of databases. Some of these M&A transactions require merging data or standardizing the data format across different data sources. During an M&A process, assess the compatibility and interoperability of the databases from both organizations. This includes evaluating differences between database systems, versions, or architectures that can pose challenges during integration. When modernizing your database infrastructure, it’s essential to take a parallel approach that addresses multiple aspects simultaneously. There are three key aspects:

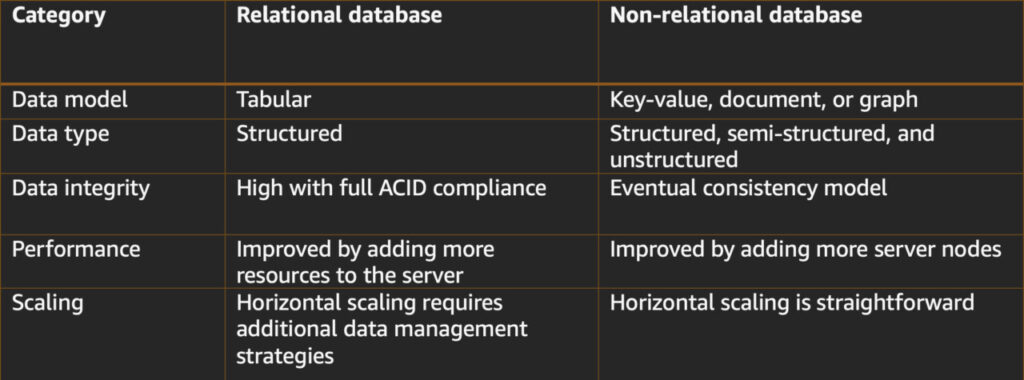

Evaluate if you’re using the right type of database for your data storage and retrieval needs. Assess whether your data is better suited for a relational database management system (RDBMS) or a non-relational (NoSQL) database. See What’s the Difference Between Relational and Non-relational Databases? to help understand the necessary conversions or migrations.The following table highlights difference between relational databases and non-relational databases for evaluating technical feasibility.*Some non-relational databases may offer ACID compliance with performance or other trade-offs

Identify the type of workload this database will be running. Will it be online analytical processing (OLAP) or online transaction processing (OLTP)? NoSQL databases are typically suited for OLTP workloads. It’s important to select the right database type as well as use the right purpose-built database. By addressing these aspects in parallel, you can not only modernize your database infrastructure, but also optimize it for your specific data storage and processing requirements.

Know what your data is going to be used for. If you plan to use your database for analytical purposes, streamline and finalize necessary mechanisms to move your data from your databases to a data lake or a data warehouse. There are several tools available to help you with this process. For example, AWS Glue can be used to extract, transform, and load (ETL) data from various sources, including databases, into a data lake or data warehouse. Alternatively, you could explore tools such as AWS Glue Databrew to clean and normalize data to prepare it for analytics and ML and Zero-ETL to automatically copy and replicate the data from source and target databases without the need to build the ETL pipeline.

Data security and compliance

Data security and compliance with regulatory requirements is a top priority. During an M&A, there might be a need to harmonize security protocols and make sure that both organizations’ databases adhere to industry regulations such as GDPR, HIPAA, or any other data sovereignty or protection laws. This step involves assessing access controls and encryption mechanisms and auditing capabilities. Services such as AWS Identity and Access Management (IAM) can help centralize access controls and enforce least privilege principles across the merged environments. AWS Key Management Service (AWS KMS) provides robust encryption key management, enabling you to protect data at rest and in transit. AWS CloudTrail records API calls, helping you audit activities and align with compliance with regulations. Plethora of database offerings at AWS meet the requirements of major data privacy & security regulations like GDPR, HIPAA, PCI DSS. AWS regularly undergoes independent audits and certifications to validate the security and regulatory compliance of these offerings. They also provide access to compliance reports and agreements through the AWS Artifact.

Data governance framework

Data governance is a methodology that verifies that data is in the proper condition to support business initiatives and operations.

Figure 1– Key aspects of data governance

Establish a robust data governance framework that aligns with the new organizational structure post-M&A. This framework should define roles, responsibilities, and policies related to data management, providing a unified approach to data governance across the combined entity. Data governance requires people, processes, and technology solutions across a range of capabilities. This includes three key milestone stages—curate, understand, and protect.

Curate data at scale to limit data sprawl – Curating your data at scale means identifying and managing your most valuable data sources.

Discover and understand your data in context to accelerate data-driven decisions — With a centralized data catalog, data can be found quickly, access can be requested, and data can be used to make business decisions.

Protect and securely share your data with control and confidence – Protecting your data means being able to strike the right balance between data privacy, security, and access.

How to Create a Data Governance Strategy for Your Small or Medium Business is a good starting reference to develop a data governance strategy.

Data mapping and transformation

During an M&A, it’s crucial to ensure seamless data integration between the two organizations. Data mapping and transformation play a vital role in this process. Create a detailed data mapping and transformation plan. This involves identifying corresponding data elements between the databases of the two organizations and developing a strategy for transforming, reconciling, and mapping data during the integration process. Standardizing data formats and values might be necessary to maintain consistency.

For example, when migrating databases or consolidating to a single database, use AWS Database Migration Service (AWS DMS) Schema Conversion. DMS Schema Conversion automatically converts your source database schemas and most of the database code objects to a format compatible with the target database. This conversion includes tables, views, stored procedures, functions, data types, synonyms, and more.

Figure 2 – Process of Schema Conversion using AWS Data Migration Service (DMS)

Data migration strategies

If the M&A transaction involves migration of data across databases, you must take downtime into account. Select appropriate data migration strategies based on the size and complexity of the databases. Options include parallel running systems, phased migration, or a complete cut-over. With parallel systems, you keep both the old and new databases running simultaneously during the migration. This minimizes disruptions but requires more resources and effort to keep everything in sync. A phased migration lets you move data over in batches, causing partial downtime during each transfer. A complete cutover is a single event where you take the old system offline, move the data, and bring up the new system—leading to significant downtime. AWS DMS is helpful for this step because it enables continuous data replication, making parallel or phased approaches smoother for supported databases by constantly syncing data from the old to the new database, reducing downtime.

When considering each option, focus on two factors—available network bandwidth and mode of transfer (online, offline, or hybrid). Think about operational impact, partitioning large data sources, preserving metadata, and noting how data transfer will impact the source storage because it might experience increased read activity, potentially slowing performance or racking up costs for higher read and transfer rates. Careful planning and testing are crucial to minimize downtime and data loss and accomplish a seamless transition. The following table shows how long it could take to transfer your data depending on the available network bandwidth:

Key: Orange (under 30 hours) – consider online transfer; Red (years) – consider offline transfer; Grey (hours) – consider online, offline, or hybrid.

Scalability and performance

Assess the scalability and performance of the combined database infrastructure. M&As often result in increased data volumes and user demands. It’s essential to ensure that the integrated database infrastructure can handle the expanded workload efficiently. Assess if after the M&A there’s a shift in your user base. Evaluate the AWS Regions in which you are running your workloads, proximity to your users, and specific latency requirements.

Some purpose-built databases such as Amazon DynamoDB and Amazon Aurora provide options to create global resources and global tables to offer seamless scalability and availability across Regions.

Business continuity and disaster recovery

Review and update business continuity plans (BCP) and disaster recovery (DR) plans to account for the changes introduced by the M&A. This includes making sure that backup and recovery processes cover the newly integrated databases and that there are clear procedures in place to address potential disruptions. It is crucial to consider the recovery time objective (RTO) and recovery point objective (RPO) for critical systems and data, because these metrics define the maximum acceptable downtime and data loss, respectively, in the event of a disaster. See the AWS Well-Architected Reliability Pillar for best practices and guidance about implementing an effective disaster recovery strategy on AWS.

Consider using managed services such as Amazon Aurora, which offers high availability (HA) by default. HA is built into the architecture of Amazon Aurora PostgreSQL-Compatible Edition, which is a proprietary database engine compatible with PostgreSQL along with Amazon Aurora MySQL-compatible Edition with six copies of data maintained across three Availability Zones. That is two copies in each Availability Zone, boosting availability with a stated availability of up to 99.99 percent availability. This translates to a potential downtime of only 4.38 minutes per year, minimizing disruption and maintaining data integrity. The following diagram shows a reference architecture of Amazon Aurora with a primary database and 3 Aurora replicas

Figure 3 – Amazon Aurora architecture with a primary DB and three Aurora replicas

Determine a proper backup strategy including backup frequency, and backup policies. Having a centralized backup strategy can help simplify data management. For example, using AWS Backup can help centrally create and manage policies and backup schedules for different data stores including Amazon Relational Database Service (Amazon RDS), Amazon DynamoDB, Amazon Simple Storage Service (Amazon S3), Amazon DocumentDB (with MongoDB Compatibility), and more.

Stakeholder communication and training

Effective communication with stakeholders is critical throughout the M&A process. This includes informing users about changes to data access, reporting tools, and any modifications to data-related workflows. Providing training sessions on the new database environment helps users adapt to the integrated system.

Budget and resource allocation

Allocate sufficient budget and resources for the database integration process. M&A activities often involve unexpected challenges, and having the necessary financial and human resources ensures the successful execution of the integration plan.

Post-merger monitoring and optimization

Implement monitoring tools to track the performance and health of the integrated databases post-merger. Continuous monitoring helps to identify issues that might arise after integration, enabling prompt resolution. Additionally, you should optimize the database configurations based on performance metrics and user feedback.

Documentation and knowledge transfer

Documenting the entire database integration process can help in smooth handovers and knowledge transfers. This documentation can serve as a valuable resource for future reference, audits, and knowledge transfer within the organization. Clear documentation also aids in troubleshooting and resolving issues that might arise during or after the integration.One of the ways you can do this is by creating a knowledge center portal for your organization using a resource such as AWS re:Post Private. AWS re:Post Private is a fully managed, secure, and private space you can use to build an organization-specific cloud community and provide access to proprietary knowledge resources. AWS re:Post Private centralizes trusted AWS technical content and offers private discussion forums to improve how your teams collaborate internally—and with AWS—to remove technical obstacles, accelerate innovation, and scale more efficiently in the cloud. You need to have either the AWS Enterprise or Enterprise On-Ramp Support Plan.

Conclusion

Successful management of databases during an M&A involves meticulous planning, thorough assessment, and effective implementation. By addressing considerations related to data quality, compatibility, security, governance, and performance, organizations can navigate the complexities of integrating databases and create a unified and efficient data environment post-merger and acquisition.

The AWS Mergers & Acquisitions Advisory Team (AWS M&A Advise) is a group of subject matter experts at AWS that provide a suite of complimentary advisory engagements to AWS customers engaged in M&A transactions. If your organization is going through an M&A transaction and wants to learn more about how AWS supports customers throughout the transaction lifecycle, reach through your organization’s aligned AWS Account Manager.

About the Authors

Nikhil Anand is a Senior Solutions Architect at AWS and is based out of London. He primarily works with SMB FSI customers in the UKI region, and has background in security, compliance, and migrations. He also operates as an advisor on M&A transactions during the customer migration journey and helps customers build and modernize on the AWS Cloud. Outside of work, he likes to keep himself engaged with sports and never misses a workout opportunity.

Saurabh Shukla is a Solution Architect at AWS. He primarily works with SMB customers within the UKI region and has background in security, threat detection, and incident response to help improve customer’s overall security posture. Outside of AWS, he is an F1 enthusiast and enjoys the weekend treks.

Source: Read More