Financial analysis has always been crucial for interpreting market trends, predicting economic outcomes, and providing investment strategies. This field, traditionally rooted in data, has increasingly turned to artificial intelligence (AI) and algorithmic methods to handle the vast and complex data generated daily. AI’s role in finance has grown significantly, automating tasks once performed by human analysts and enhancing the accuracy and efficiency of financial analysis. Integrating advanced technologies, such as large language models (LLMs), has allowed for more sophisticated analysis and decision-making processes, transforming financial professionals’ operations.

Despite these advancements, substantial barriers remain between the finance sector and the AI community. One significant challenge is the proprietary nature of financial data and the specialized knowledge required to analyze it effectively. These factors impede the AI community’s meaningful contribution to financial tasks. There is a clear need for financial-specialized AI tools that can democratize access to advanced analytical capabilities and improve decision-making across the financial industry. Addressing this gap could revolutionize financial analysis and decision-making by making sophisticated tools available to a broader range of users.

Current AI models used in finance are typically designed for straightforward, single-task operations. Traditional methods in financial analysis include fundamental analysis, which evaluates companies to determine their value, and technical analysis, which studies market actions to forecast future price trends. While AI has automated many tasks, such as sentiment analysis and market prediction, its application in finance remains limited by the need for more sophisticated models capable of handling complex, multi-faceted analyses. As financial professionals increasingly turn to AI, the demand for more advanced tools grows.

Researchers from AI4Finance Foundation; Columbia University; Shanghai Frontiers Science Center of Artificial Intelligence and Deep Learning, NYU Shanghai; Business Division, NYU Shanghai; Shanghai AI-Finance School ECNU introduced FinRobot, an innovative open-source AI agent platform designed to support multiple financially specialized AI agents. Developed by the AI4Finance Foundation in collaboration with institutions like Columbia University and NYU Shanghai, FinRobot leverages LLMs to perform advanced financial analyses. This platform bridges the gap between AI advancements and financial applications, promoting wider adoption of AI in financial decision-making. By making these tools accessible through open-source initiatives, FinRobot aims to enhance the capabilities of financial professionals and democratize advanced financial analysis.

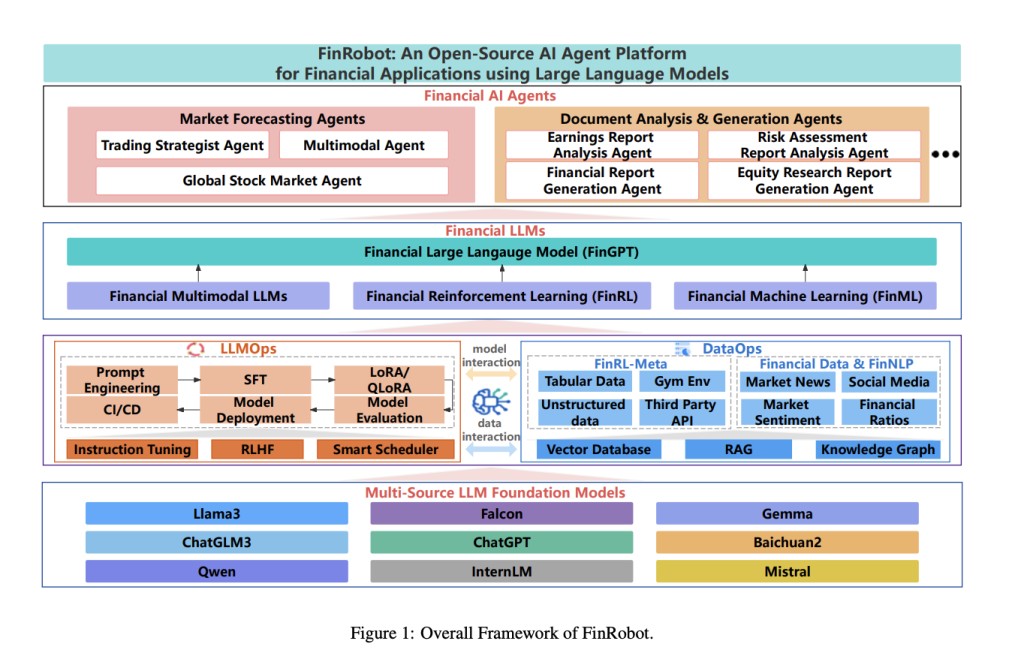

FinRobot’s architecture is organized into four major layers, each designed to address specific financial AI processing and application aspects. These layers work together to enhance the platform’s ability to perform precise and efficient financial analyses.

Financial AI Agents Layer: This layer focuses on formulating the Financial Chain-of-Thought (CoT) by breaking down complex financial problems into logical sequences. It includes various specialized AI agents tailored for different financial tasks, such as market forecasting, document analysis, and trading strategies. These agents use advanced algorithms and domain expertise to provide actionable insights.

Financial LLM Algorithms Layer: The Financial LLM Algorithms layer configures and utilizes specially tuned models tailored to specific domains and global market analysis. It employs FinGPT alongside multi-source LLMs to dynamically configure appropriate model application strategies for particular tasks. This adaptability is crucial for handling the complexities of global financial markets and multilingual data.

LLMOps and DataOps Layer: The LLMOps and DataOps layer produces accurate models by applying training and fine-tuning techniques and using task-relevant data. This layer manages the extensive and varied datasets necessary for financial analysis, ensuring that all data fed into the AI processing pipelines is high quality and representative of current market conditions. It also supports LLMs’ integration and dynamic swapping to maintain operational efficiency and adaptability.

Multi-source LLM Foundation Models Layer: This foundational layer integrates various LLMs, enabling the above layers to access them directly. It supports the plug-and-play functionality of different general and specialized LLMs, ensuring the platform remains up-to-date with financial technology advancements. The Multi-source LLM Foundation Models layer incorporates LLMs with parameters ranging from 7 billion to 72 billion, each rigorously evaluated for effectiveness in specific financial tasks. This diversity and evaluation ensure optimal model selection based on performance metrics such as accuracy & adaptability, making FinRobot compatible with global market operations.

The platform addresses critical challenges such as transparency, global market adaptation, and real-time data processing. For example, the Financial AI Agents layer enhances complex analysis and decision-making capacity by employing CoT prompting to dissect financial challenges into logical steps. The Multi-source LLM Foundation Models layer supports multilingual model integration, enhancing FinRobot’s ability to analyze and process diverse financial data. By leveraging diverse LLM architectures, FinRobot ensures precise adaptation and performance optimization, making it a valuable tool for professional analysts and laypersons.

The evaluation of two demo applications highlights FinRobot’s capabilities. The first application, Market Forecaster, synthesizes recent market news and financial data to deliver insights into a company’s latest achievements and potential concerns. For instance, the system evaluated Nvidia’s stock performance, noting steady increases and CEO optimism about AI, which boosted investor confidence. The second application, Document Analysis & Generation, uses AI agents to analyze financial documents like annual reports and generate detailed, insightful reports. These applications demonstrate FinRobot’s ability to provide comprehensive and actionable financial insights.

In conclusion, FinRobot enhances accessibility, efficiency, and transparency in financial operations by integrating multi-source LLMs in an open-source platform. This innovative platform addresses the complexities of global markets with a multi-layered architecture that supports real-time data processing and diverse model integration. FinRobot accelerates innovation within the financial AI community and sets new standards for AI-driven financial analysis. FinRobot promises to significantly improve strategic decision-making across the financial sector by fostering collaboration and continuous improvement, making sophisticated financial tools accessible to a wider audience.

Check out the Paper and GitHub. All credit for this research goes to the researchers of this project. Also, don’t forget to follow us on Twitter. Join our Telegram Channel, Discord Channel, and LinkedIn Group.

If you like our work, you will love our newsletter..

Don’t Forget to join our 42k+ ML SubReddit

The post FinRobot: A Novel Open-Source AI Agent Platform Supporting Multiple Financially Specialized AI Agents Powered by LLMs appeared first on MarkTechPost.

Source: Read MoreÂ